Avalanche: Investors going short on AVAX can watch out for these levels

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Avalanche seemed primed for another plunge on the price charts

- A bounce toward $14 can not be discounted but can offer an opportunity for sellers

Avalanche flipped its market structure from bullish to bearish earlier this month following the market-wide selling pressure witnessed recently. Bitcoin plummeted from $21.5k to $16.2k and could head lower once more.

Read Avalanche’s Price Prediction 2023-24

More daring lower timeframe traders can seek to bet on a bullish couple of days. However, more risk-averse traders can wait for an opportunity to sell, with clear invalidation presented on the charts. The TVL of Avalanche saw some advances recently, but could this be a bullish short-term catalyst for AVAX?

The market structure was bearish as sellers remain aggressive

On the 12-hour chart, AVAX broke beneath the bullish order block at $14.5 on 9 November. It flipped its structure from bullish to bearish on 8 November when the price broke beneath a recent higher low. Around the same time, the Relative Strength Index (RSI) took a nose dive as bearish momentum seized control of the market.

The Chaikin Money Flow (CMF) and the On-Balance Volume (OBV) also took a huge hit as selling pressure increased enormously. The bearish outlook has not yet changed. The Fibonacci retracement and extension levels showed that the next support level to watch out for sat at $10.06. This was also a significant psychological level.

For more conservative higher timeframe traders, the bearish breaker in the $15 region can be a place where they can look to enter short positions. More aggressive traders can view the $14 area as a place to enter short positions. In either scenario, the inference was that AVAX will face a large amount of selling pressure near these levels. Invalidation would be a session close above $14.06 for the more aggressive entry, and above $16.01 for the conservative approach.

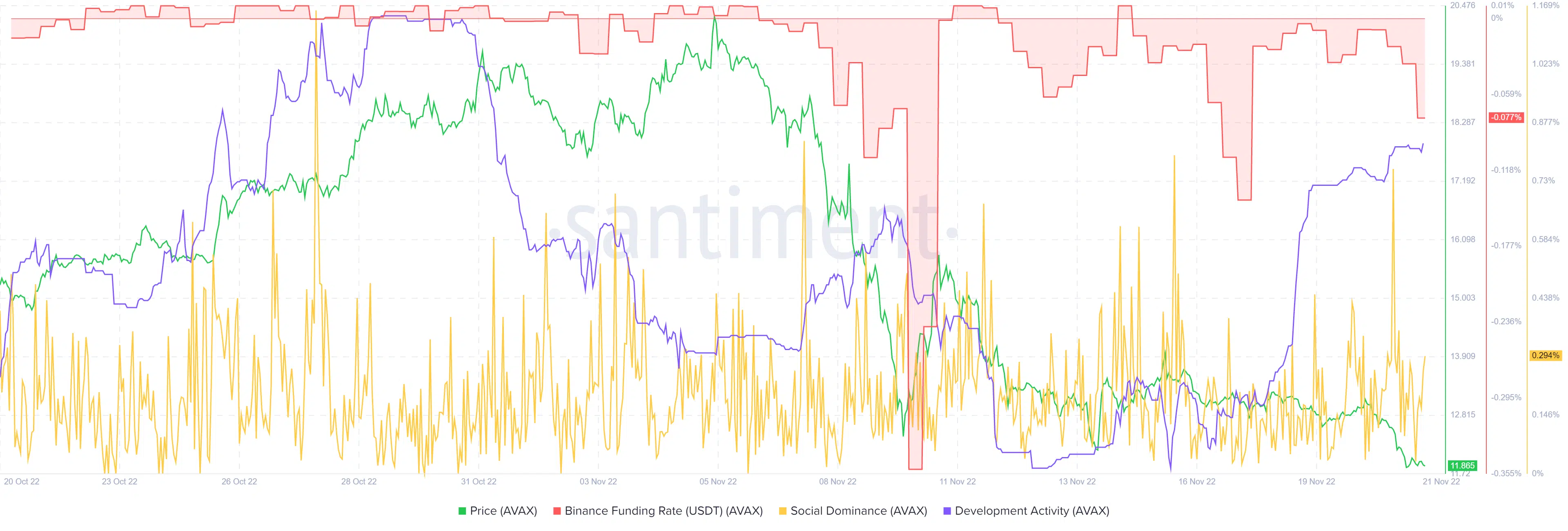

Funding rate negative as futures participants bet on lower prices

Source: Santiment

Development activity has been on the rise in recent days and that was the only positive to take away for long-term investors. Social dominance has been somewhat steady in recent months with sporadic surges to the 0.7% mark.

As for the futures market, traders appeared to be positioned bearishly as the funding rate saw a dip into negative territory. Open Interest has also been in a downtrend in the past two weeks.

Technical factors and sentiment was strongly in favor of the bears. This does not mean a bounce toward $14 or even $15 will not occur. Instead, higher timeframe traders can look for a retest of these regions to search for good probability shorting opportunities.