Binance Coin repays investor confidence as it soars above $300, will $350 be next

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

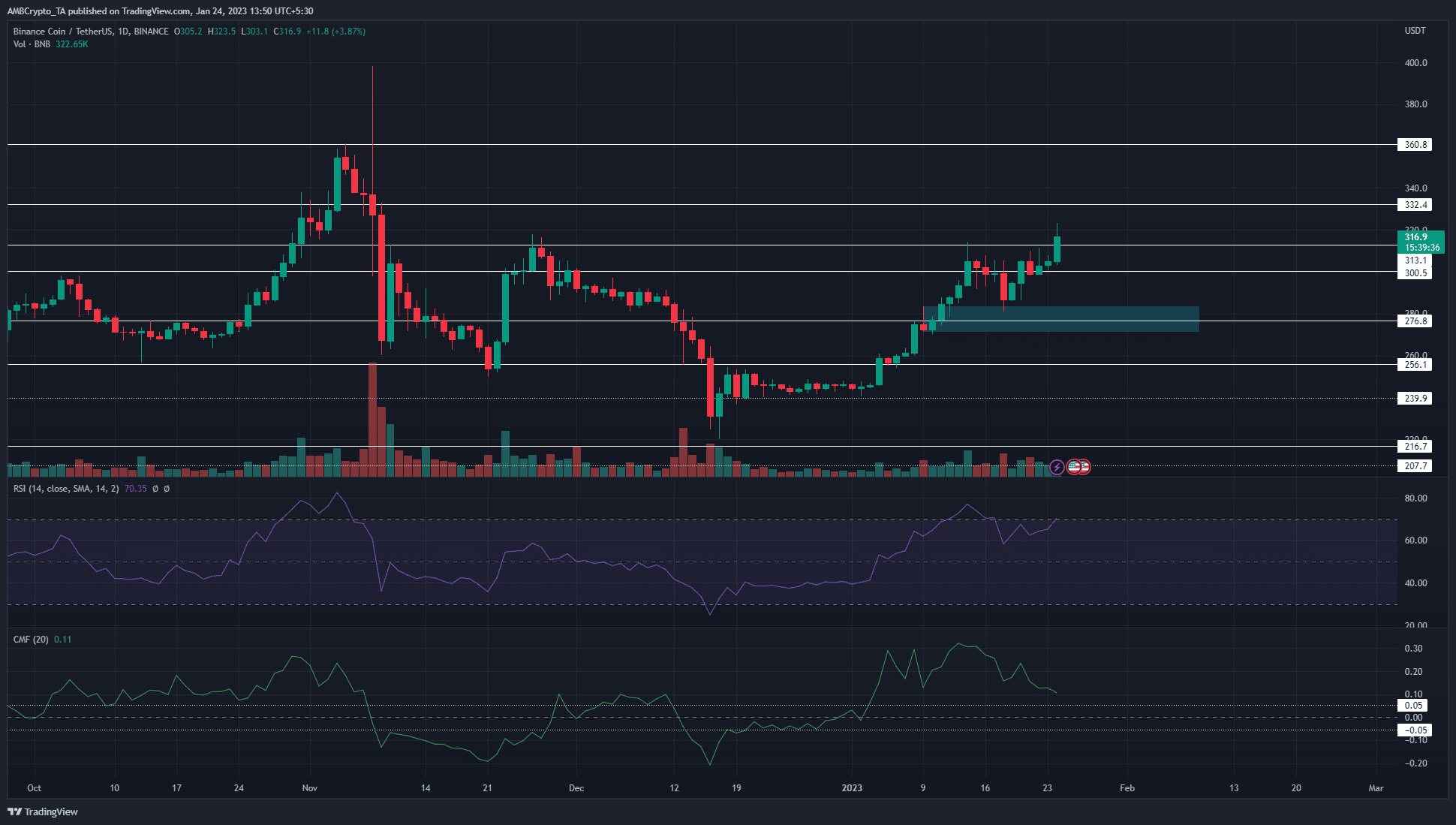

- The retest of the $280 area saw a sharp bullish reaction.

- $307 has offered resistance over the past ten days but was beaten in the recent hours of trading.

Bitcoin [BTC] continued to stay above the $23k mark, as bulls could wait for a move above $23.2k to buy into the bullish momentum. Conversely, they could wait for a drop to $22k before buying. However, a daily session close to $20.6k would indicate that bears had the upper hand.

Read Binance Coin’s [BNB] Price Prediction 2023-24

The dominance of BTC bulls in the past three weeks saw Binance Coin [BNB] register notable gains as well. More impressively, the bulls drove prices above $314, where they had struggled over the past week.

The liquidity above $315 has been collected- what is next?

Liquidity rests where a large number of stop-loss orders lie. In the past ten days, the $300-$315 has served as resistance, just as it did in late November. This changed in the past 24 hours of trading when BNB could push higher to reach $323.5.

At the time of writing, the lower timeframes noted a drop from $323 to $314. This could be a bullish retest of former resistance, and Binance Coin can continue to climb higher. The CMF was above +0.05 throughout January, which showed significant capital flow into the market. The RSI also noted strong bullish momentum, but would form a bearish divergence soon.

Such a divergence need not indicate a reversal of the uptrend- rather, it could be the first sign of a pullback toward $300. Hence, buyers can wait for a foray into the $300-$310 area to buy BNB. A daily session close below $298 would shift the structure to a bearish bias. Therefore, this can be an invalidation for BNB buyers in the $300 zone.

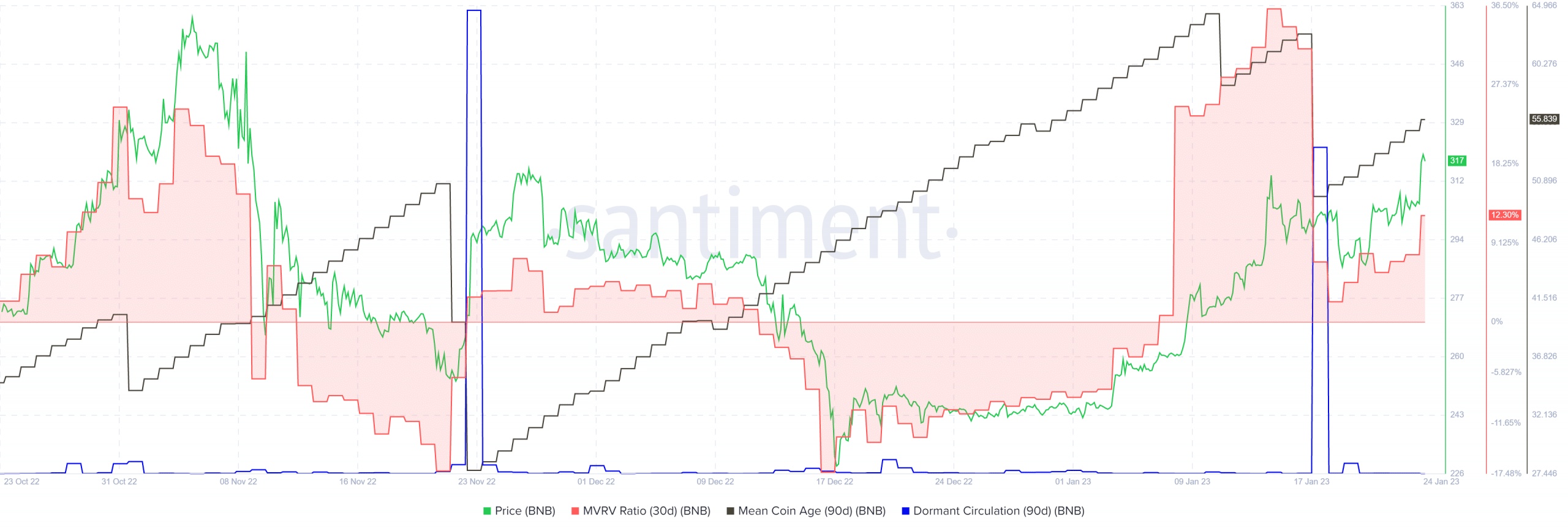

The mean coin age begins another uptrend and the MVRV ratio also slides higher

Source: Santiment

There was a sharp drop in the MVRV ratio and the mean coin age on 17 January. The dormant circulation (90-day) also saw a sharp spike to suggest intense near-term selling. The next day, 18 January, saw the price fall from $305 to $281. As seen on the price chart, this was a retest of a bullish order block from earlier this month, and a rally followed.

Since then, the mean coin age has ticked upward to show a network-wide accumulation. The MVRV ratio was also reset, although not entirely.

Realistic or not, here’s BNB’s market cap in BTC’s terms

Based on the technical and on-chain metrics, BNB holders can look to book profits, thereby seeing the coin drop toward $300. However, the market structure was bullish, and buying pressure was witnessed. After $300-$315, the next significant resistance lies at $350.

Thus, there is a good chance that Binance Coin could climb to those heights, so long as Bitcoin does not fall beneath the $22k mark.