BAYC overcomes ‘dooms-month’ November but can APE decline to follow

- BAYC recorded a massive surge in its November performance, disregarding the crypto market crash

- APE’s on-chain condition indicated slight declines but there could be hope for long-term holders

Bored Ape Yacht Club [BAYC] not only survived the turbulence that hit the crypto and NFT market in November, but the collection also put up an excellent performance. The first week in the previous month was marked by the FTX contagion, which led to the massive crypto market cap nosediving.

Of course, its impact spread to the linked NFT market.

Read ApeCoin’s [APE] price prediction 2023-2024

Interestingly, that was no concern for BAYC. According to DappRadar, the blue-chip collection registered an 87.56% volume increase in the last thirty days. This meant that BAYC was the top performing collection across all chains in November.

Though other top collections were able to follow the same steps, none had the impact as BAYC.

Dissecting the specifics of BAYC

NFT collectibles’ aggregator CryptoSlam reported that BAYC’s sales summed up to $61.42 million within the aforementioned period. Furthermore, there were 741 transactions that took place between 289 buyers. However, there was something that could not be ignored. In the last thirty days, no BAYC holder sold any part of the collection.

This could be because investors have decided to hold the asset for the long-term. It was also not related to the floor price, especially as it was almost 70 ETH at press time.

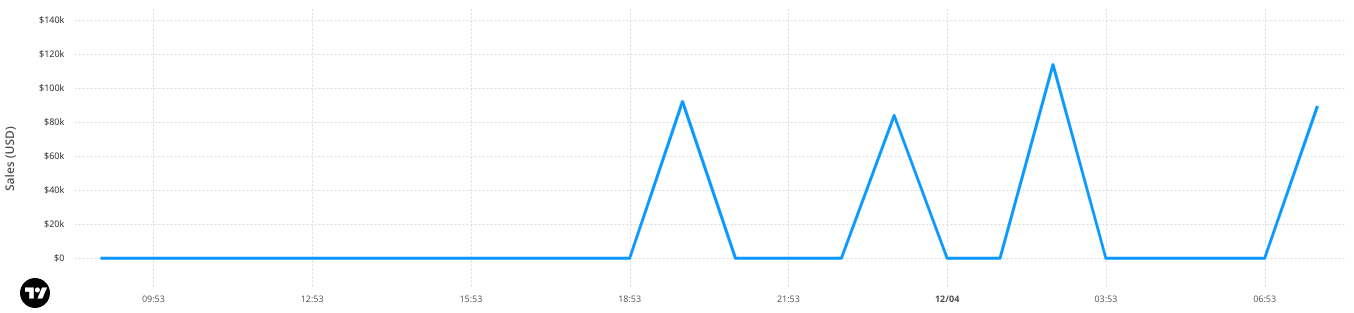

The volume in the last 24 hours had declined by 70% and sat at $378,559 at press time. Thus, the collection had not started December on a good note. So, this could neutralize speculation about a possible NFT market bull season.

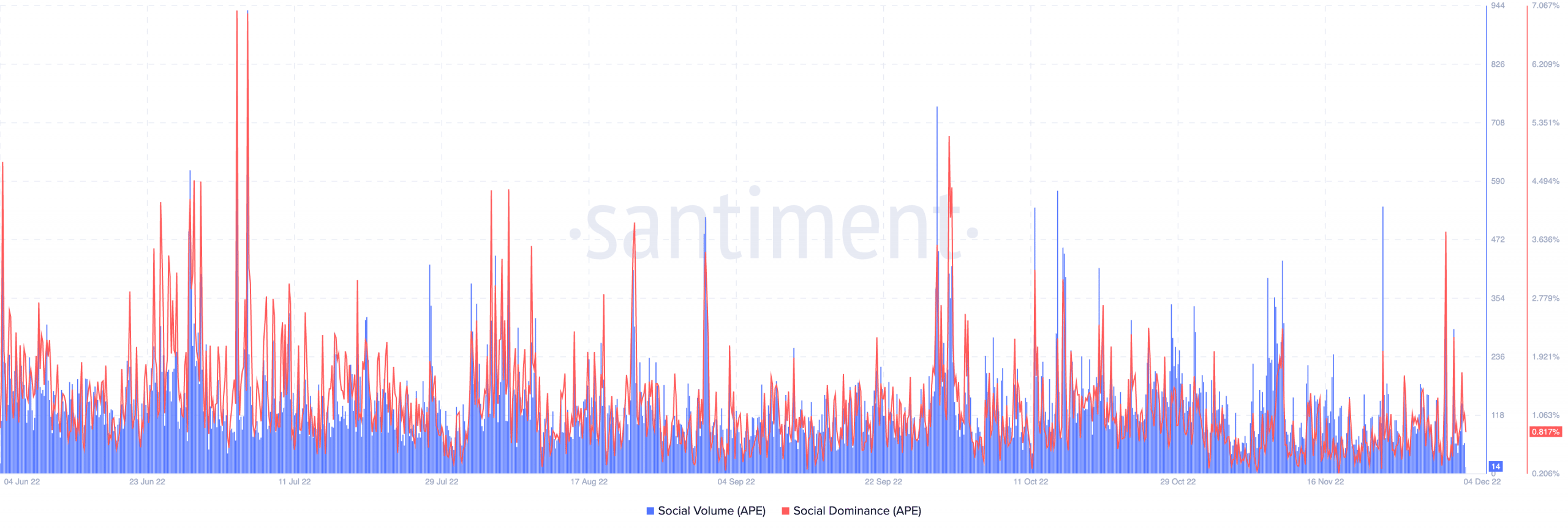

For its governance token, Apecoin [APE], it was the complete opposite. CoinMarketCap revealed that APE decreased by 13.34% at press time. On the social front, APE didn’t disappoint to a great extent. According to Santiment, APE’s social dominance was 0.954%. At this rate, it implied that the asset was reasonably involved in discussions about the crypto community.

The social volume could not replicate the dominant form. As of this writing, Santiment’s data showed that APE’s social volume was 14. Therefore, the token could not match up in terms of the search for it.

Is waiting for APE worthwhile?

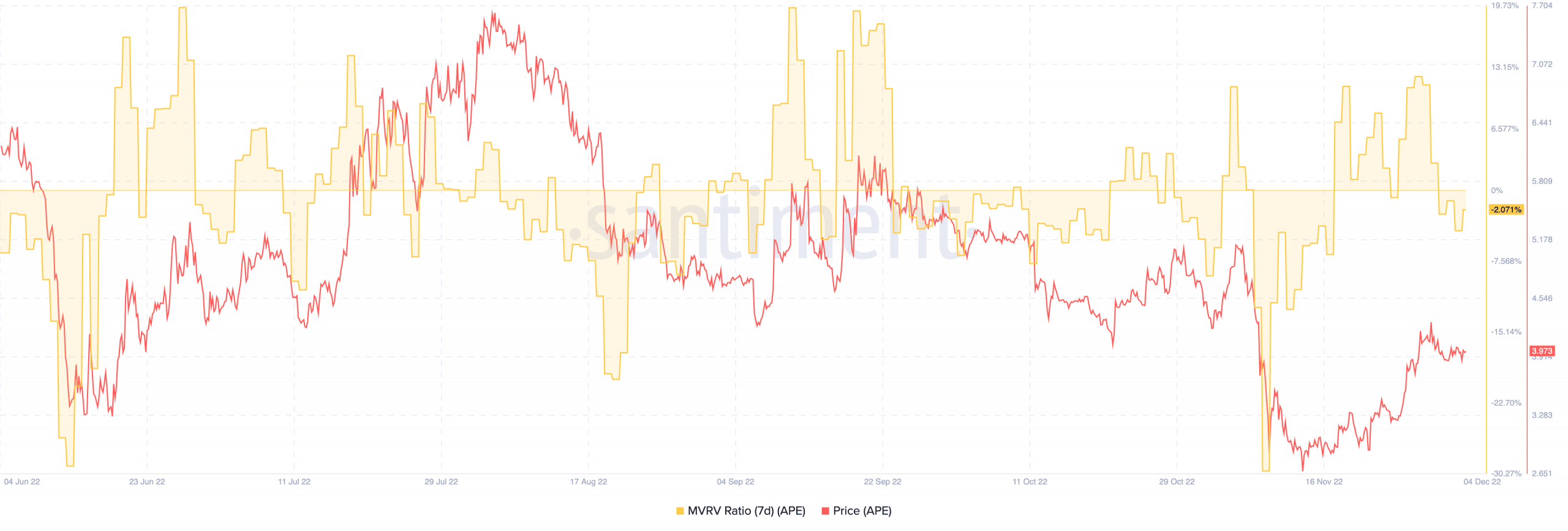

APE investors should avoid quick expectations with the current status of the token. At press time, the seven-day Market Value to Realized Value (MVRV) ratio was down at -2.07%. The extended one-year period showed that the MVRV ratio was -8.536%. Thus, token holders were nearer to meeting up with the average price bought.

With such a close distance, it might not be a bad idea if investors hoping for a bull return hold on to APE. However, there was no certainty about the period for respite return.