ATOM drops to critical price level – More shorting gains likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bearish momentum looked to flip critical support level to extend sellers’ dominance.

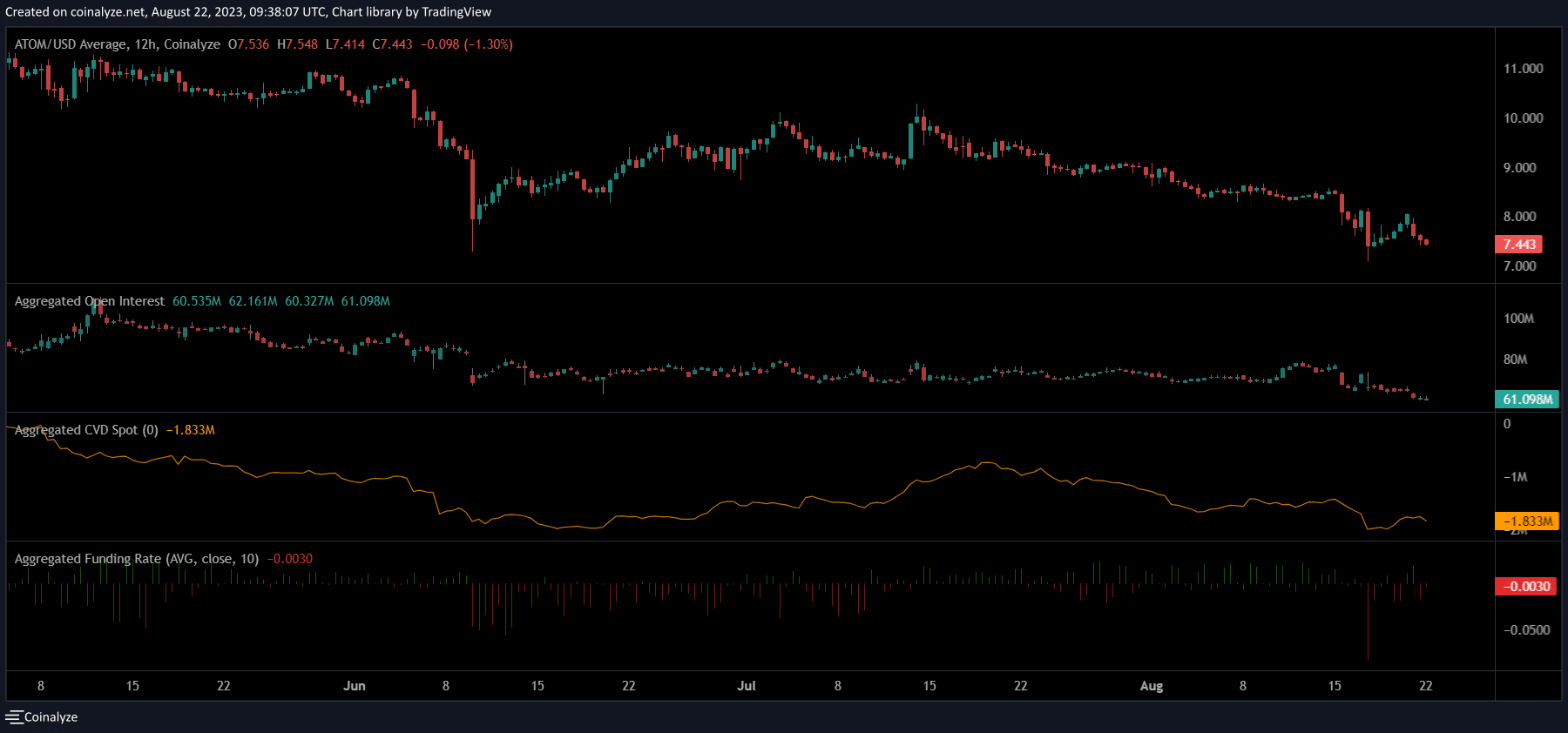

- Dwindling Open Interest highlighted liquidation of long positions.

The extended bearish action in the crypto market saw Cosmos [ATOM] descend to the year-low price level of $7 – $7.5. Despite a brief recovery, a 6% dip over the past 24 hours saw ATOM head toward the $7.2 support level, as of press time.

How much are 1,10,100 ATOMs worth today?

With Bitcoin [BTC] continuing its sideways price action between $25.8k and $26.2k, bears could look to extend their leverage by flipping the current support.

Is ATOM headed to a new year low?

The Relative Strength Index’s (RSI) sharp drop from a reading of 43 to 34 over the past day highlighted the significant bearish momentum. With the RSI hovering over the oversold zone, it hinted that price could break below the critical support level in the coming days.

Furthermore, the On Balance Volume (OBV) maintained its steep drop. This signaled a massive loss of interest in ATOM’s current price action.

Consequently, the selling pressure on the higher timeframes could see bears flip the $7.2 level. Sellers could look to drive prices toward the $6 to $6.5 price zone, which is a key demand level on the weekly timeframe.

On the other hand, an influx of buying pressure could see bulls defend the $7.2 support again. This could see ATOM register a price reversal in the short term.

Declining Open Interest underscored bearish dominance

The selling pressure along with dwindling Open Interest (OI) underlined the bearish market sentiment. The OI declined by over $6 million over the past 48 hours, per Coinalyze. This indicated liquidation by discouraged long traders.

Read Cosmos’ [ATOM] Price Prediction 2023-24

Similarly, the Funding Rate fluctuated between positive and negative. Also, the Spot CVD continued to decline, highlighting the waning demand for ATOM.

Together, this pointed to a continuation of the bearish trend in the short term.