Attention, Bitcoin traders! BTC’s next upswing may depend on this crucial factor

Bitcoin [BTC] traders have found themselves in a nail-biting situation this week following its downside in the last seven days. The bearish performance sent BTC crashing and at press time, the crypto king stood in a critical zone on a short-term support. Its direction from this point stood at the mercy of the FOMC meeting.

Bitcoin sat on its short-term support with a $19,004 price tag at press time. However, its performance in the next 24 hours will have drastically changed depending on the outcome of the FOMC meeting. The latter is expected to feature a Federal Fund rate revision in the U.S. This will impact investor sentiment as has been the case in the past.

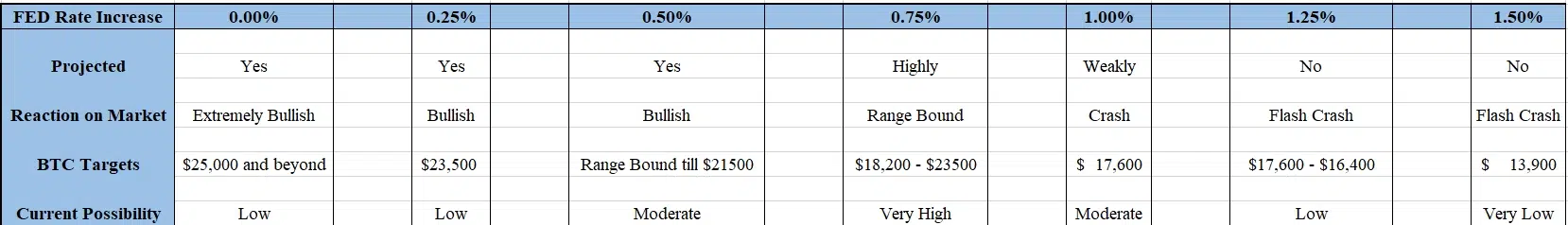

Current projections favor a 0.5% or 0.75% increase. The latter would trigger a stronger bullish sentiment for BTC while the former would support a range-bound performance. This was the case as per the chart which provides a guide or assesses the potential outcome based on Federal rate data.

Although the current sentiment was heavily in favor of a 0.5% to 0.75% rate, a 1% rate hike could still be a possibility. A 1% rate is expected to trigger a bearish sentiment. However, the resulting downside might push BTC towards the $17,600 price range.

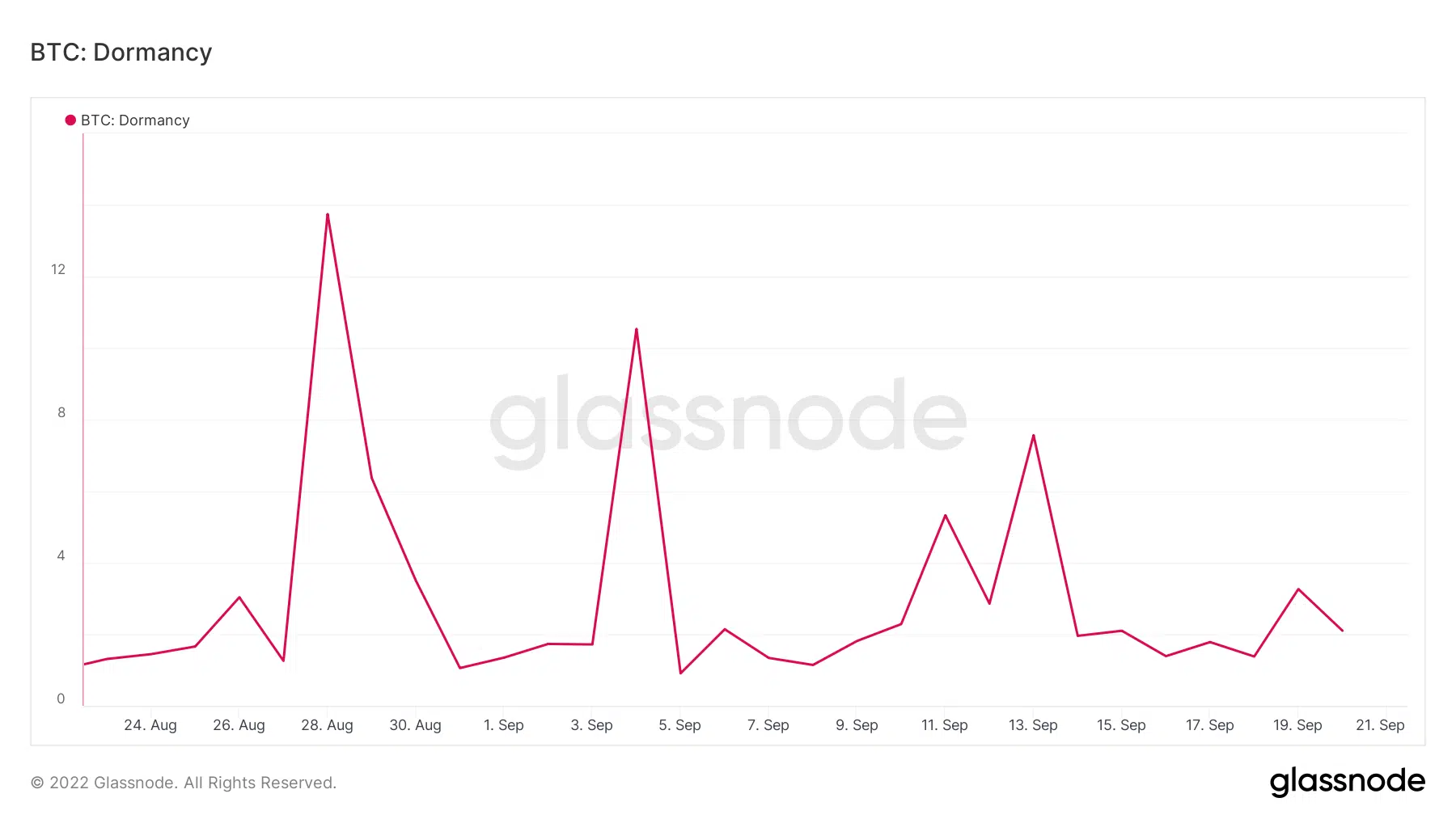

Furthermore, on-chain metrics highlighted an uncertainty as investors await the critical FOMC decision. The dormancy metric indicated that dormancy dropped significantly in the last 30 days. At press time, it stood near its monthly lows, which is unsurprising since investors are waiting to see how the market will react.

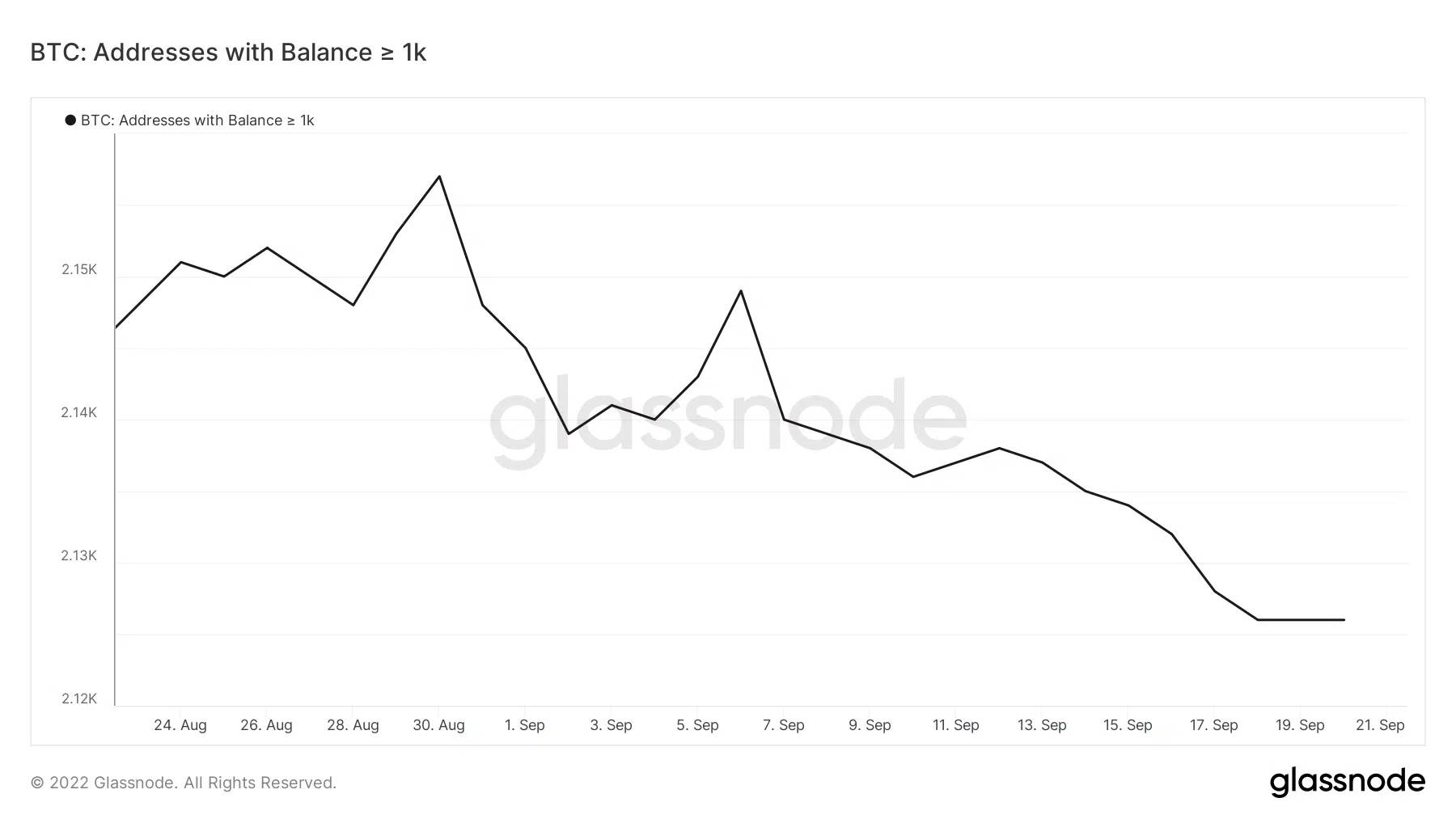

The dormancy reflected whale activity especially from around mid-Month. Addresses holding more than 1,000 BTC dropped substantially from 15 September. However, outflows from these addresses also tapered out since 18 September. This outcome mirrored the uncertainty around the FOMC meeting and the impact of the announced rate.

Loading the gun

The possible outcome could be one of another sharp uptick or a slight drop. Addresses that have already been selling are most likely to take advantage and start accumulating especially if there will be an additional downside. This outcome could potentially provide a softer landing, hence a limited downside.

On the other hand, a favorable outcome from the FOMC might trigger a strong buy signal especially by the whales. Such an outcome may support a strong recovery towards the end of the week.

Thus, the outcome of the FOMC meeting will provide a rough idea of how the Federal Reserve has been doing as far as combatting inflation may be concerned. A positive outcome might ease the sell pressure on Bitcoin and the higher risk asset class in general.