Altcoin

AVAX posts 16% weekly gain: A $30 move possible only IF..

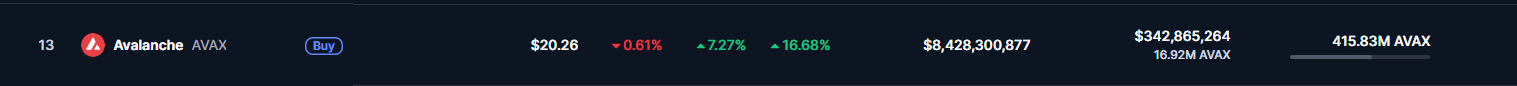

Avalanche surged 16%, with TVL recovery and a potential breakout toward $30 resistance in sight.

- AVAX surged 16%, leading top-10 ecosystems with rising DeFi TVL and renewed market momentum

- TVL rebound and bullish sentiment could drive AVAX toward $30, but key resistance remains ahead

Avalanche [AVAX] is back in motion, posting a sharp 16% gain over the past week to become the fastest-growing top-10 ecosystem this month.

The move comes despite a continued slide in Total Value Locked (TVL), which has fallen from over $1.5 billion to around $1.1 billion since the start of 2025. Still, the latest price action suggests a shift in sentiment, with investors betting on a potential breakout.