Should AVAX holders expect bull rally after 14% drop in 7 days?

- AVAX was down by more than 12% in the last seven days.

- Indicators and metrics looked bullish on the token.

Like most cryptos, Avalanche [AVAX] bears also controlled its price last week as its value dropped.

However, if AVAX manages to flip a key resistance into its new support, then investors might witness the token kick-start yet another bull rally.

Avalanche is bleeding

According to CoinMarketCap, AVAX’s value plummeted by more than 14% in the last seven days. In the last 24 hours alone, the token’s value dropped by over 2%.

At the time of writing, AVAX was trading at $46.75 with a market capitalization of over $17.6 billion, making it the 10th largest crypto.

Interestingly, AMBCrypto’s look at IntoTheBlock’s data revealed that at press time, 74% of AVAX investors were in profit. Though this price action was bearish, things might change in AVAX’s favor soon.

Crypto Tony, a popular crypto analyst, recently posted a tweet highlighting that if AVAX manages to flip its existing resistance level of $64.5 to its support, then AVAX might begin a bull rally in the coming weeks.

Will Avalanche turn bullish?

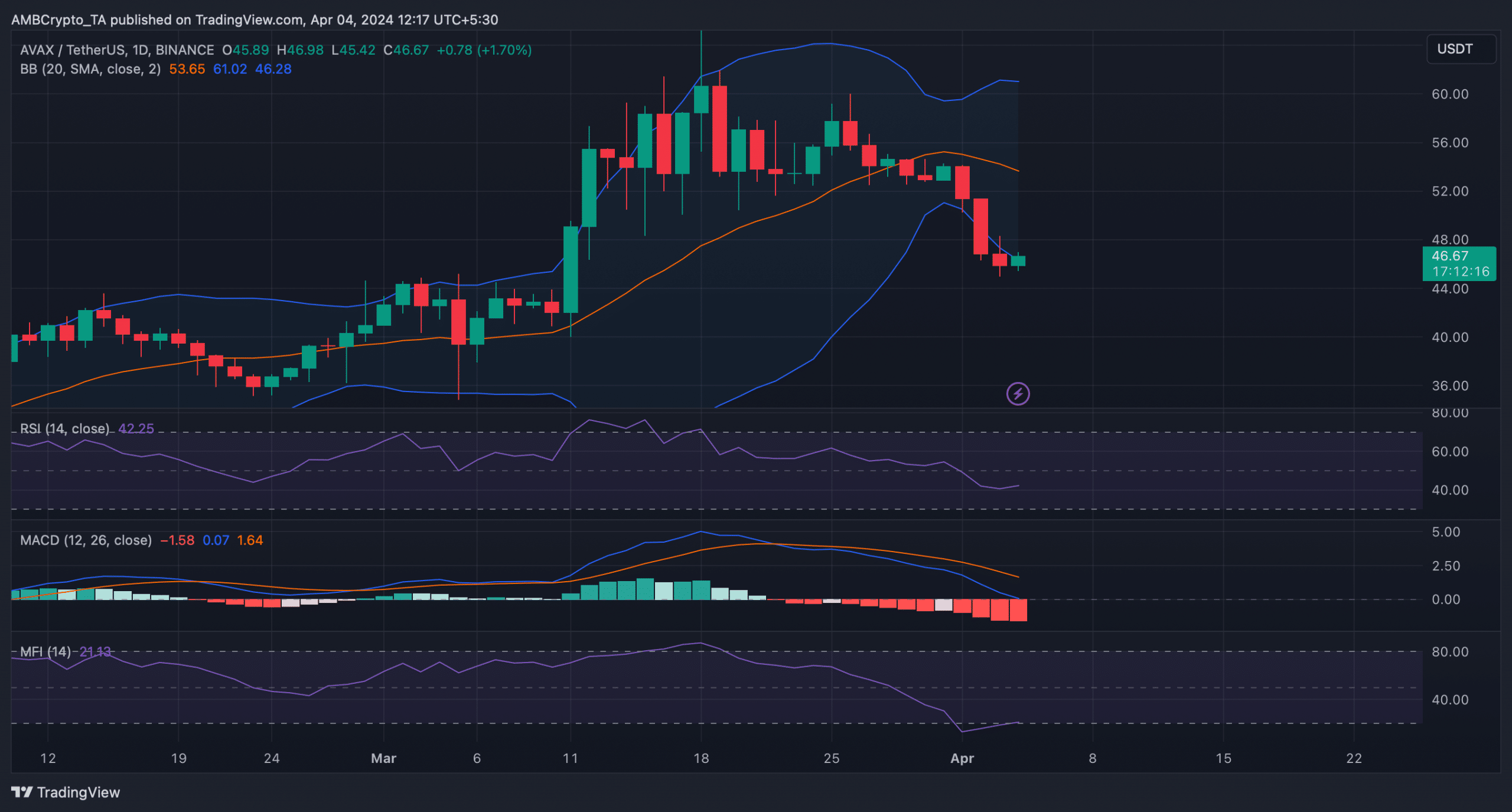

To see whether AVAX will manage to flip its resistance into its new support, AMBCrypto checked its daily chart. Our analysis revealed that its MACD displayed a bearish advantage in the market.

However, the rest of the indicators supported the bulls.

For instance, its Money Flow Index (MFI) went up from the oversold zone. This might increase buying pressure and push AVAX’s price up. Its Relative Strength Index (RSI) also registered a slight uptick.

The token’s price renounced at the lower limit of the Bollinger Bands at press time as well, as evident from the latest green candlestick. This hinted that the chances of a price uptick are high.

If a price uptrend is bound to happen, then AVAX might face resistance in the short term at a level before it reaches $64.5.

AMBCrypto’s analysis of Hyblock Capital’s data revealed that AVAX’s liquidation will surge once its price reaches the $48.9 mark. In order for the token to reach $64.5, it must first go above $48.9.

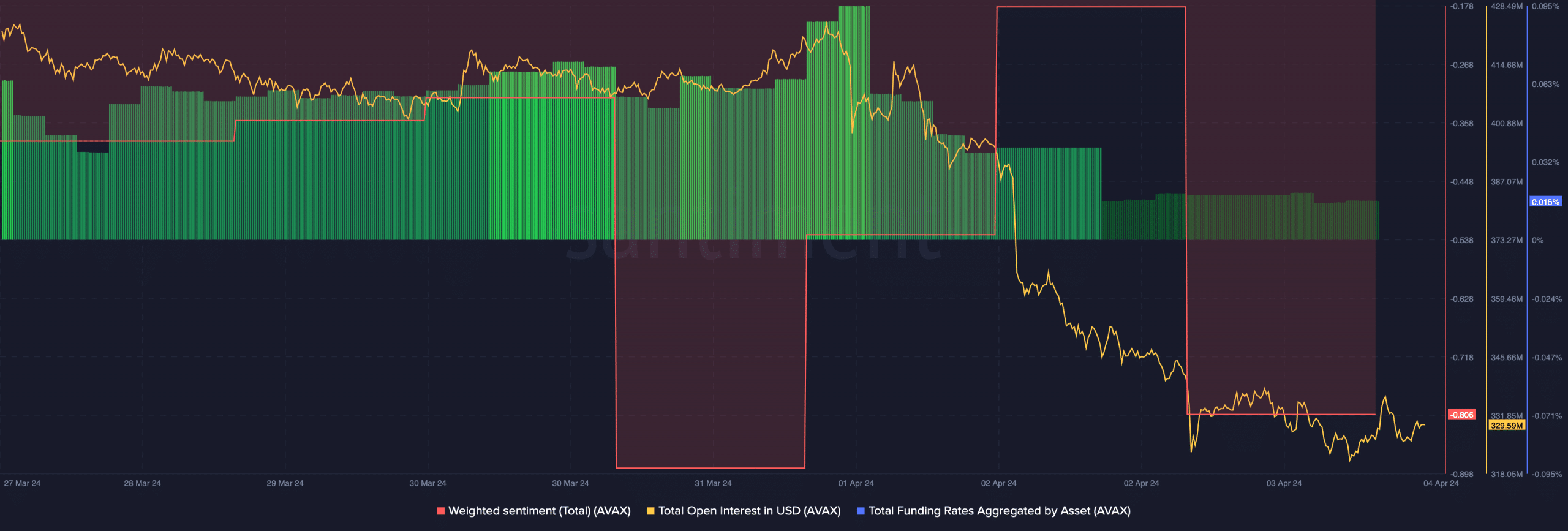

Our analysis of Santiment’s data revealed that the AVAX might actually manage to go above the near-term resistance.

This seemed to be the case as AVAX’s Funding Rate dropped, meaning that Futures investors were not buying AVAX at its lower price.

Realistic or not, here’s AVAX market cap in BTC’s terms

Additionally, its Open Interest fell along with its price. Whenever the metric falls, it increases the chances of the ongoing market trend changing.

However, investors were still not confident in AVAX, which was evident from the drop in its Weighted Sentiment.