AVAX: Here’s why bulls could target or bypass the $14 supply zone

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- AVAX witnessed a 20% surge in price in the last 10 days

- AVAX’s demand in the derivatives market remained positive

Avalanche [AVAX] surged by 20%, rising from $10.85 to $12.97 in the past 10 days. Based on the daily charts, AVAX bulls could target a crucial supply zone.

At press time, AVAX flickered red and was trading at $12.53. It had just faced a short-term price rejection at $12.97. Similarly, BTC faced rejection at $17.50K but could be bolstered if the US Consumer Price Index (CPI) announcement on January 12 favors traditional stock markets.

Such a BTC rally could boost AVAX bulls to overcome the $12.97 hurdle and target this supply zone.

Read Avalanche [AVAX] Price Prediction 2023-24

The $14.0 supply zone: Can the bulls reach it?

The Relative Strength Index (RSI) on the daily chart was at 57, a considerable level above the 50-midpoint. It had risen from the oversold zone since the beginning of the year. This showed that buying pressure had increased steadily in the past 10 days; as such, bulls had the upper hand.

Therefore AVAX bulls could attempt to push above the $12.97 level and target the $14.0 supply zone, especially if BTC breaks above the $17.50K mark. However, AVAX bulls could face intense opposition from sellers if it hits the supply zone.

So investors with diamond hands could wait and sell off at this zone. Nonetheless, a strong bullish BTC could try to push AVAX even above the supply zone, but bulls must overcome some extra obstacles if it comes to that.

Are your holdings flashing green or red? Check with AVAX Profit Calculator

Alternatively, bears could gain more influence before AVAX hits the supply zone and push the prices lower. Such a downward move would invalidate the above bullish bias. The downtrend could be checked by the $11.73 or $10.85 support levels.

AVAX saw positive sentiment and demand in the derivatives market.

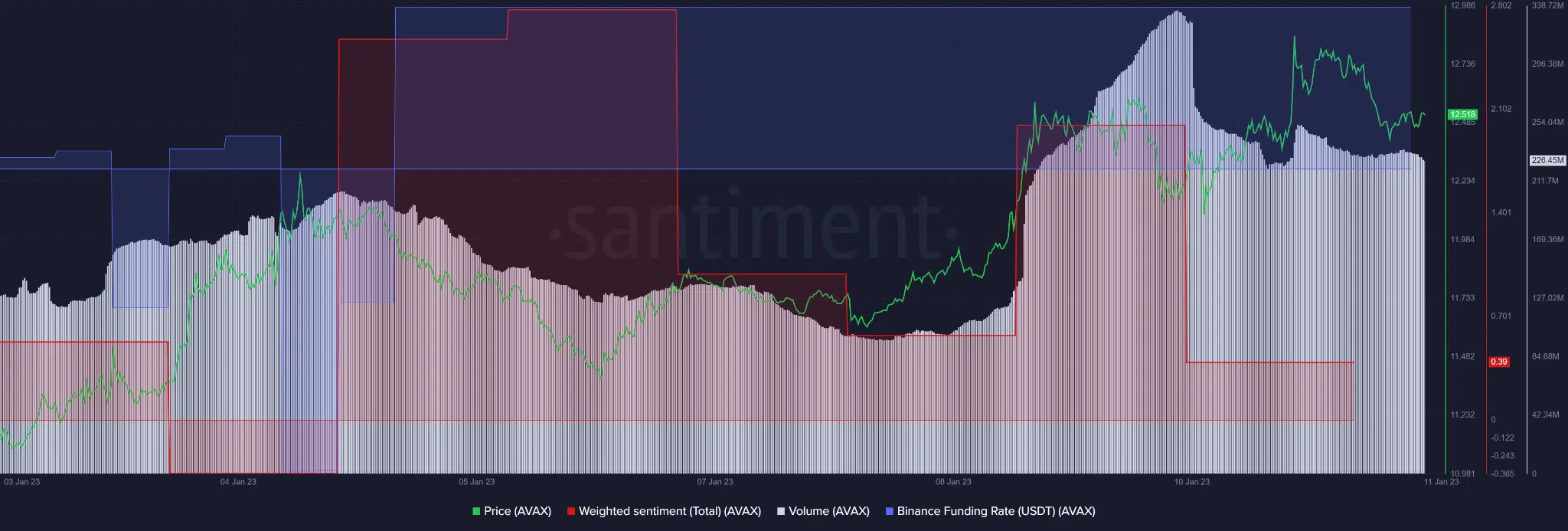

According to Santiment, weighted sentiment and Binance Funding Rate for AVAX/USDT pair remained on the positive side since 5 January. This showed that investors remained bullish on AVAX, and the demand in the derivatives market didn’t change despite a slight drop in price at the time of writing.

However, a decline in trading volumes could undermine bulls’ uptrend momentum. Any uptick in trading volume alongside a bullish BTC could signal a major rally toward the supply zone. Therefore, investors should track BTC movements.