Assessing whether you should be worried about XRP’s long-term price

The never-ending Ripple-SEC lawsuit might just have a potential deadline. In a filing related to its pending class action, dated 23 February 2022, Ripple reportedly agreed to a new date of 18 November 2022. On the contrary, the date, as written on the report, was 26 August 2022. Alas, that’s not all.

On top of that news, there are reports that both XRP bulls and SEC insiders expect Ripple to emerge victorious. Such speculations were further fueled after the SEC reportedly removed the case/lawsuit from its website.

Who needs XRP?

Despite Ripple gaining significant traction of late, for many, XRP hasn’t reciprocated this momentum.

XRP and Ripple do share a degree of interdependence. In fact, some believe that the valuation of Ripple is intrinsically tied to the market price of XRP. Even so, a recent tweet storm expanded on why the altcoin’s price action is the way it is.

A thread on XRP price, without discussing price, because I don't do that. So why doesn't XRP go up with all the announced partners? 🧵

(A long, amateur twitter essay.)

— WrathofKahneman (@WKahneman) March 8, 2022

A pseudonymous Twitter user, WrathofKahneman, highlighted the reasons behind XRP’s slow price action in a series of tweets. The analyst opined that the demand for XRP isn’t strong enough (yet). Ripple, instead, could source the liquidity cheaply & integrate it.

Ripple’s On-Demand Liquidity (ODL) allows customers to instantly move money around the world at any time – even weekends and holidays. In fact, ODL transactions in Q3 2021 accounted for 25% of total dollar volume across the network. However,

“ODL doesn’t push the price up the way much hope since every buy side has a sell side. (ignoring LOC). But it is powerful long term to get XRP moving in greater volume & corridors, increasing usefulness & desirability.”

XRP’s growth, the analyst added, has been deemed fit for the long run. It captures as much global value as possible as it remains an embedded part of the global financial system. Ergo, XRP’s price, despite consolidating just under the $1-mark, isn’t a concern, he claimed.

According to him, in the long-term, XRP would surge as global transactions continue to speed up.

I hope you can see why there is no "switch" to throw, only corridors for liquidity to be added. Gradually! – retail shouldn't be enough $ to shock the price up with good volume. If a gov or Amazon, something huge buys in, that could be explosive, but that's not a switch. /7

— WrathofKahneman (@WKahneman) March 8, 2022

Needless to say, there isn’t much incentive for retail XRP traders right now. Also, understandably, there is a lot of bias against it. In the short run, however, the following may be good signs to look out for –

The sign I watch for: the growth of other companies, especially Ripple competitors, using the XRPL Companies like Xago – making XRP payments without ODL, or Forte. That feels like a threshold of some kind. What if JP Morgan gave in and tried to corner the XRP market!? /12

— WrathofKahneman (@WKahneman) March 8, 2022

Here’s what traders should really look at

XRP registered a significant hike in ‘Institutional Capital Flows’ ($0.9M) thanks to recent geopolitical tensions. In fact, this was the first time it noted a positive monthly return since October.

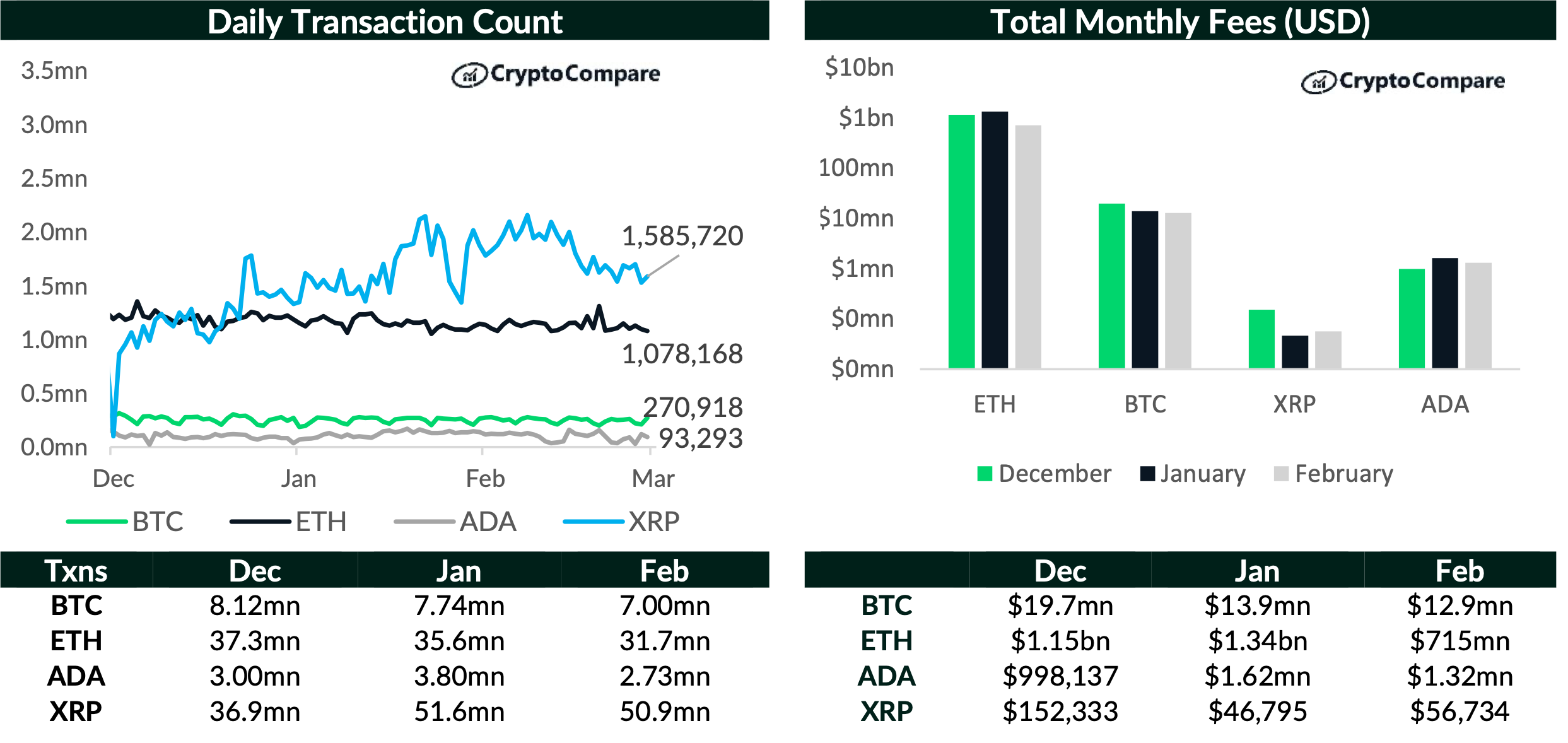

XRP’s price grew by 20.2% in February to $0.75, hitting a fully diluted market capitalization of $64.1B by the end of the month. Monthly USD volumes rose by 32.6% to $2.43B while 30-day volatility almost doubled as it jumped from 65.2% to 119%. On-chain activity slightly decreased as monthly transactions fell 1.28% to $50.9M.

Additionally, in February, XRP remained the blockchain with the highest transaction volume, as per CryptoCompare’s report. It recorded around $50.9M transactions over the month.

Source: CryptoCompare

The timing of these findings is interesting. Especially since XRP whales moved large quantities of the cryptocurrency between private wallets. This amounted to around 78 million XRP, worth more than $55 million.