Binance Coin’s [BNB] breakout above $300 means this for the market’s bulls

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The daily market structure has turned bullish

- A pullback as deep as $290 remains a possibility though

Binance Coin [BNB] reacted extremely positively over the past two days of trading. The bullish euphoria over Bitcoin’s gains translated across the crypto-market and BNB gained by 20.5% within four days. A retracement before a sustained move higher up the charts remains possible too.

Is your portfolio green? Check the Binance Coin Profit Calculator

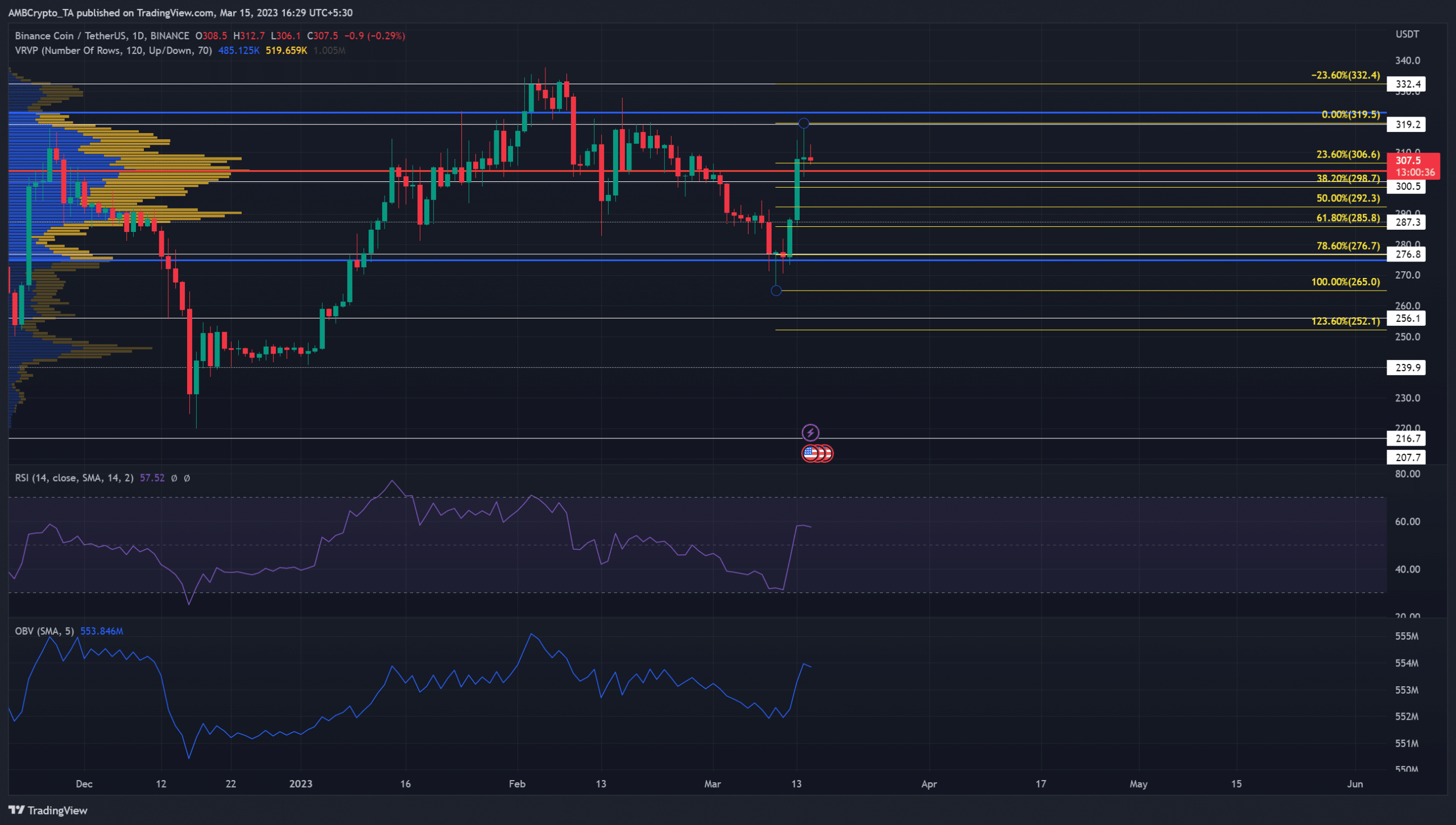

On the daily timeframe, the market structure for Binance Coin seemed to be bullish once more. The recent lower high at $294 was beaten during the latest reversal, but the $309-mark has posed some resistance over the past 24 hours.

A strong confluence of support at $292

The Volume Profile Visible Range showed that the price was right above the Point of Control, based on the trading from 8 February. The POC was at $304.2, and Binance Coin seemed to be retesting it as support, at the time of writing.

The Value Area High and Low were found at $322.8 and $274.7, respectively. This meant that $304.2 and $274.7 are two levels buyers will be interested in. In fact, a set of Fibonacci retracement levels (yellow) were drawn based on the latest surge too.

It showed the 78,6% retracement level lay at $276.7, which was almost the same level as the VAL. Moreover, the price action from early March showed the $285-$292 region was significant support on the lower timeframes. The RSI crossed over above the neutral 50-level and indicated bullish momentum had taken root. The OBV also recorded gains and could continue higher.

How much are 1, 10, or 100 BNB worth today?

Therefore, longer-term buyers can wait for a retracement into the $285-$292 zone. More risk-averse traders can wait for a positive reaction over three days before looking to buy and trade with the trend.

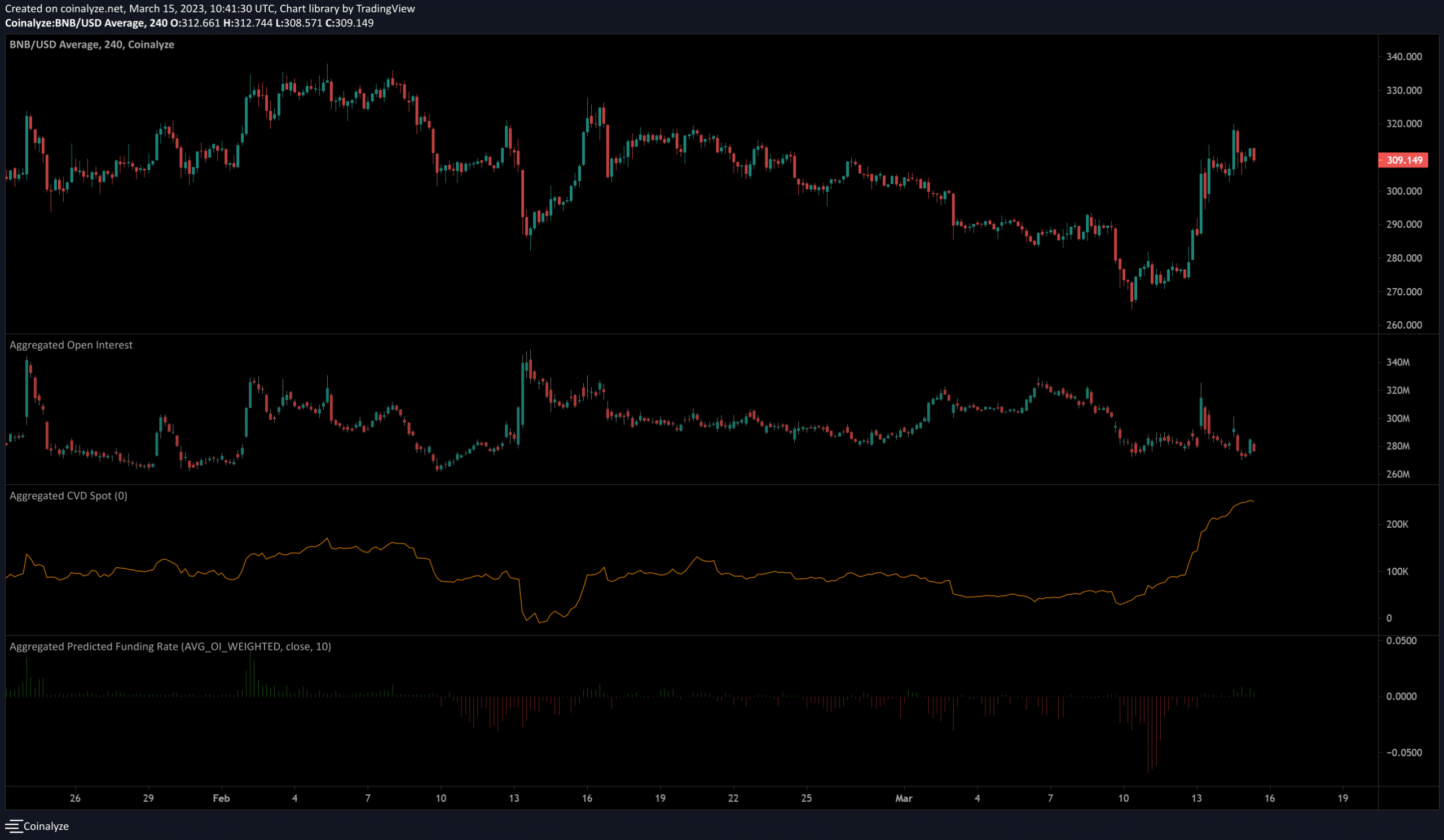

Spot CVD surges past February highs in response to demand

Source: Coinalyze

The funding rate had been negative over the last two days, but it has since slowly climbed above into positive territory. This implied long positions were once more dominant in the market – Signs of a possible flip in sentiment.

The rising spot CVD underlined strong demand, but the Open Interest dipped over the last 48 hours. And yet, the price has appreciated during this time, which is evidence of weakening bullish sentiment.