AVAX crosses above downtrend line – is a recovery sustainable

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- AVAX recovered slightly above a key short-term downtrend line.

- The sentiment was positive, but AVAX faced a price rejection at press time.

Avalanche’s [AVAX] recovery could be limited despite improved investors’ confidence. The asset recently dropped from a high of $22.8 to a low of $19.4, a 14% plunge. The drop happened after Bitcoin [BTC] temporarily lost the $23k zone.

Is your portfolio green? Check out the AVAX Profit Calculator

Bulls launched an impressive recovery attempt, but their efforts seemed unsustainable, as suggested by technical indicators.

AVAX faced price rejection at $21.04

Bulls inflicted a bullish breaker after finding steady support at $19.50. The momentum saw AVAX break the resistance at $19.81 and a convincing cross above the downtrend line, which flipped the short-term market structure to bullish.

However, the price rejection at $21.04 set the bulls back. AVAX could settle on the seven-period EMA of $20.52 or $20.40 support levels before returning to retest the 21.04 level.

However, if BTC lost the $23k zone, AVAX bears could devalue the asset below $20.40 and 26-period EMA in the next few hours. The extended plunge would invalidate the bias described above. But the drop could settle at $19.81 or the downtrend line.

The Relative Strength Index (RSI) and On Balance Volume (OBV) registered a downtick, indicating that bulls could be undermined in the short term.

AVAX recorded improved investors’ confidence, but…

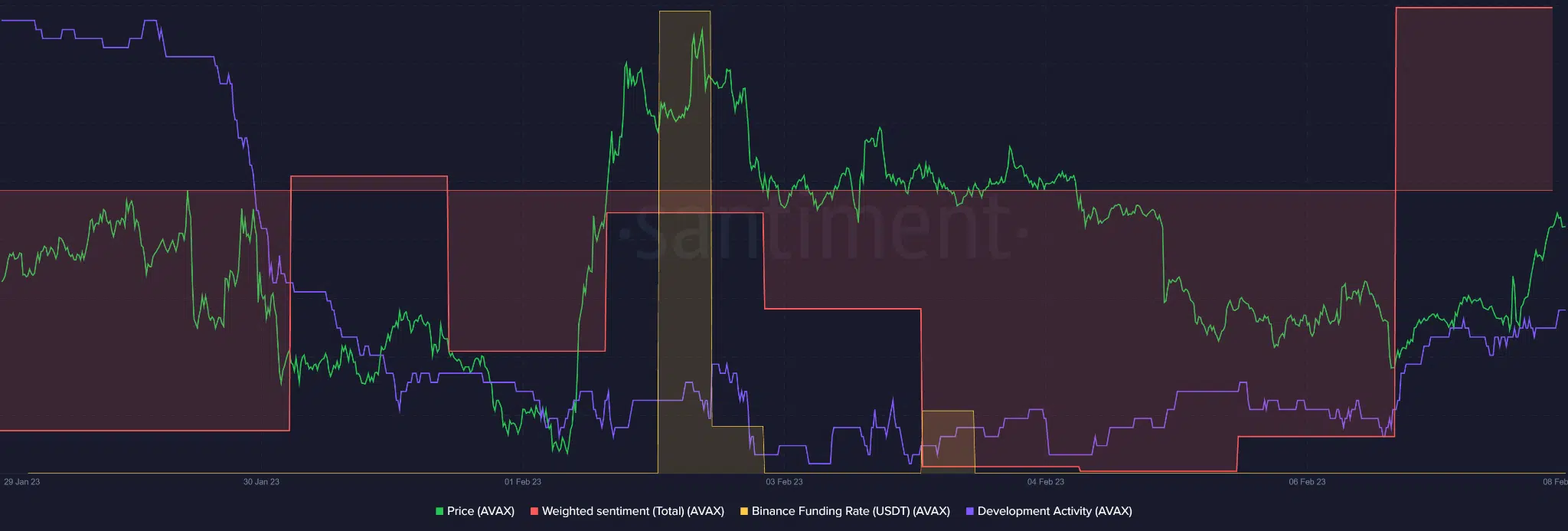

As per Santiment’s data, AVAX recorded improving investors’ confidence from 5 February, as evidenced by the flipping of weighted sentiment from negative to positive. Notably, the investors’ outlook could have been boosted by the rising development activity in the same period.

It showed that investors felt assured by the network’s prospects, which was also reflected in a surge in price.

Read Avalanche’s [AVAX] Price Prediction 2023-24

However, the Funding Rate was relatively flat in the same period. Despite being positive, the lack of more demand for the asset in the derivatives market could undermine the strong uptrend momentum needed to bypass the price rejection level at $21.04.

Therefore, AVAX recovery momentum could be limited, and traders should watch for the price rejection level at $21.04 alongside BTC’s price action.