Assessing why it may finally be game over for Axie Infinity [AXS]

Axie Infinity, the monster-battling game, has been setting startling benchmarks in the gaming ecosystem lately. In fact, ever since it started garnering mainstream adoption from the crypto-community, its token has soared significantly on the charts.

A tale of conflicting numbers

The gaming protocol’s 30-day cumulative revenue managed to cross the $298.9 million mark, at the time of writing. Surprisingly, Axie’s 9-figure revenue is nowhere close to the 8-digit revenue of PancakeSwap ($12.9 million), Ethereum ($8.3 million), SushiSwap ($3.6 million), and Aave ($2.4 million). Astonishing, isn’t it?

On 27 July, the protocol’s native token AXS was trading at its highest value – $53.69. However, its value has depreciated by 35% since. At press time, AXS was valued at just $43.33.

Now, let’s take a further look at the state of a few metrics to make sense of the aforementioned numbers that seemed to be in conflict with each other.

Development activity – the stumbling block?

A host of reasons can be attributed to the token’s fall in value. However, more than anything else, the unimpressive pace of its development activity seems to be the major hurdle for now.

Over the past few days, AXIE’s server has seen several shutdowns. As a result of the errors and disconnections, players have been forced to stay away from the game. In fact, they have been pretty vocal about the same on social media platforms like Twitter too.

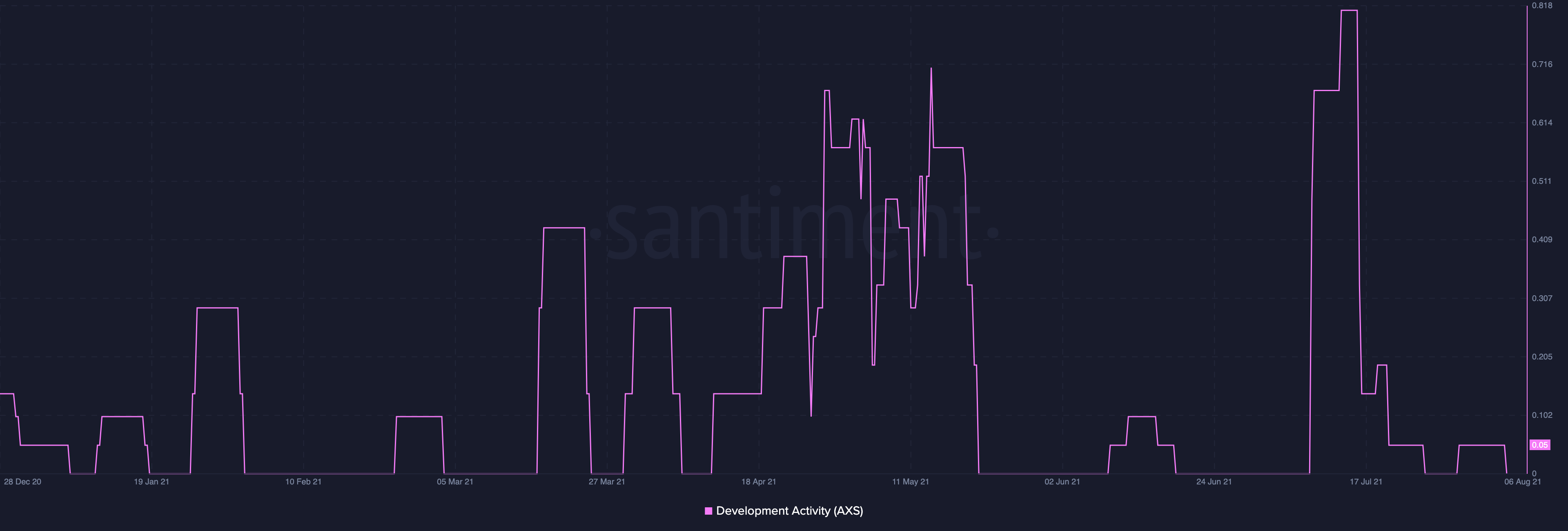

As can be observed from the chart, the development activity metric reflected a mere value of 0.5, at the time of writing. Notably, the same had crossed the 1.5 mark several times in the month of May. The aforementioned low levels of activity imply that engineers are not necessarily solving network-centric issues rigorously.

Furthermore, the number of commits on GitHub also shrunk from 1k (on 19 July) to 920 (on 6 August). To make matters worse, Santiment’s data highlighted how the network’s active developer count remained zero in the 19 July to 21 July period.

It’s worth noting, however, that AXS noted a slight recovery, at the time of writing, as one developer remained active.

No new purchasers for AXS

Now, the total number of daily active users saw a sharp increase of over 233% following the end of July. The same went on to hit 900,000 players last month. Even though this might end up compounding in the weeks to come, it should be noted that the same would add to the burden of the server.

What’s more, the rise in the number of gamers did not necessarily have a positive impact on other on-chain metrics.

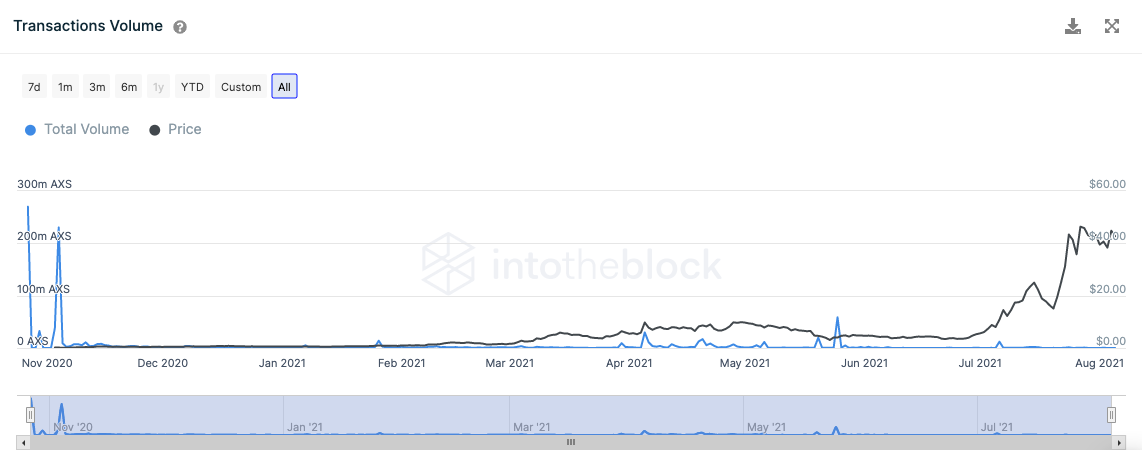

AXS’s average transaction size managed to cross the psychological $200k barrier back in July. However, the same has stagnated to around the $8k zone of late. The token’s transaction volume too, for that matter, has fallen of late. The metric witnessed random spikes of up to $60 million in the June-July phase. Alas, it was down to $45k, at the time of writing.

The aforementioned dips, to a fair extent, are suggestive of the fact that new players are not keenly purchasing the token due to ecosystem-centric issues.

Other social metrics did not paint a very hopeful picture either. AXS’s social volume has also started shrinking. During the latter half of July, Axie used to get up to 400 mentions on social media on a daily basis. However, the same is now under 100. The search trend too, for that matter, is spending more time on the downside lately.

Things were going on pretty smoothly for Axie Infinity, until its server started breaking down every now and then. According to a recent Axie announcement, it could take “days” or “perhaps weeks” for things to get back to normal. If not resolved at the earliest, it might become quite difficult for Axie to recover back from the downside.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)