Attention KCS holders! This week may be far from your expectations because…

Crypto assets or firms, thanks to the FTX exposure, are either being dumped like FTT or closing shop like BlockFi. And allegedly KuCoin exchange’s exposure to FTX spooked users. Amidst the overall bearish market sentiment and BTC struggling to break the $18K resistance, users feared the exchange could be adversely affected alongside its native token (KCS).

Read KuCoin’s [KCS] price prediction 2023-2024

Johny Lyu, Ku Coin exchange CEO, swiftly clarified that there was no direct exposure to FTX. He reiterated that the exchange never deposited money in FTX. Additionally, he noted that they planned to issue proof-of-reserves and champion as an industry standard to rebuild trust in the industry.

As part of the transparency call in the space, the CEO issued hot and cold wallets of its exchange’s crypto holdings.

From day 1 of building KuCoin, we have been transparent to our users. The overview of some of KuCoin’s hot and cold wallet addresses are clickable for their current holdings. https://t.co/zpjdlwoSpx https://t.co/vEuNY6LhW9

— Johnny_KuCoin (@lyu_johnny) November 11, 2022

Furthermore, it was worth noting that the exchange held about 70 million KCS, its native token. Compared to the 98 million KCS total circulating supply, the exchange held roughly three-quarters of the native coin. In comparison, the Binance exchange held 58 million BNB, its native token, out of the 158 million in the current market circulation. That’s roughly a third of the total supply.

However, KuCoin’s post of proof-of-funds attracted mixed reactions from users. Some praised the move. But others called for complete transparency by showing their liabilities and debt obligations. The mixed sentiment undermined KCS’s price performance and exposed its holders to losses.

KCS on the charts

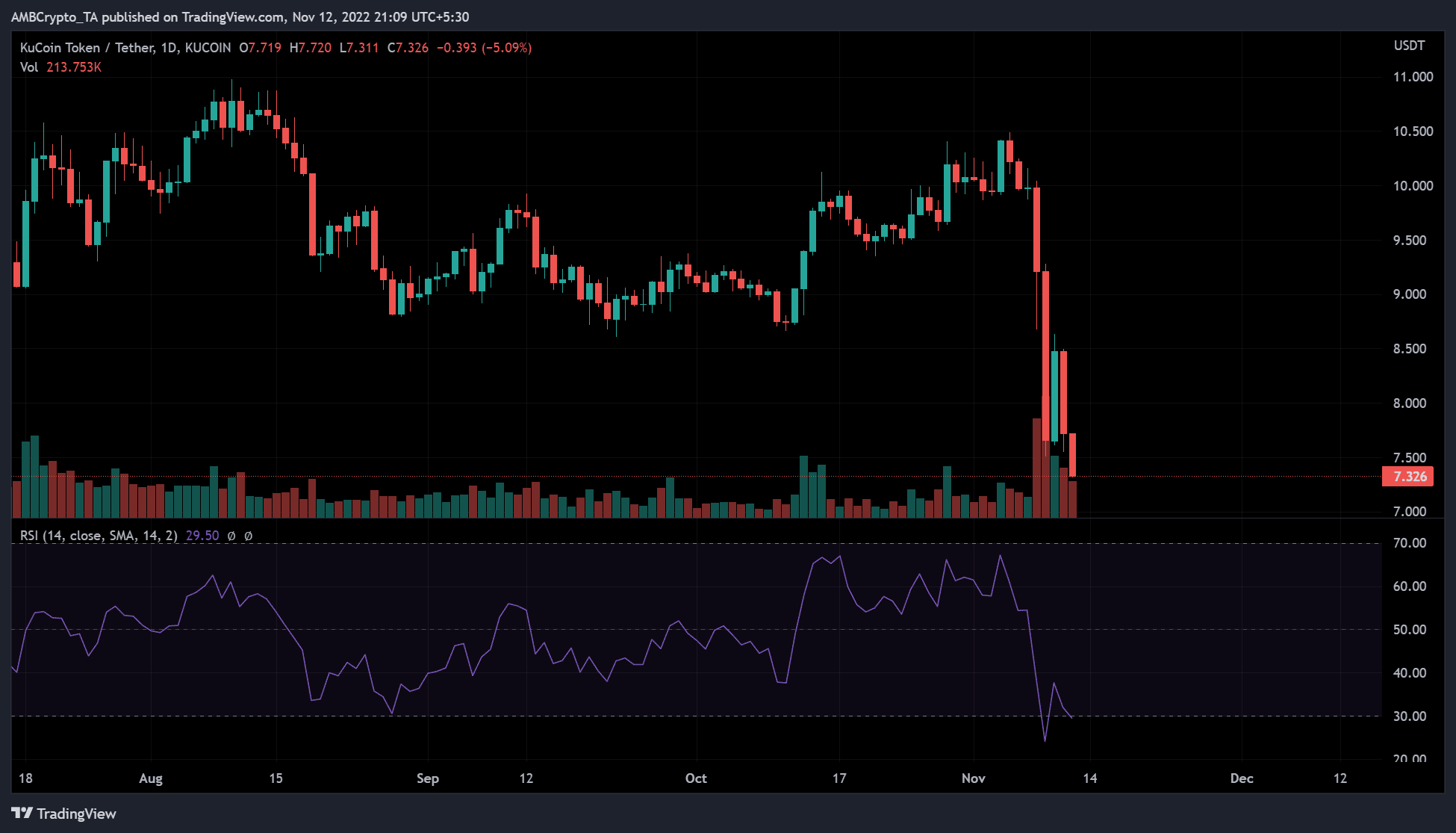

KuCoin was down by 5% on the daily chart, trading at $7.324 as of 12 November. The Relative Strength Index (RSI) had slightly retreated from the oversold territory before making a U-turn towards it again. Furthermore, KCS could have witnessed a massive sell-off amid its significant price drop. KCS shed almost $50 million of its market cap, dropping from $770 million to about $720 million, as per Coinmarktcap data.

A metric viewpoint

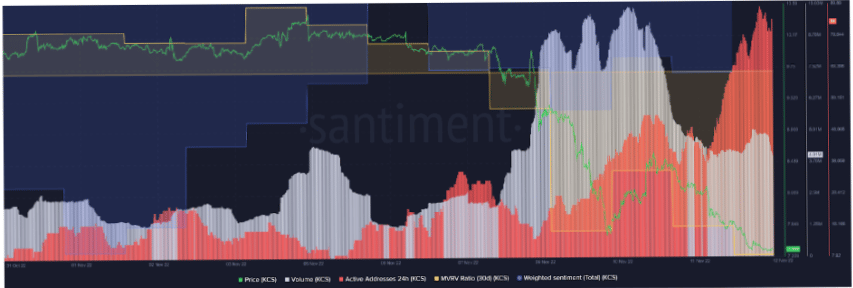

Analysis of data from Santiment showed that KCS’s weighted sentiment dropped, indicating a bearish sentiment on the token. Correspondingly, the number of active addresses increased within the last 24 hours as the price dropped, a likely indication of users disposing the token.

An uptick in volume confirmed the building selling pressure that dented holders’ earnings. The 30-day Market Value to Realized Value (MVRV) was also positive till 7 November. But on 12 November, it tanked deeper into the negative territory, thus showing that short-term KCS holders incurred more losses.

Although the clarity on FTX exposure and issuing of proof-of-reserves was to build user trust, KCS’s performance exhibits the opposite outcome. The current bearish sentiment on the market could further expose KCS holders to more losses.