Assessing the ‘why’ behind ETH’s gas price spike due to Binance

- Ethereum’s gas fees spiked due to Binance’s Proof-of-Reserves endeavors

- Activity on the network increased, however, sentiment against Ethereum declined

Over the last few days, there was a massive spike in Ethereum’s [ETH] gas fees and gas spent. This massive spike was caused by Binance moving large amounts of Ethereum for their Proof-of-Reserves endeavors.

Read Ethereum’s [ETH] Price Prediction 2023-2024

Ethereum propels ahead

As can be seen from the image below, Ethereum’s gas fees reached new highs, soaring to 222 gwei. According to Wu Blockchain, this occurred because:

“Binance consolidated funds from countless deposit addresses to the Binance14 hot wallet in preparation for the next stage of POR check.”

This led to Binance generating 889 ETH gas fees and transferring over 437,000 ETH in a bid to validate its Proof-of-Reserves and maintain the faith of its customers.

The Ethereum Gas fee once soared to 222 Gwei, as binance consolidated funds from countless deposit addresses to the Binance14 hot wallet in preparation for the next stage of POR check. Binance has completed its BTC reserve and is starting an ETH check. https://t.co/Tan4AEjNMn pic.twitter.com/ylgUZ40pYa

— Wu Blockchain (@WuBlockchain) December 10, 2022

However, this spike in gas fees could have had a negative impact, as high gas fees could impact retail investors and affect the overall sentiment against Ethereum.

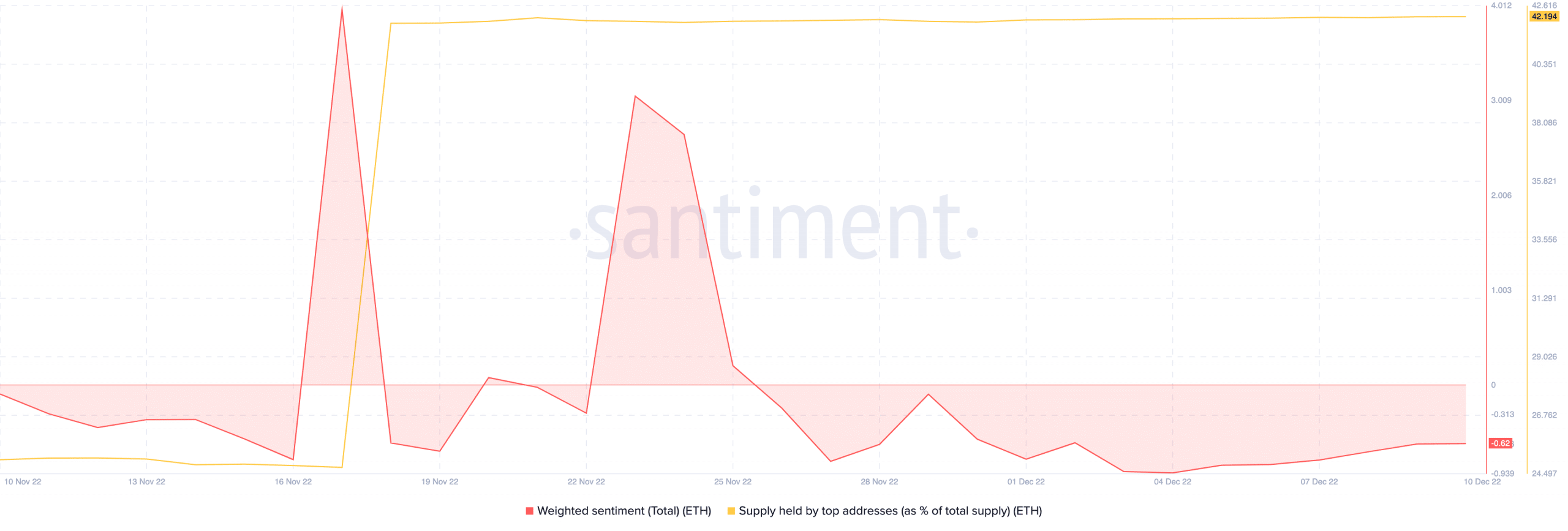

From the chart provided below, it can be observed that the weighted sentiment against Ethereum was negative. However, despite that, large addresses continued to accumulate ETH.

As evidenced by the chart below, the percentage of Ethereum held by large addresses grew significantly after 16 November. This support from large addresses could help sustain Ethereum‘s growth.

Another positive for Ethereum would be the spike in the network’s activity.

The number of active addresses on the Ethereum network grew materially over the last two weeks and sat at 33.3k addresses at the time of writing.

Coupled with the aforementioned information, the number of addresses holding more than 0.01 ETH also reached a four-month high of 22k addresses, according to Glassnode.

? #Ethereum $ETH Number of Addresses Holding 0.01+ Coins just reached a 4-month high of 22,444,478

View metric:https://t.co/XXb0u19ouH pic.twitter.com/H4UvSmgU16

— glassnode alerts (@glassnodealerts) December 10, 2022

Are investors ‘short’ sighted?

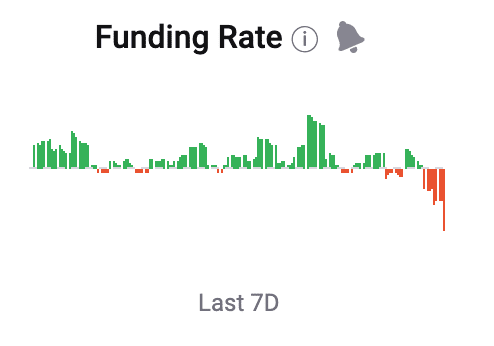

Despite support being shown by large addresses and the high activity on Ethereum’s network, traders were not confident in Ethereum’s growth.

The image given below revealed that the funding rate for Ethereum declined. Thus, traders who took short positions against Ethereum had increased and were willing to pay long-term traders.

It is yet to be determined whether these short sellers will be able to take a profit.

At the time of writing, ETH was trading at $1,272.6. Its price rose by 0.62% in the last 24 hours.