Based on cumulative returns, here are the top alts to consider investing in

In crypto, there’s a tendency to focus on market caps and daily price movements. But for a fresh perspective, let’s instead take a look at the cumulative returns for some top assets this week.

Altcoins battle it out

Messari’s recap for the week ending 3 March revealed that the altcoin champion of the week was Terra [LUNA] with a 40% gain. Messari Insights stated,

“The Cosmos based IBC chain has been on an upwards trend for the past two weeks as the Cosmos ecosystem has seen positive crowd sentiment for the past weeks.”

In second place was Polkadot [DOT], which bagged a 13% return with reference to LUNA.

Naturally, investors are eagerly eyeing LUNA, the seventh biggest coin by market cap at press time. They might also be wondering how it is doing overall when compared to DOT.

At press time, DOT was trading at $16.67, having fallen by 7.18% in the past week. Meanwhile, LUNA was changing hands at $85.76, having rallied by 16.41% in the past week.

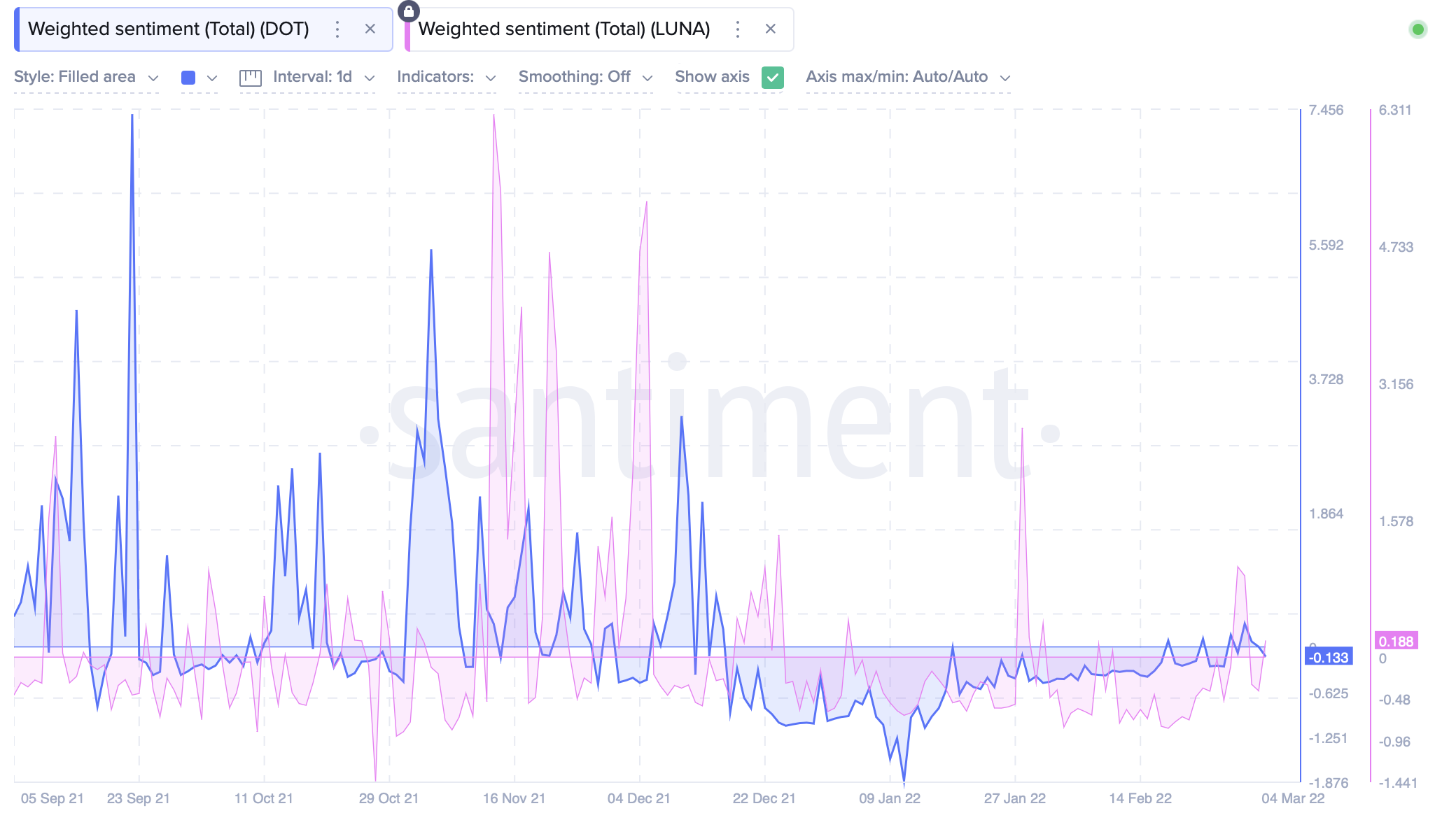

Source: Santiment

Looking at the weighted sentiment, however, we see that DOT and LUNA are not too far apart. While weighted sentiment for DOT was around -0.133, weighted sentiment for LUNA was 0.188. In summary, it seems as though both DOT and LUNA investors are hovering close to neutral territory.

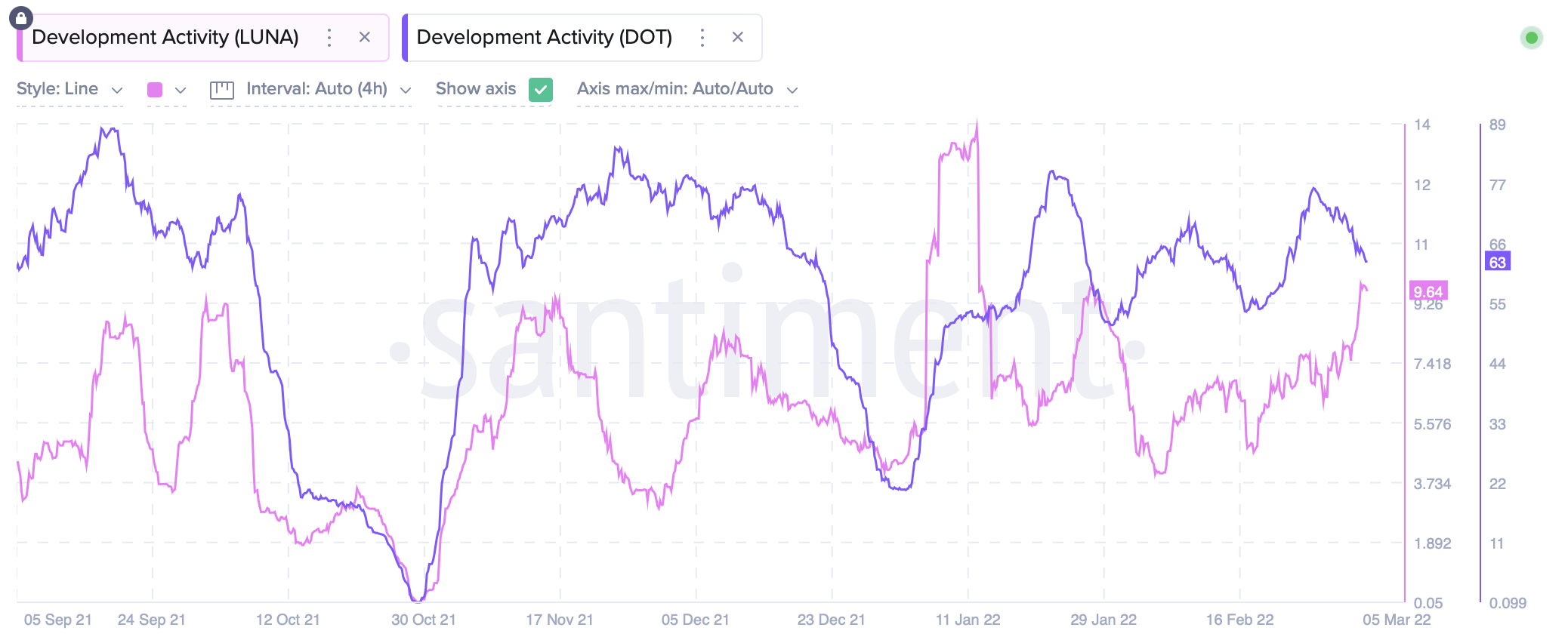

Source: Santiment

Coming to development activity, we can see that DOT is in the lead but seeing a downtrend, while LUNA is on the rise. However, there is still a large difference in activity between the two networks, so it is unlikely for LUNA to overtake DOT any time soon in this respect.

Source: Santiment

Grab on and hold on?

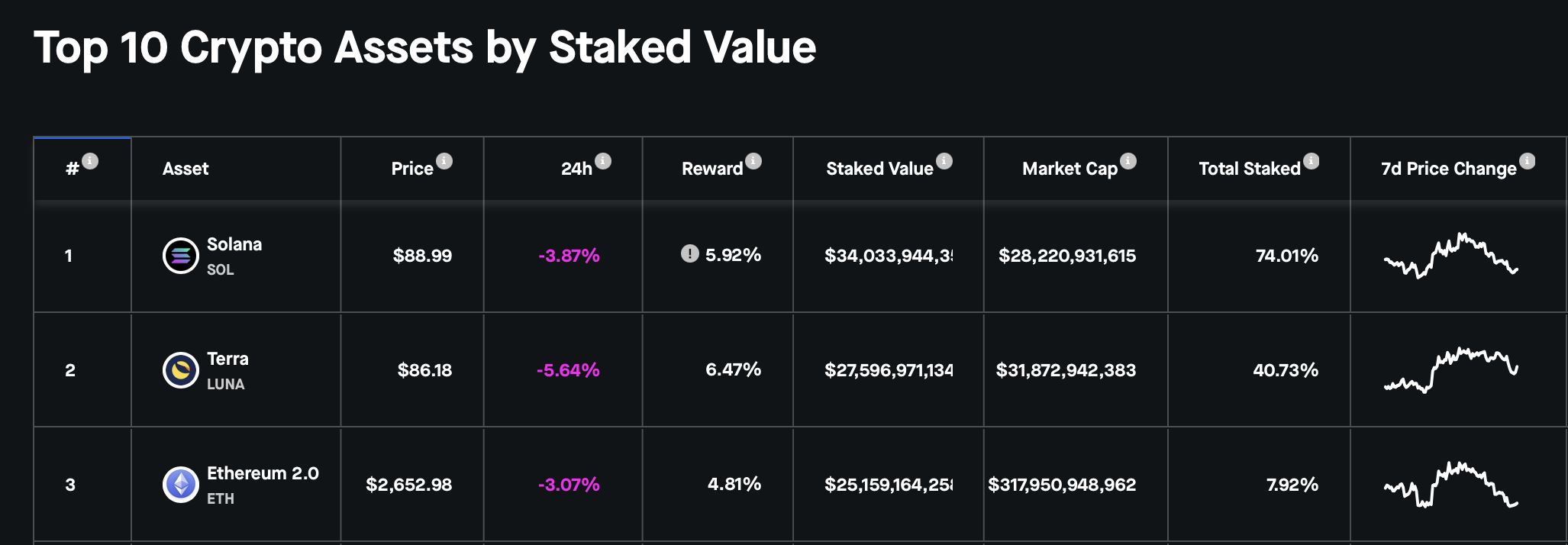

Polkadot may be grabbing headlines thanks to its parachain slot auctions, but Terra marked a milestone of its own after it surpassed Ethereum 2.0 in terms of staked value.

One factor that might be behind the development is the market’s rising demand for TerraUSD [UST].

Source: staking rewards.com

Swap and shop

After Polkadot founder Gavin Wood donated around $5.8 million in DOT to Ukraine’s official crypto address, there was the question of how many different cryptocurrencies’ addresses the Ukraine administration would have to create to receive funds. To that end, Uniswap provided a feature to exchange its listed assets to ETH before donation.