Binance Coin bulls attempt to challenge the local highs again, but…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

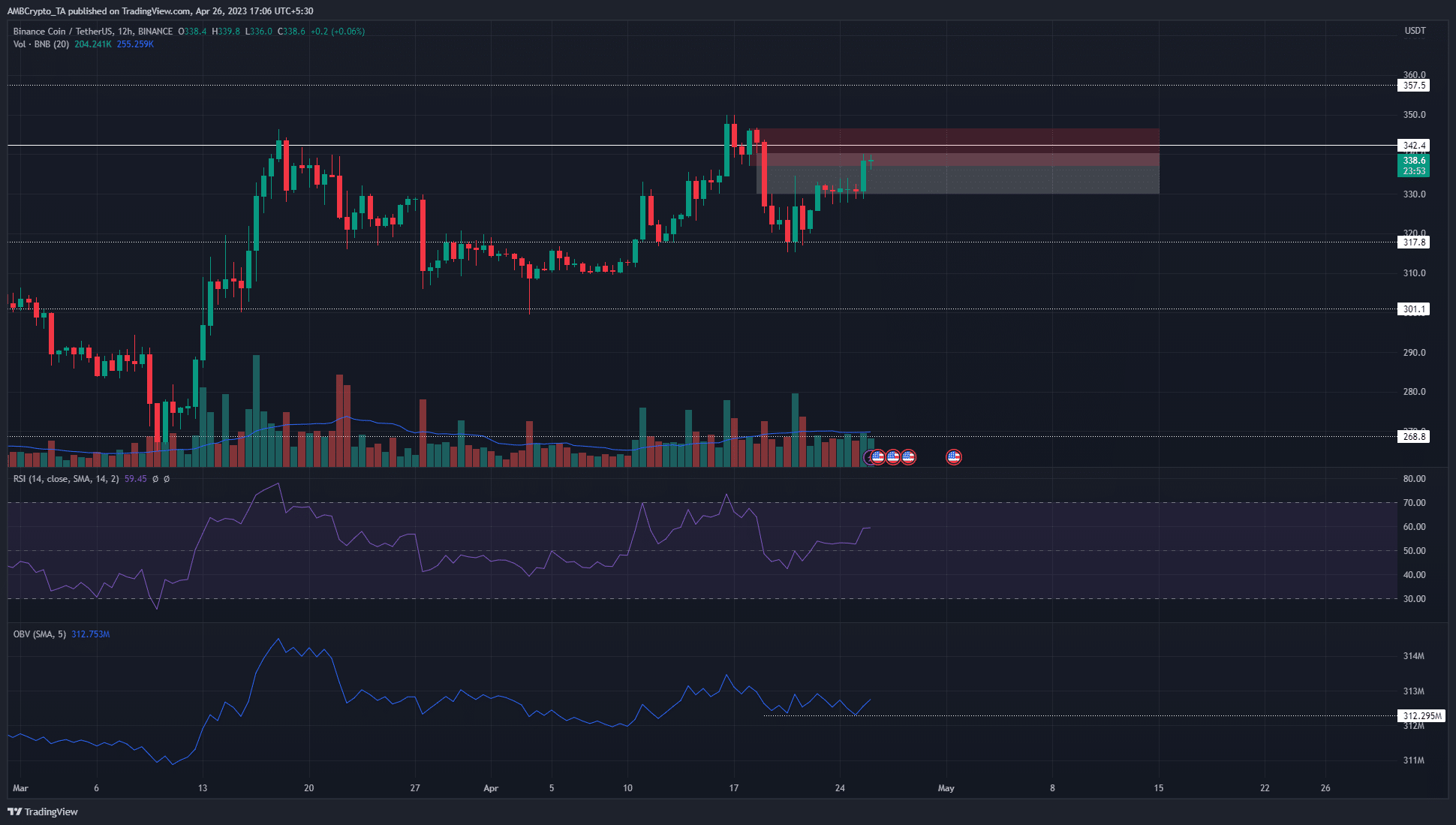

- The 12-hour market structure was bearish, with a confluence of resistances at $342.

- The bullish short-term sentiment could prevail if demand began to intensify and pushed BNB above $350.

In a recent article, we pointed out that the $315 area of support could see a bounce in prices for Binance Coin. Given the bearish sentiment in the market and around Bitcoin last week, it appeared likely that BNB could fall further toward $300.

Read Binance Coin’s [BNB] Price Prediction 2023-24

The indicators showed bullish momentum but the demand fueling the rally was weak. This suggested that the bulls could face rejection yet again- can they turn things around within the next two days?

Binance Coin approaches $342 yet again and a range formation can’t be ruled out

The RSI climbed back above neutral 50 on the 12-hour price chart on 22 April. This highlighted momentum favored the bulls, but it hasn’t climbed above 60 yet. Meanwhile, the OBV meandered around a near-term support level.

The lack of a bounce on the OBV despite the rally from $315 this past week suggested that buyers remained more cautious than enthusiastic. The trading volume was enormous in mid-March but barely broke above the 20 SMA over the past few days.

Is your portfolio green? Check the Binance Coin Profit Calculator

The OBV and a lack of volume suggested that BNB could form a range between the $315-$345 levels over the weeks to come. The move below the previous higher low at $337 on 19 April flipped the market structure to bearish and left a large fair value gap (white) in the $330-$340 zone.

Moreover, this region had confluence with the bearish order block (red box), which meant the possibility of rejection from the $340-$350 area was good. A breakout past $350 would likely take BNB to the next resistances at $358 and $388.

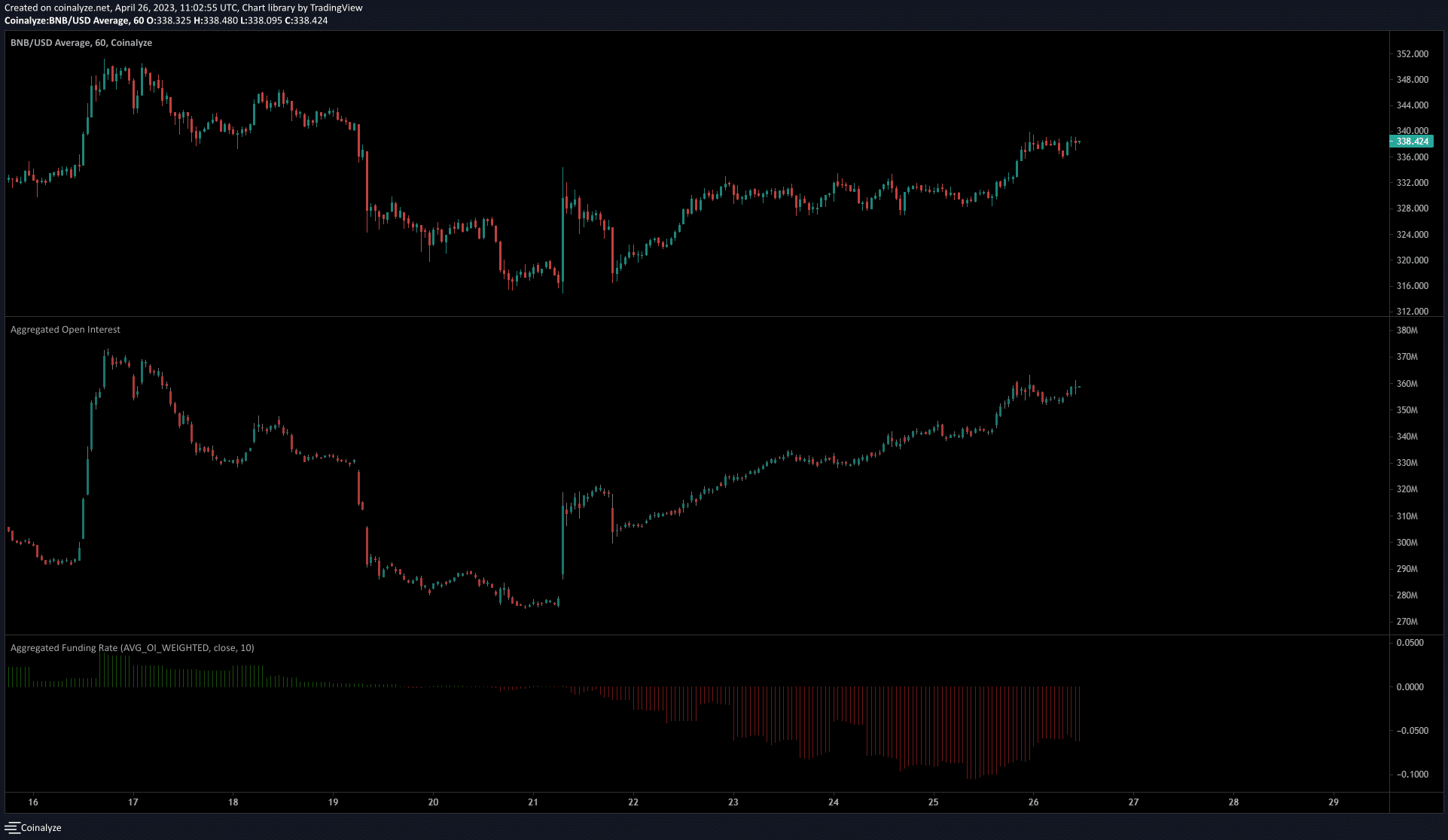

Futures data showed rising bearish sentiment began to shift in the past 24 hours

Source: Coinalyze

The negative funding rate showed that a majority of the market had been bearish in the past few days, and doubled down on it even as the prices rose.

On 24 April, the Open Interest rose alongside falling prices to indicate strong bearishness. Liquidation data from Coinglass showed $49.2 million worth of short positions liquidated on 25 April.

The rising OI showed that bullish speculators were entering the market in force, and the funding rate has begun to fall toward zero.

Long/short data showed the past 24 hours saw 53% of positions being long, which also pointed toward a shift in sentiment. If sustained, it could see BNB breach the $345 resistance area. The lack of demand for the OBV was a concern.