Avalanche investors could be disoriented as AVAX exhibits these signs

- Avalanche DEXs reach new milestones in terms of deposit capacity

- NFTs, revenue, and minted NFTs on Avalanche decline while stakers on network witness a surge

Avalanche, a decentralized finance (DeFi) platform, witnessed noteworthy growth in its decentralized exchange (DEX) market. This was due to the fact that the deposit capacity of GLP on Yeti Finance, a popular DEX on Avalanche, reached a new milestone.

This positive development indicated that the ecosystem on Avalanche was expanding and many investors and traders were attracted to Avalnche’s ecosystem.

@GMX_IO GLP has hit the $1M deposit capacity ?

Yeti Finance remains one of the best protocols to borrow against high demand and diverse collaterals (BTC.B, Aave/BENQI supplied assets, JOE) on #Avalanche. pic.twitter.com/2MjrT6OYMD

— Yeti Finance ? (@YetiFinance) January 9, 2023

Are your AVAX holdings flashing green? Check the profit calculator

New updates and upgrades

One of the reasons for this growth could be new products being launched such as Delta Prime, which is expected to bring new opportunities for its ecosystem.

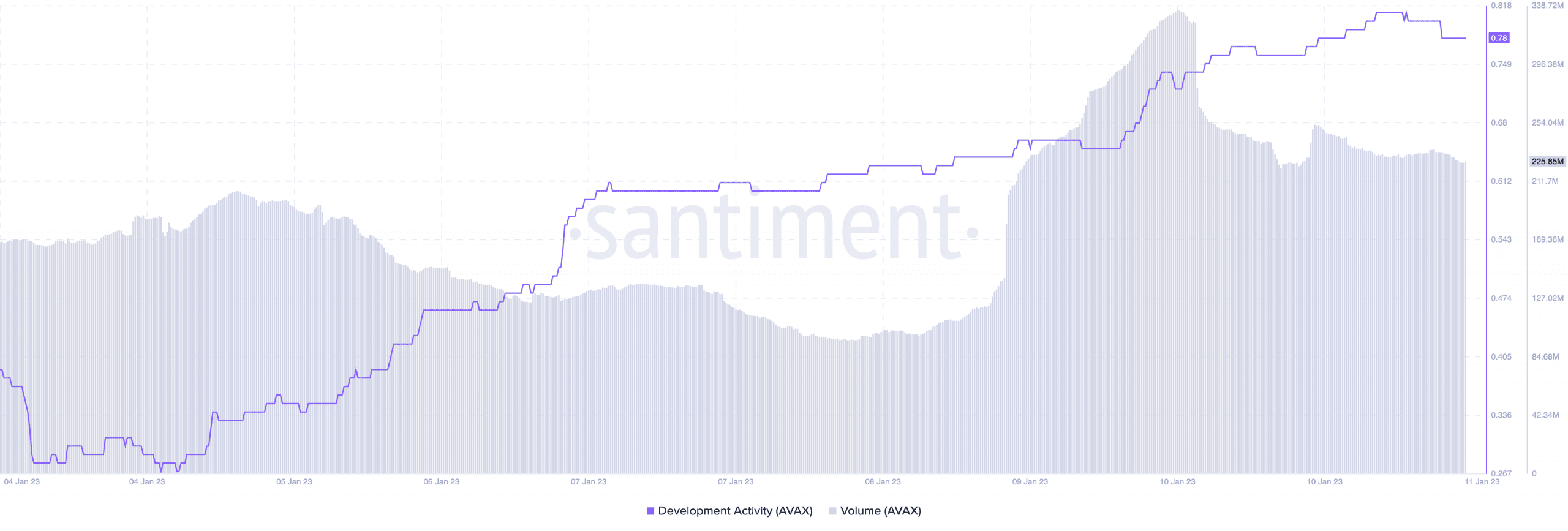

Another factor contributing to this growth was the increasing development activity on Avalanche network. A growing development activity implied that new upgrades and updates could be expected in the future. Moreover, this development activity also suggested that the Avalanche team was actively working to enhance the capabilities of their platform and make it more appealing for users.

Data from Santiment also showed that Avalanche token’s overall volume also increased over the past month. Its volume went from $165 million to $225 million in a week. This implied increased interest in AVAX and growing trading activity of the token.

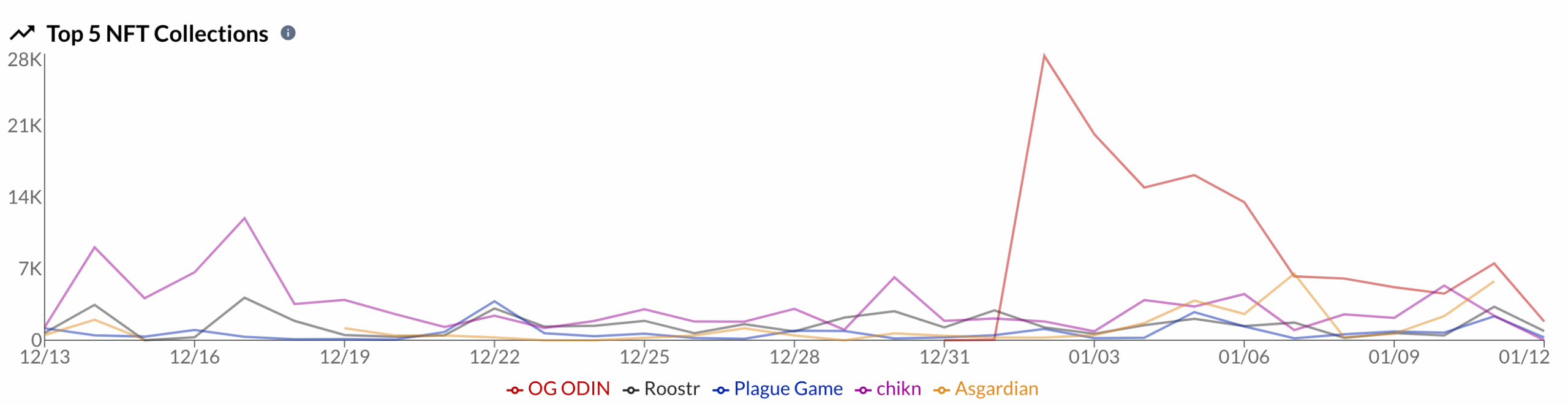

However, the state of Avalanche’s NFTs was far from great. Blue chip NFT’s on Avalanche saw a decline in volume over the last month. Along with that, the number of NFTs being minted on Avalanche also decreased according to data provided by Avax NFT stats.

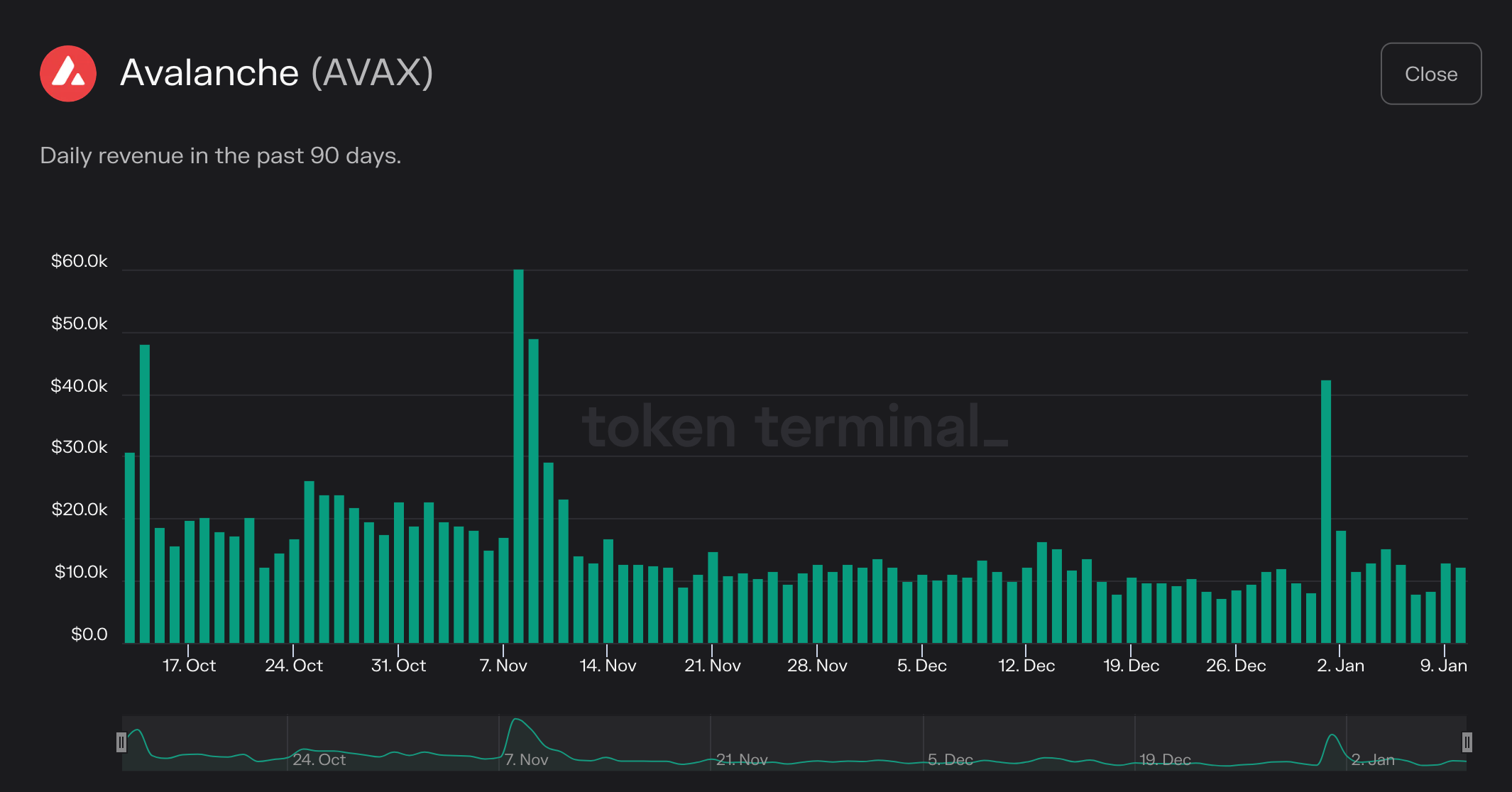

This decline in NFT interest impacted Avalnche’s revenue as well. According to data provided by token terminal, the revenue generated by Avalanche decreased by 27.4% over the last week. Cumulatively, the revenue generated by Avalanche was $3.6 million at the time of writing.

How much AVAX can you get for $1?

Stakers remain interested

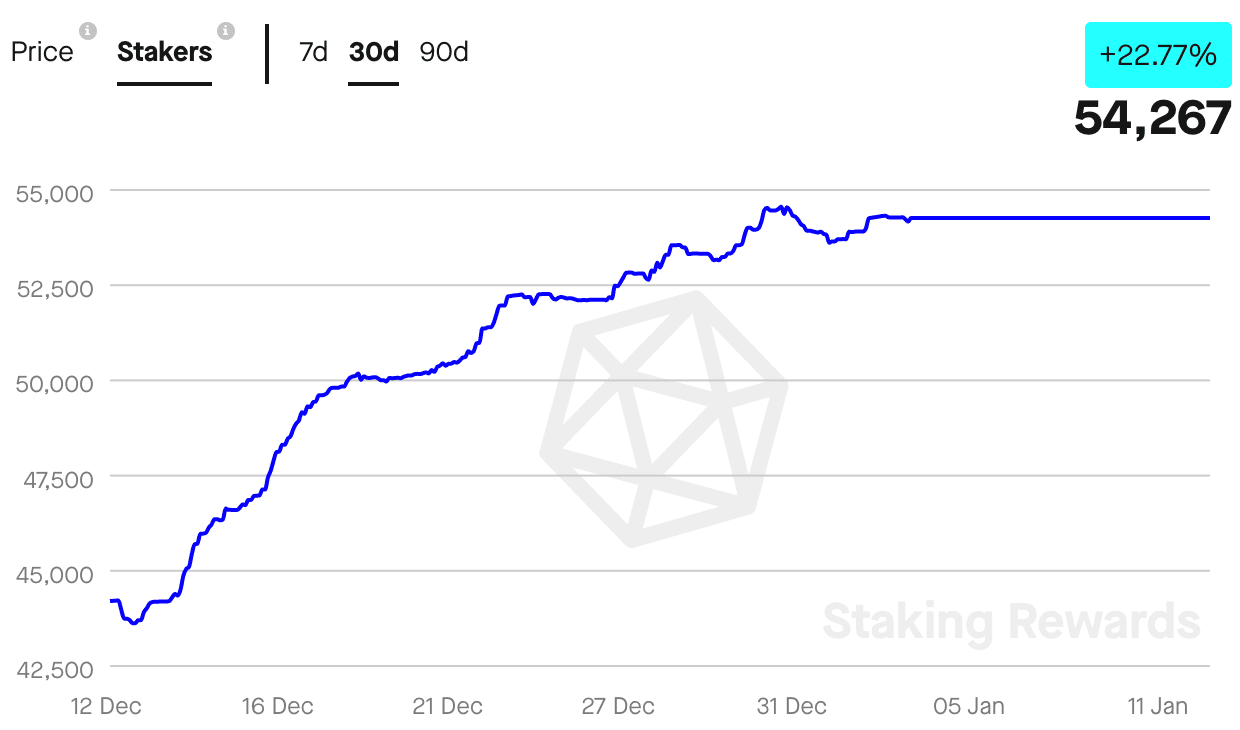

Despite these issues, stakers continued to show faith in Avalanche. The number of stakers on the Avalanche network increased over the past month. Based on staking rewards data, the number of stakers on Avalanche grew by 22.77% in the last 30 days.

At press time, the number of stakers on the Avalanche network were 54,267. This increase in staking activity indicated user interest and trust in the protocol.

It remains to be seen how these factors impact the price of AVAX. At press time, Avalanche was trading at $12.54, and it grew by 0.42% in the last 24 hours.