AVAX traders need to be on their toes amid Avalanche’s latest drop in…

- Avalanche’s social dominance and mentions fell, but its TVL remained stable last week.

- AVAX’s price dropped by more than 3% in the last 24 hours, and a few indicators looked bearish.

Avalanche [AVAX] witnessed a massive downfall in its social activity last week. This put the chain in a tricky spot. A decline in its popularity might be a result of its bearish price action.

Things got worse upon checking its volume, which increased while its price dropped. A look at its on-chain metrics and daily chart provided a better understanding of what was going on in Avalanche’s ecosystem over the last seven days, causing these plummets.

How much are 1,10,100 AVAXs worth today

Avalanche’s popularity takes a blow

AVAX Daily, a popular Twitter handle that posts about the blockchain’s developments, revealed in a recent tweet about its social performance. As per the tweet, AVAX’s social mentions declined by over 94%.

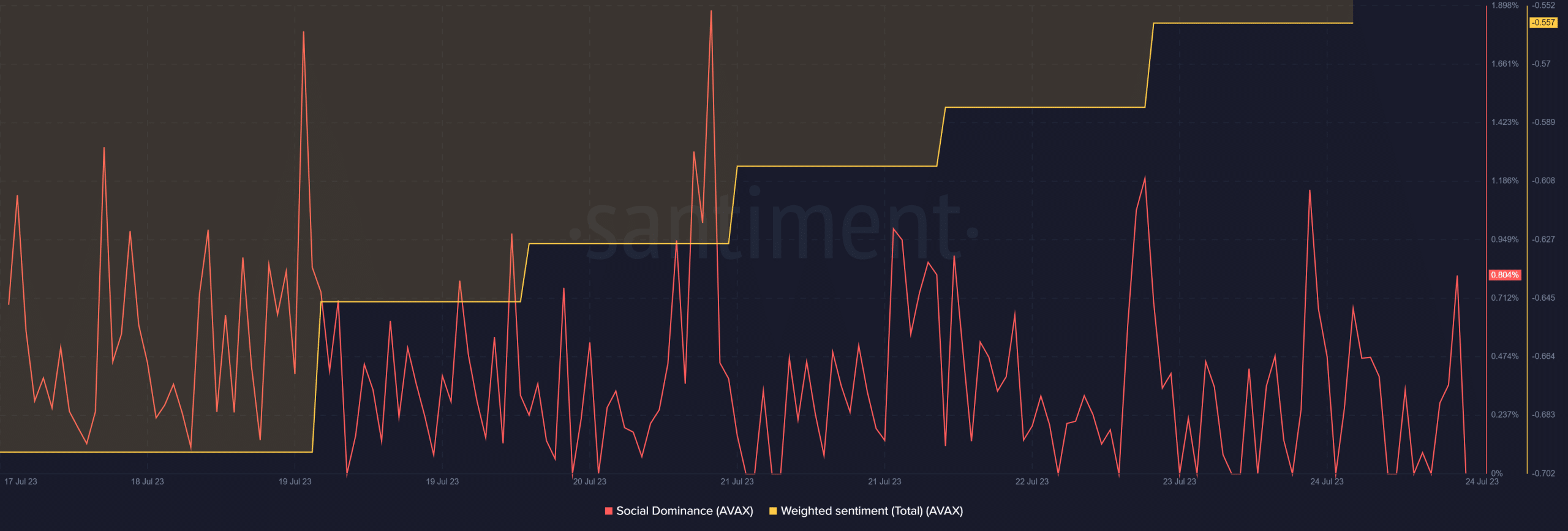

Following the trend, AVAX’s social engagement and contributors also fell substantially last week. Adding to the misery, its social dominance also declined equally over the last seven days, reflecting a drop in its popularity.

?Avalanche Weekly Social Signals?

Most Influential Projects@MeritCircle_IO@wanchain_org@DeFiKingdoms@_VaporFi

Influencers of the Week@cryptojack@AltCryptoGems@Trader_XO@SirKunt

Source: @LunarCrush#AVAX $AVAX #Avalanche pic.twitter.com/sXsyfCOjLU

— AVAX Daily ? (@AVAXDaily) July 23, 2023

Interestingly, the blockchain managed to stabilize its TVL last week, as evident from DeFiLlama’s chart. AVAX Daily’s tweet also revealed that Struct Finance and Coinsquare were the top 2 TVL gains in the Avalanche ecosystem last week.

The drop in the blockchain’s popularity was also noted on Santiment’s chat as its social dominance chart remained low. However, its weighted sentiment improved, which could be taken as a positive signal.

Are investors having sleepless nights?

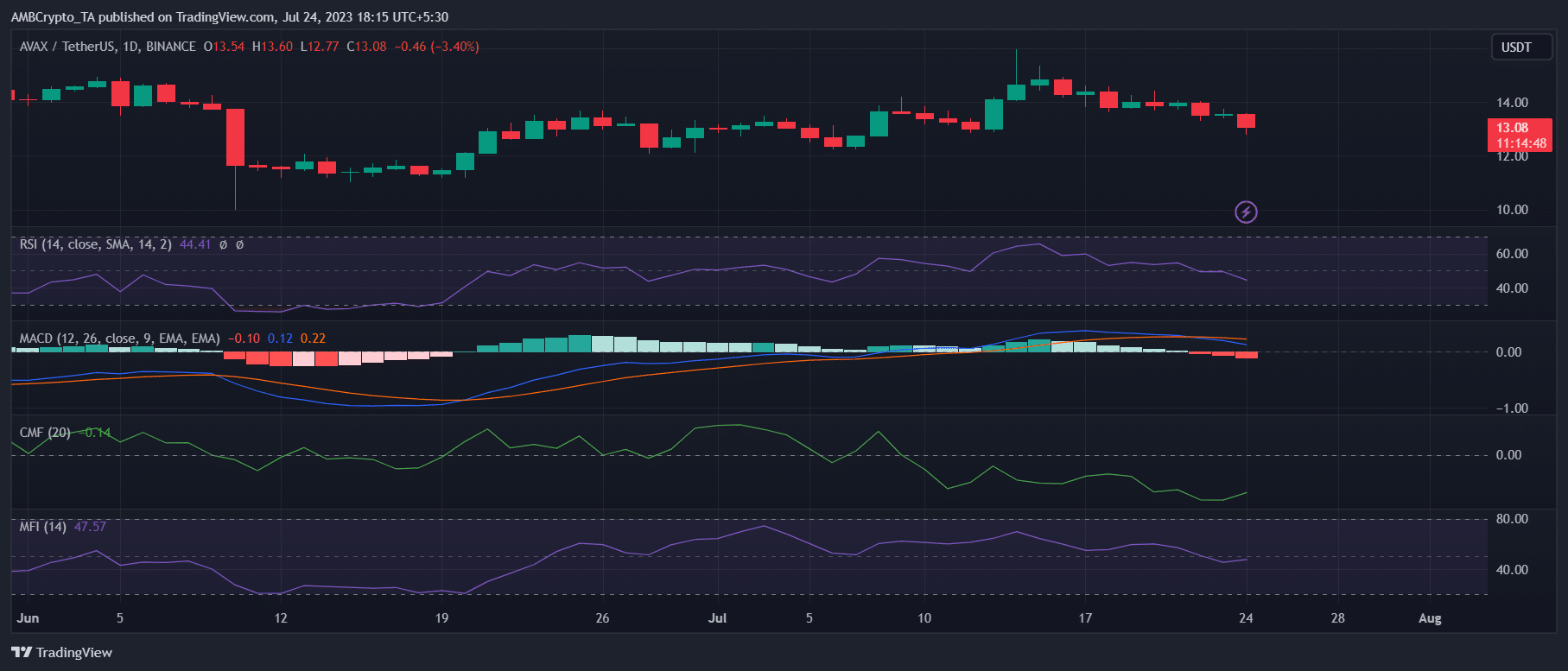

While its social metrics fell, the token’s price action also remained bearish. As per CoinMarketCap, AVAX was down by more than 6% and 3% in the last seven days and past 24 hours, respectively.

At press time, it was trading at $13.08 with a market capitalization of over $4 billion. The worse news was that while the token’s price plummeted, its trading volume went up, which is a typical bearish signal.

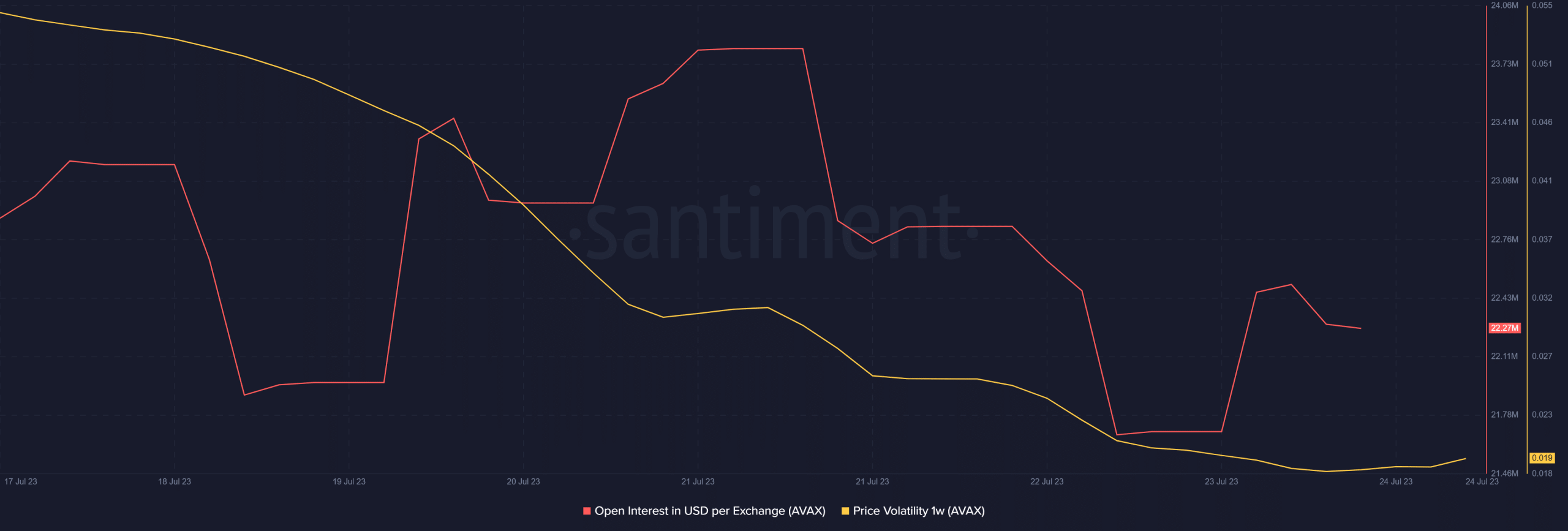

Thanks to the price decline, the token’s 1-week price volatility also fell. However, its open interest also declined, giving hope for a trend reversal.

Read Avalanche’s [AVAX] Price Prediction 2023-24

Though AVAX’s open interest gave hope for better days, its market indicators revealed a different story. The Moving Average Convergence Divergence (MACD) displayed a bearish crossover.

Avalanche’s Relative Strength Index (RSI) moved southward, further increasing the chances of a continued downtrend. However, the Chaikin Money Flow (CMF) was bullish, as it went up slightly in the last few days.

Additionally, AVAX’s Money Flow Index (MFI) also followed the CMF, which looked bullish for the token.