Is holding Ethereum in Q4 far from profitable? These metrics suggest…

- Ethereum turned inflationary as network supply fees fail to surge

- Network validators remain staunch in their duty to avoid slashing events while ETH consolidated

Ethereum’s [ETH] quest for profitability took another sour turn as it returned to inflationary condition after a few attempts at the opposite. According to Token Terminal, the decentralized blockchain daily earning in the last 365 days revealed a very low value.

Hence, indicating that network gains were almost non-existent. By inflationary, it meant that Ethereum on-chain transactions on the network were extremely low. So, it has also become difficult for Ethereum to record increases in gas fees.

Ethereum is unprofitable / inflationary again ? pic.twitter.com/6glPmYYCWu

— Token Terminal (@tokenterminal) December 4, 2022

Read Ethereum’s [ETH] Price Prediction 2023-2024

Amid the aforementioned happenings, Token Terminal also revealed that it had affected Ethereum’s revenue which dropped by 4.7% in the last 24 hours. Same as the supply side fees which witnessed a 5.3% decline within the same period.

Trust not the process?

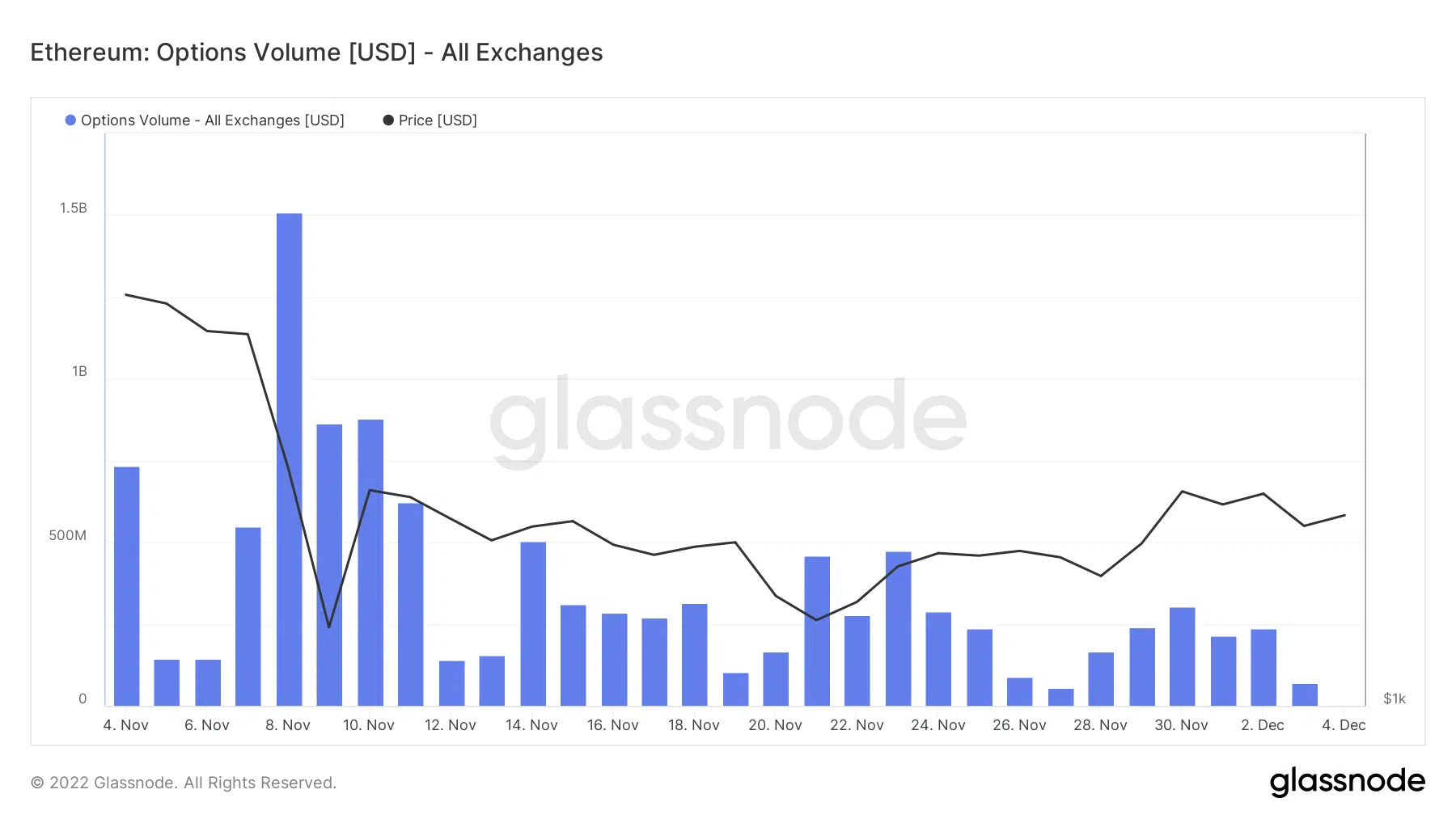

The supply section was not the only afflicted one across the Ethereum blockchain. According to Glassnode, interest in funding the options market had also been met with roadblocks. At press time, data from the on-chain platform showed that the options volume across all exchanges was $71.52 million.

This value was an obvious decrease from the supply for most of November. Following the plunge, it implied that contracts open for Ethereum were not impressive. This also implied that traders did not trust the altcoin enough to execute trades in their favor.

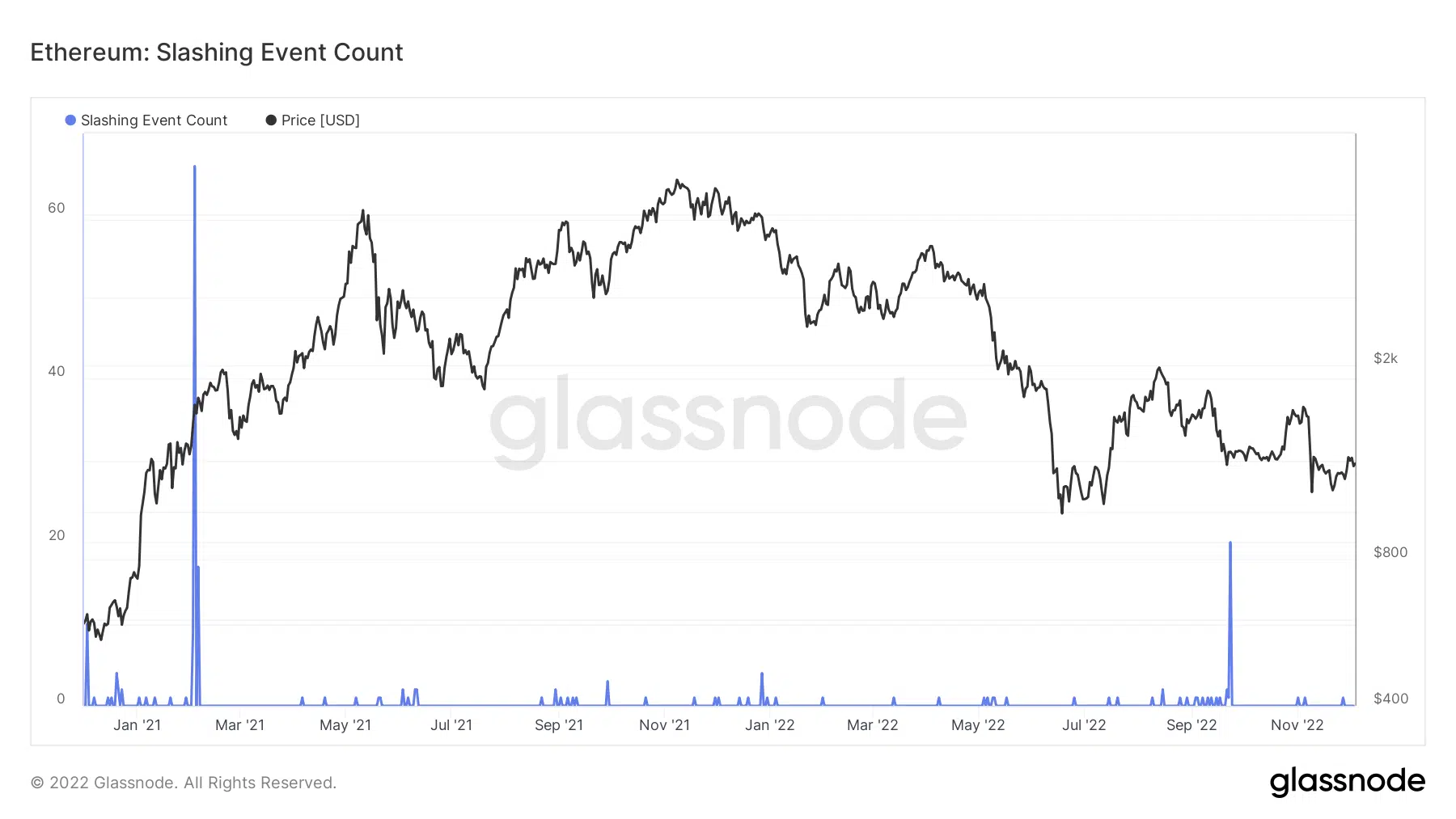

Moreover, not all parts of the network were down in the drain. For some like the slashing event count, this was a period to render a helping hand to the network. As of this writing, the Ethereum slashing event count was zero despite disorderliness a few days after the Merge.

At point zero, it implied that there had been fewer cases of proposing invalid blocks. Neither has there been a case of verifying an invalid fork to the Ethereum blockchain. So, there were little concerns about the network’s health as validator behavior has not been messy.

ETH, what about you?

As for the ETH price, it has been able to sustain above the $1,000 region. Based on CoinMarketCap data, ETH was trading at $1,255 at the time of writing. This value illustrated a 2.10% decline in the last 24 hours, as was the case for many cryptocurrencies.

Besides, ETH was less likely to exit the current zone in the short term. This was because the four-hour chart showed that the altcoin was far from extreme volatility as indicated by the Bollinger Bands (BB).

In terms of its Moving Average Convergence Divergence (MACD), ETH’s momentum was largely bearish. At a MACD value of -6.46, it might require an all-inclusive harmony for buyers to reverse the situation.