AVAX remains bullish, but long-term investors should wait for this level

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- A level of support with a pocket of liquidity at $18 meant Avalanche retained strong support despite recent selling.

- A Bitcoin crash beneath $22.3k could make buying Avalanche risky.

Bitcoin [BTC] fell beneath the $23k mark over the past few hours of trading. At the time of writing, much of the crypto market stood in the red for the day. Avalanche [AVAX] also noted losses during the day’s trading. The asset fell from $20.24 to stand at $19.73, a loss of 2.5%.

Realistic or not, here’s AVAX’s market cap in BTC’s terms

Higher timeframe analysis showed that Avalanche could be set for a dip toward $18.7 and the $17.8 levels. Bullish traders can wait for a bounce and a lower timeframe bullish market structure before looking for entries to long positions.

Higher timeframe bulls can wait for AVAX to drop into an area of interest

The market structure of Avalanche remained bullish on the one-day timeframe. To the south, below $19, it has a higher timeframe level of significance at $18.6. The zone from $17.5-$18.6 represented a pocket of liquidity.

In mid-January, many candlewicks in this zone were rejected on lower timeframes. This meant that, at that time, sellers were dominant in this zone. When the $18.6 level was breached in late January 2023, it signified bullish dominance. Hence, a retracement into this pocket of liquidity would likely see strong buyers.

Further south, AVAX has a level of support at $16.8 and at $15.77. A daily session close beneath $15.77 will flip the structure to bearish. Until then, buyers can look to bid at important support levels, although it could be risky.

The RSI was falling toward neutral 50 to show bullish momentum was waning. In contrast, the OBV was rising to show buying pressure.

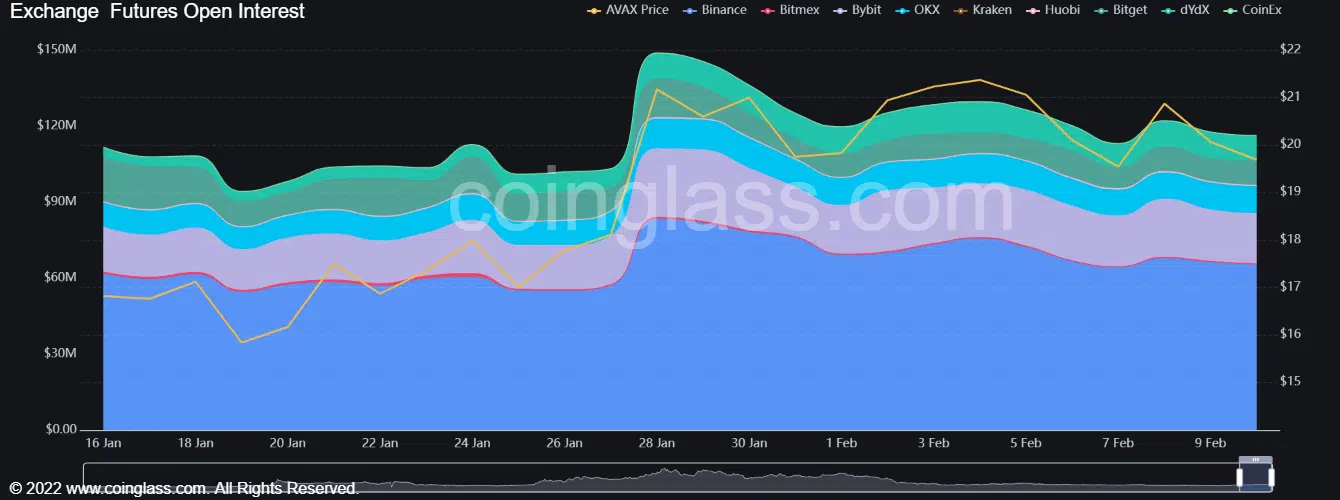

Open Interest falls, but funding rate remains positive

Source: Coinglass

How much are 1, 10, 100 AVAX worth today?

Open Interest spiked upward on 28 January. Since then, it has made a series of lows. During the same period, AVAX reached $21.6 and pushed higher to reach $22.75. By this time, the OI had already weakened, not to mention the bearish divergence the RSI made with the price.

The funding rate remained positive, which suggested market participants were bullishly positioned and have not yet flipped strongly. Overall, buyers looking to hold AVAX for a few weeks before selling can wait for a bullish reaction across the market before buying, and cut their losses to a drop below $15.7.