Assessing why Chiliz [CHZ] may witness short-term downside before retesting these levels

The Chiliz [CHZ] network achieved robust growth and utility in the last two years courtesy of fan token launches. Unfortunately, this was not enough to shield its native token CHZ from the bear market. CHZ bulls made a healthy appearance since mid-June but this might just be the beginning.

A comparison of CHZ’s price action to that of most other top cryptocurrencies reveals something interesting about its price action. While most of the digital currencies extended their downside in June, CHZ’s bearish retracement pushed it slightly below its May support level. It has bounced back by as much as 45% to its latest top at $0.12.

CHZ traded at $0.108 on 22 July after a slight retracement in the last three days. However, its price action in the last three months provides insights into what to expect moving forward. CHZ still has room for more upside by at least 28% from its current price level before retesting its closest resistance zone within the $0.140 price level. The latter is within the 0.236 Fibonacci retracements and the same level demonstrated resistance in May.

Can CHZ bulls sum up enough momentum for resistance retest?

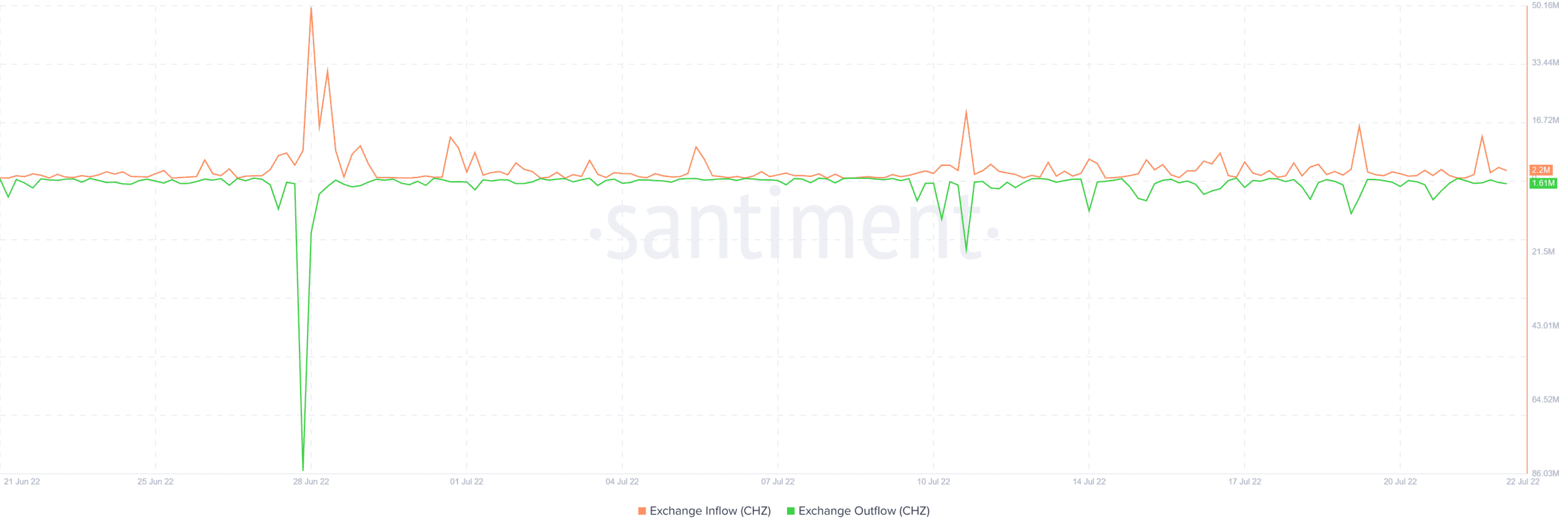

CHZ’s long-term performance will probably be past the $0.140 resistance by a mile. However, the short-term remains full of uncertainty. We can eliminate some of this uncertainty by looking at CHZ’s exchange flows to determine if there is enough buying volume for some more upside. CHZ’s exchange inflows maxed out at 12.12 million coins in the last 24 hours, against outflows as high as 1.68 million coins.

Source: Santiment

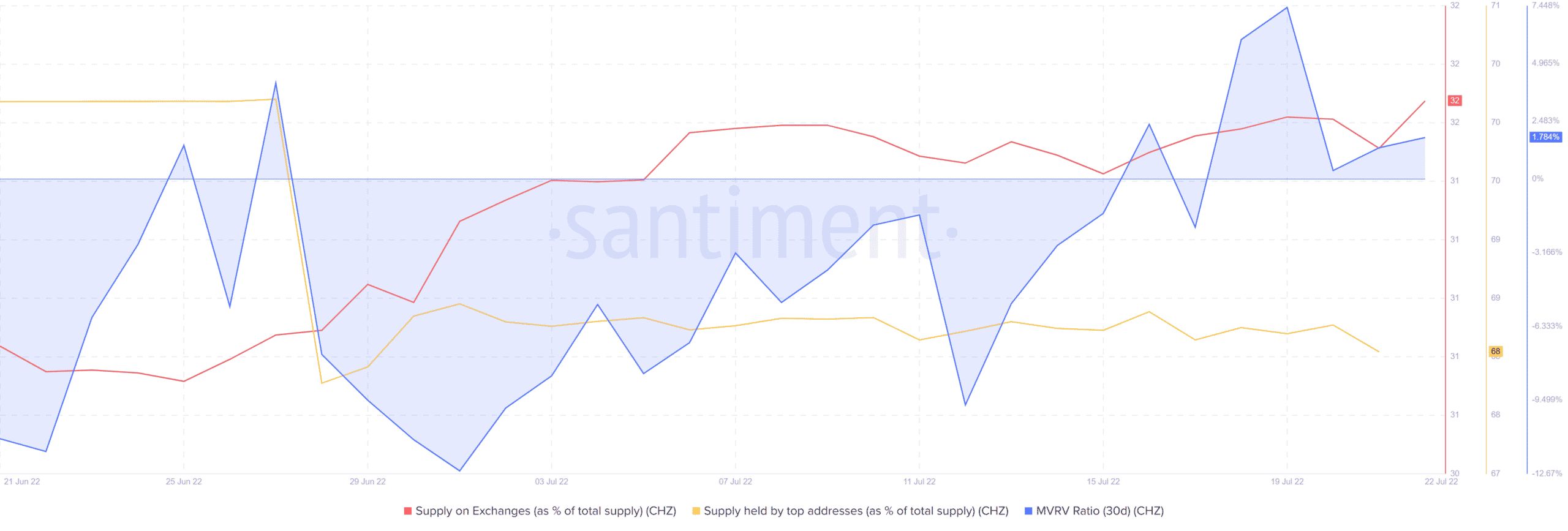

CHZ had higher exchange inflows than outflows, thus leaning towards the bearish side. The above observation aligns with an increase in the increase in supply on exchanges, as well as the outflows from top addresses. In other words, CHZ might be due for some more downside as selling pressure from top addresses increases.

CHZ’s 30-day MVRV ratio is up considerably in the last 30 days. This indicates that most of the bottom buyers are already in profit and thus the incentive to sell. This also means they will likely be looking to get back in at lower prices.

A bear on the loose

CHZ’s on-chain metrics suggest that we will likely witness some more short-term downside before that elusive resistance retest. However, this is subject to prevailing market sentiment, which might still support a strong upside.