AVAX: Bears refuse to let go even as DeFi activity rises

- DeFi protocols contributed significantly to Avalanche’s transaction count and active user base.

- AVAX was still grappling with bearish sentiment.

Avalanche [AVAX], the decentralized proof-of-stake blockchain, registered a drastic surge in network activity on its C-Chain since the beginning of May. According to Avalanche Explorer, the transaction count hit 427,612 on 17 May, the highest value in more than a month.

Read Avalanche’s [AVAX] Price Prediction 2023-24

The upsurge marked a remarkable turnaround from the declining activity prevalent since mid-April.

The C- Chain or the Contract Chain is the default smart contract blockchain on Avalanche which enables the creation of any Ethereum [ETH]-compatible smart contracts.

Avalanche ‘DeFi’es all odds

The surge was primarily driven by Circle [USDC] and decentralized finance (DeFi) protocols like Stargate Finance [STG] and Trader Joe [JOE]. While stablecoin transfers generally dominate trading activity on most blockchains, it was the growing popularity of DeFi applications which grabbed the attention.

Which applications are driving usage on the @avax C-chain?

Top 3:

1. @circle

2. @StargateFinance

3. @traderjoe_xyz pic.twitter.com/KHBcFvEZ6f— Token Terminal (@tokenterminal) May 19, 2023

The two protocols accounted for a large chunk of Avalanche’s user base while also contributing heavily to the overall transaction count. According to data at press time, Stargate Finance was the biggest protocol in terms of active users in the last 24 hours, with a count of 18.75k, while more than 11k users interacted with Trader Joe’s smart contracts.

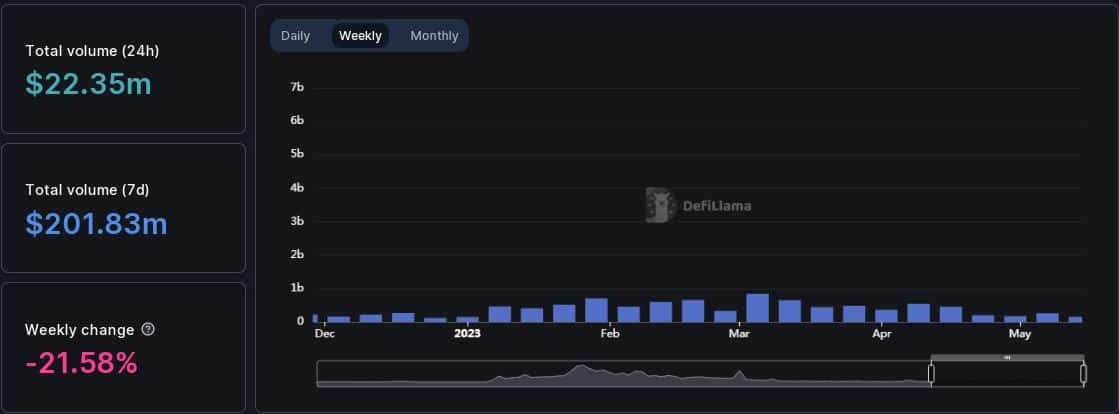

TVL, DEX volume remains tepid

Trader Joe’s total value locked (TVL) registered a weekly growth of 3.46%, per DeFiLlama. Stargate Finance, on the other hand, saw the total worth of its assets increase marginally by 0.22%.

While the two projects contributed to overall liquidity on the chain, the net impact was not substantial owing to their lower share of Avalanche’s TVL. The total worth of assets on the chain was $1,46 billion at press time, having stagnated in March.

Avalanche’s weekly decentralized exchange (DEX) volume plunged 21%, putting into question the chain’s established reputation as being DeFi-friendly. Most of the top DEXs on the chain, including Trader Joe, recorded weekly drops in volume.

Will AVAX see resurgence?

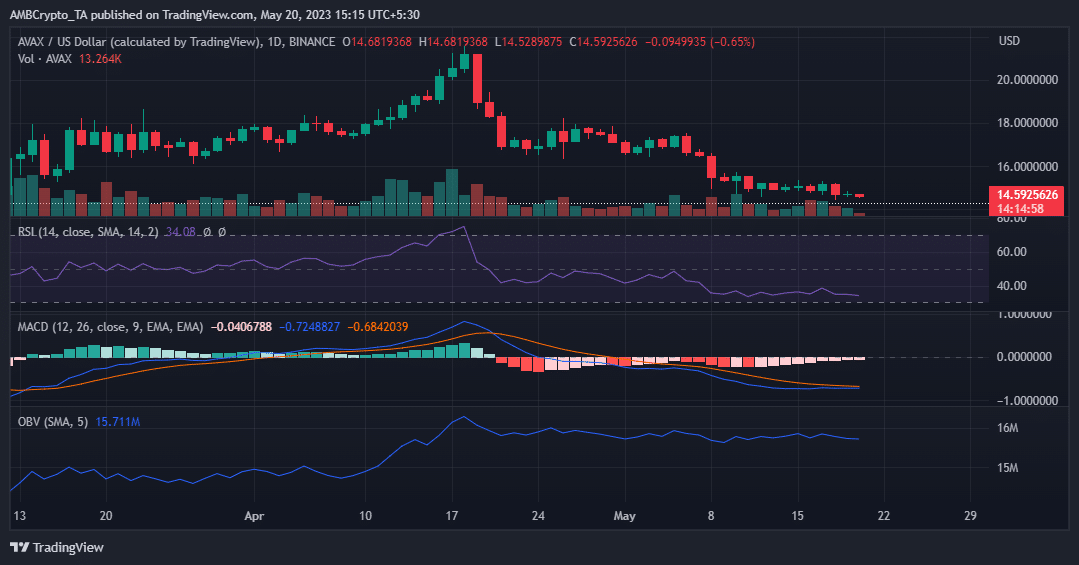

AVAX exchanged hands at $14.6 at press time, representing a 0.5% drop in the last 24 hours. With a market cap of more than $4.8 billion, the coin was ranked 16 in the list of top cryptos by valuation. Most of the technical indicators on a daily timeframe gave bearish signals.

Realistic or not, here’s AVAX’s market cap in BTC terms

The Relative Strength Index (RSI) continued to move below the neutral 50 level, implying sustained selling pressure. The indicator was still not in the oversold zone; hence, the chances of a reversal were slim. The Moving Average Convergence Divergence (MACD) stayed in negative territory, reinforcing the bearish sentiment.

The On Balance Volume (OBV) trended downwards, suggesting an outflow of capital.