Avalanche: What does May have in store for AVAX as April ends heavily in the red

AVAX just concluded another bearish week during which it extended its downside to 47% from its April high. It peaked at $103 on 2 April after a healthy pump from mid-March, before concluding the bearish monthly performance in April at $55.05.

April turned out to be an overall bearish month for most of the top cryptocurrencies. It traded at $58.55 at the time of writing, after bouncing back from yesterday’s $55.05 low. Its 47% monthly drop puts AVAX below its March low.

Is AVAX due for a reversal or will it continue dipping?

The last time that AVAX was in its current price range was in January 2022 before registering a healthy pump. Its Money Flow Indicator confirms the strong bearish momentum but its –DI is currently crossing the ADX.

This means the bearish trajectory might be about to cool down, in which case the bears would take over for some due upside. Its latest dip puts it in the oversold territory as currently indicated by the RSI.

Here are some near term Fibonacci-based price levels to watch out for if the price turns bullish. The 0.236 Fibonacci retracement line maps onto the $63 price level, and the 0.382 Fibonacci line aligns with the $69.10 price point.

The latter has previously been tested as support on multiple occasions. The $73 level may also be of interest as far as short-term resistance is concerned and it aligns with the 0.5 Fibonacci retracement line.

Is there potential for more downside?

There is still a significant possibility of extended downside even if AVAX is currently oversold. Market factors may continue to suppress the price. The possibility of a bullish performance or continued price drop depends on market sentiment.

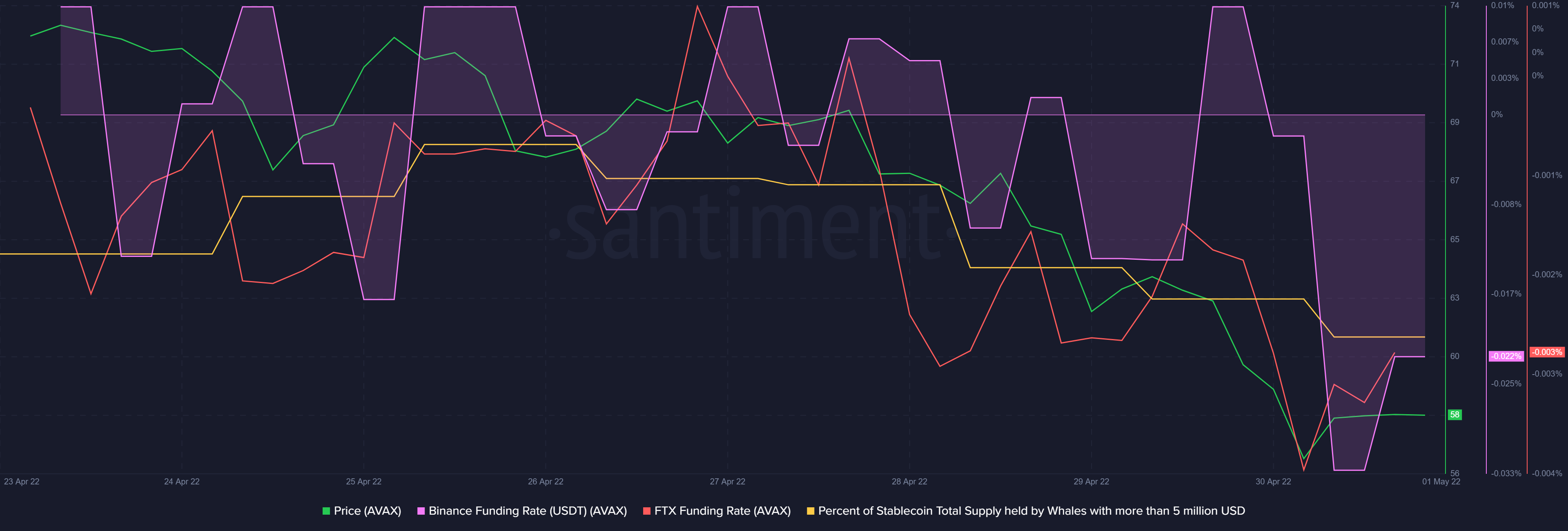

Some Santiment indicators such as the Binance and FTX Derivatives funding rates have dropped significantly in the last few days, suggesting low investor confidence. The market is likely to experience more downside in such market conditions.

However, both the Binance and FTX funding rates indicate some sentiment recovery in the last few hours, and this aligns with the slight recovery from Saturday’s lows.