Binance Coin: How BNB buyers can capitalize on this breakout rally

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- BNB witnessed an expected up-channel breakdown

- The altcoin could find reliable rebounding grounds.

- Funding rates and Open Interest displayed a slight bearish edge

Since dropping towards its 16-month low in mid-June, Binance coin [BNB] has clawed back to reclaim the $261-baseline. The altcoin traversed within the constraints of this baseline alongside the $296-ceiling for nearly six weeks.

Here’s AMBCrypto’s price prediction for Binance Coin [BNB] for 2023-24

Owing to several uncertain macroeconomic factors, BNB, like most altcoins, struggled to break into a high volatility phase over the last month. With the sellers confirming a patterned break, the coin could see a near-term decline phase before a revival.

At press time, BNB was trading at $282.7.

BNB saw a patterned breakdown, here’s how it could rebound

Since swooping to its multi-monthly lows on 18 June, BNB flipped one-eighty as the buyers recouped their forces from the lows of $197.

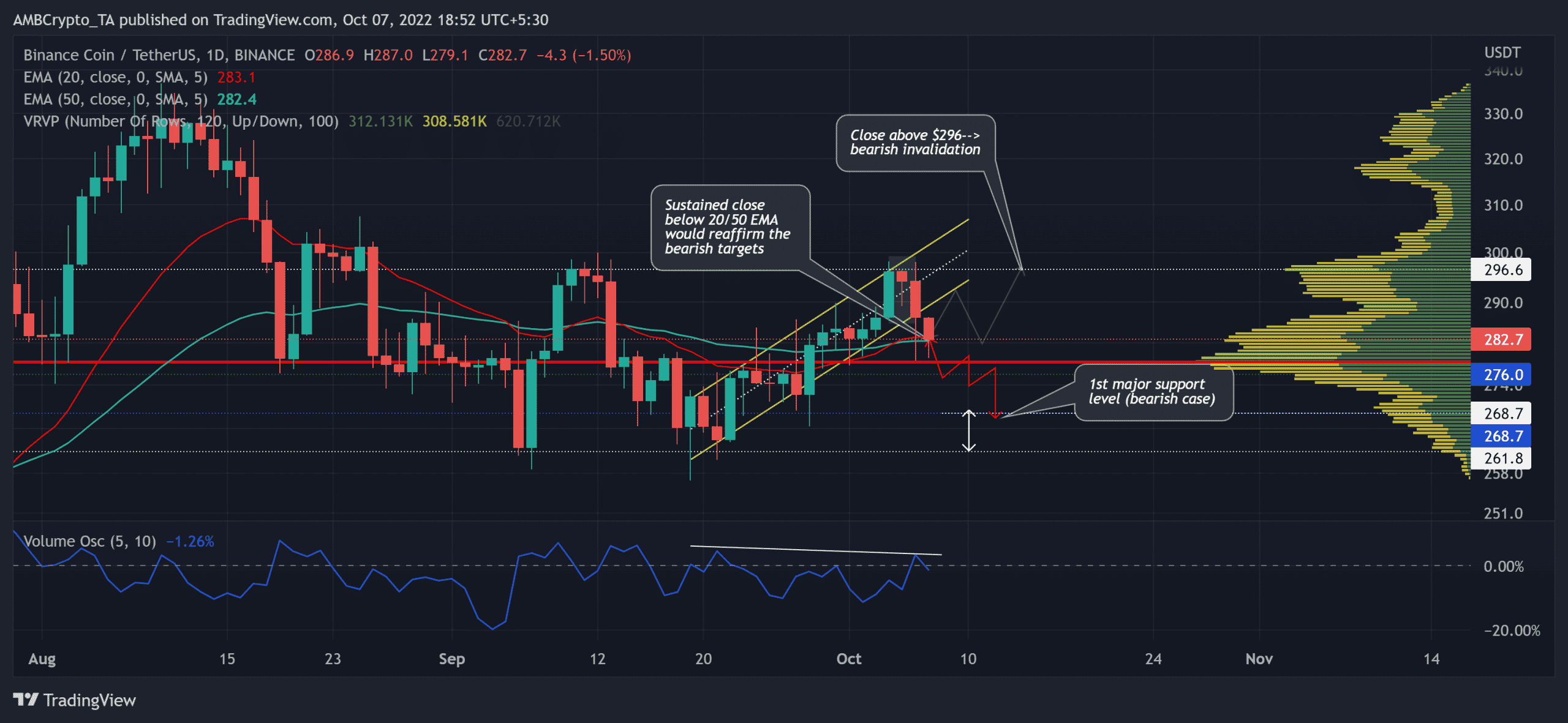

While the alt undertook a sideways track over the last month, the $261-$296 oscillation range has exhibited reliable rebounding tendencies. As a result, the recent reversal from its immediate ceiling evoked an evening star candlestick pattern, one that propelled an up-channel breakdown.

Moreover, during the recent up-channel gains, the coin’s volume oscillator marked lower peaks, suggesting weakness in the uptrend.

The resulting bearish outcome would expose the alt to a potential test of the $261-$268 range. To reaffirm this outcome, bears would need to sustain a position below the 20/50 EMA.

Alternatively, the price could see a bounce-back from its Point of Control (POC, red) as it offered the highest liquidity over the last few months. Any potential rebound above the 20/50 EMA could see its first major testing level at the $296 region.

To enter a long position, however, the buyers must wait for a rebound above the EMAs or the long-term baseline in the coming sessions.

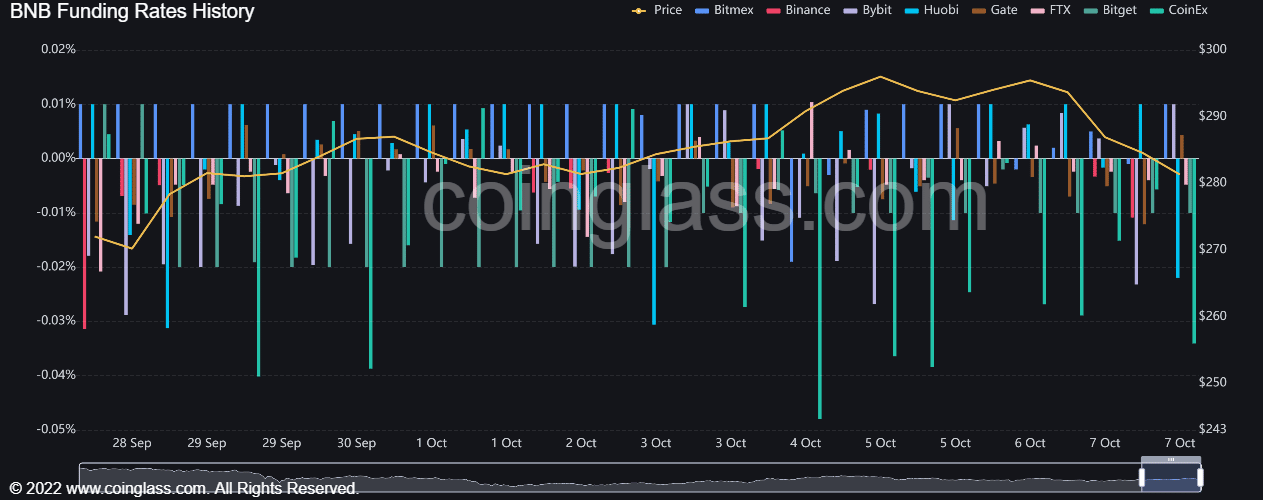

An analysis of the latest funding rates revealed a rather mixed sentiment. On Binance, they stood at equilibrium and did not flash a preference for either the bearish or the bullish side. Four other exchanges including Huobi and FTX revealed a negative funding rate at press time.

Furthermore, BNB Futures Open Interest revealed a total 6.84% decline over the last 24 hours. Correspondingly, the price action declined by nearly 3.81% during this time. More often than not, a decline in both price and Open Interest indicates liquidation by discouraged traders having long positions.

Finally, keeping an eye on Bitcoin’s movement and the broader sentiment would be important to complement the aforementioned analysis.