Betting on an Ethereum recovery? Here’s what you need to know

ETH‘s price was around the $2000 level based on data from coinmarketcap.com. Exchange inflows have increased consistently over the past weeks, till the crash; however, it is no longer at the same level as that of Bitcoin. It is anticipated that selling pressure is, therefore, less and the top 10 exchange whale holdings have started declining.

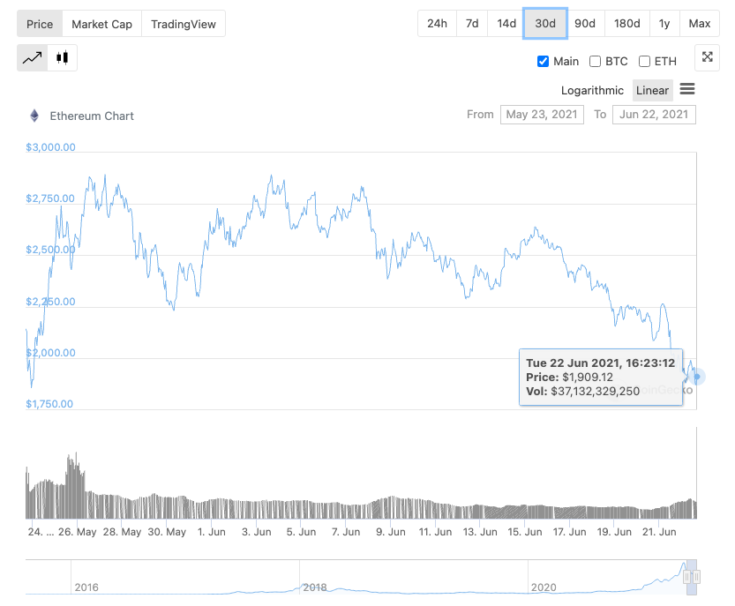

ETH price chart | Source: CoinGecko

Based on the above price chart, there have been multiple instances of V-shaped recovery over the past 30 days. There are fewer chances of further sell-off of ETH across spot exchanges based on the trend and these metrics. What’s more, the top 10 non-exchange whales, HODLing ETH for a long duration continue to HODL record levels of ETH. Additionally, their number has increased in response to the drop in price on exchanges.

The current recovery is important for the price as there is an update scheduled on the ETH network in a few weeks. Ropsten, Goerli, and Rinkeby testnets will eventually see the London upgrade implemented. The London upgrade is set to go live on Ropsten, at block 10499401, which is expected to happen in the fourth week of June 2021.

Looking at the fear and greed index, in the case of ETH signaled fear in the current market. Based on this metric, this is the time to accumulate, in anticipation of an upcoming price rally. Further, as the social dominance and social volume of ETH recovers, the price is anticipated to rally and hit a local high before the end of this week.

These metrics support the bullish narrative, and following that, investment inflow from institutions and whales, both on and off exchanges are likely to increase buying pressure and generate further demand.