Binance Coin reaches a significant resistance zone, can the bulls conquer it?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

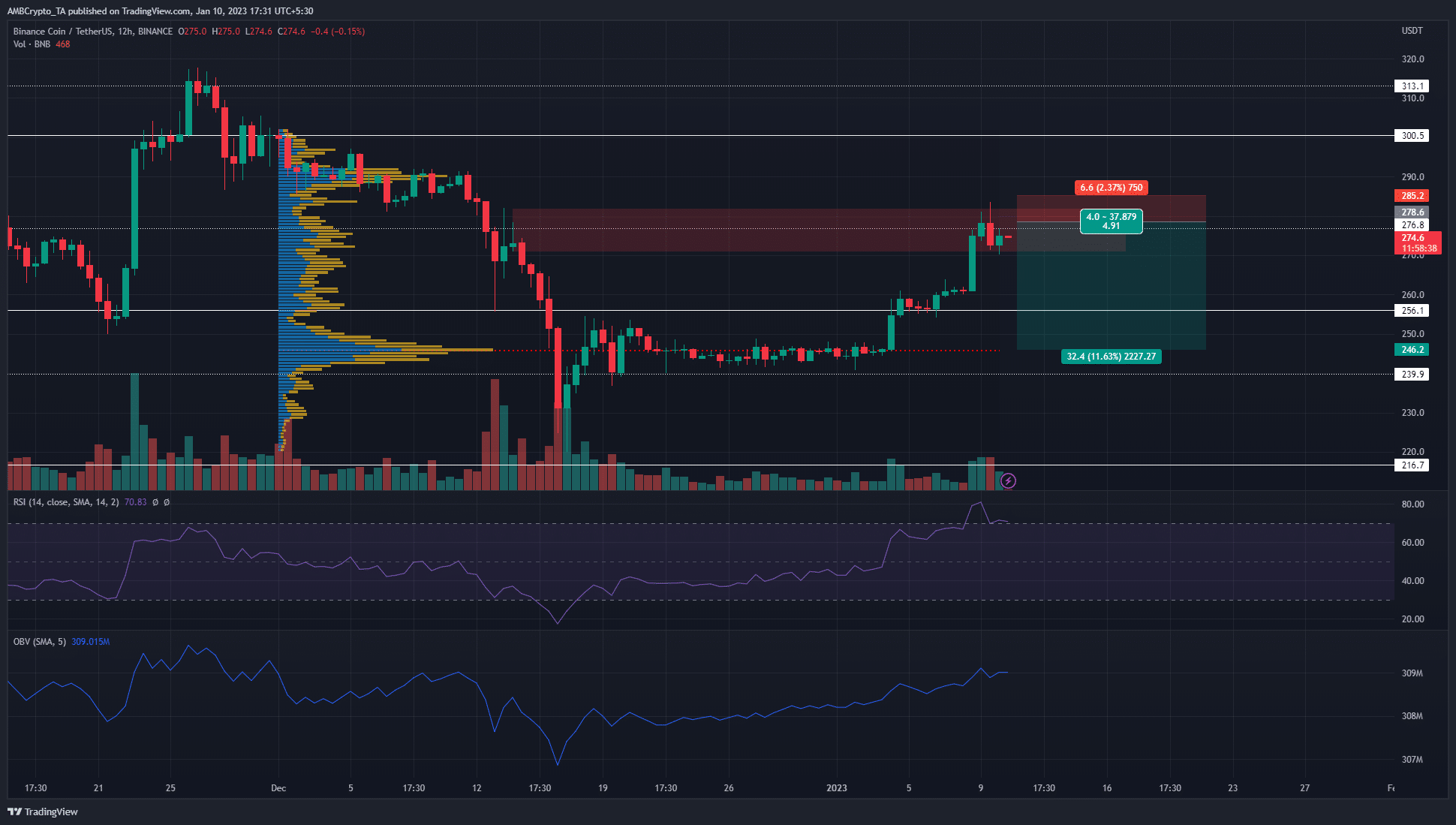

- The $278 mark and its vicinity had a strong confluence of resistance levels

- Traders can wait for a lower timeframe break in the structure downward before shorting

Binance Coin has recovered from the sharp plunge it saw in mid-December. The $250 area was expected to pose stiff resistance to the price, but the asset was able to flip $256 to support and climb higher.

Read Binance Coin’s [BNB] Price Prediction 2023-24

This came in the wake of some short-term bullish momentum from Bitcoin. The king of crypto was able to climb past the $17k mark, and at press time stood at $17.2k. It faced resistance at $17.3k and $17.6k. A breakout past these levels could usher in another move upward across the crypto market.

The strong surge in recent days has left inefficiencies to the south that the price could fill

There are many paths for Binance Coin going forward. A move above the bearish order block at $278 will likely see Binance Coin rise to $300 and $315. However, buyers might need to beware a fake rally past $280 before a reversal.

The other path was consolidation between $260-$280 for BNB. Like the consolidation in late December, this could give bulls time to reload ammunition before launching BNB higher. This was a more unlikely scenario, as Bitcoin faced intense resistance at $17.6k.

Are your holdings flashing green? Check the BNB Profit Calculator

A more likely path was a rejection in the $275-$280 area. The swift move upward has left fair value gaps on the chart that the price could seek out. For traders to enter short positions, a move beneath $270 and a subsequent retest can offer a selling opportunity.

A move northward can force a large amount of liquidations, and traders can wait for a northward flush before assessing their options.

Bears can expect a move south to the Point of Control at $246. This was the Point of Control based on the Fixed Range Volume Profile, which also showed the $283.7 mark to be the Value Area High.

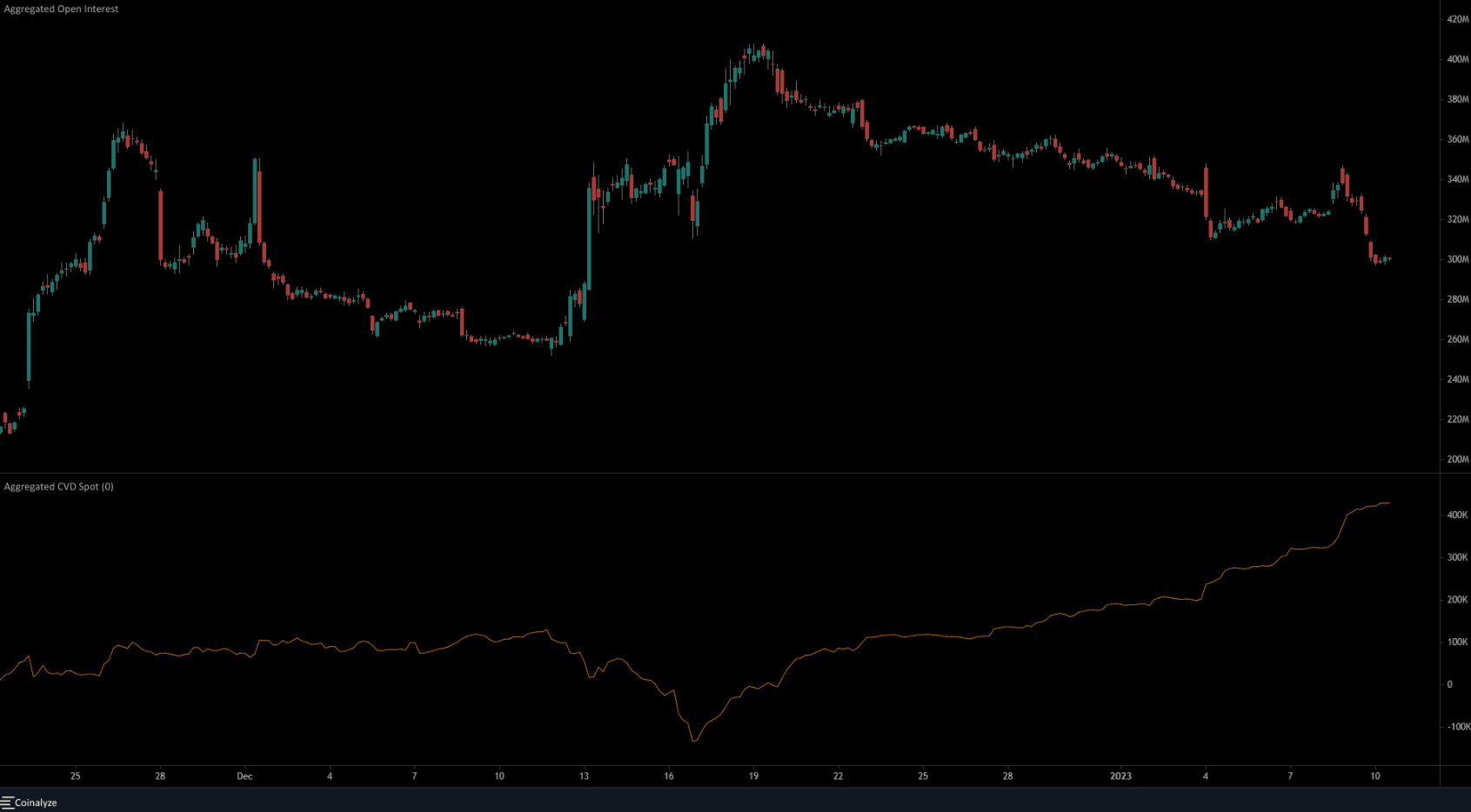

The Open Interest pointed toward discouraged long positions

Source: Coinalyze

On 12 December, Binance Coin began to drop from $285. On 16 December it reached the lows at $225. During this time the Open Interest was rising, to show strong bearish sentiment. However, when BNB forged its recovery back to the $280 zone, only the spot CVD was on the rise.

In fact, over the past couple of days, when BNB climbed from 260 to $280, the Open Interest has actually declined. This was indicative of discouraged longs, and pointed toward some bearishness in the market.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)