Binance just enhanced its ETH staking position: Here’s what you need to know

- ETH staking gains momentum after staking unlocks, proving investor confidence.

- At press time, ETH whales held the market back after a recent sale.

Not so long ago we were wondering whether ETH staking unlocks will lead to a massive outflow from staking pools. Potentially trigger more sell pressure. Fast forward to the present and it is clear that the unlocked staking contributed to more confidence.

Is your portfolio green? Check out the Ethereum Profit Calculator

Even Binance is jumping in on the available opportunities. Blockchcian research firm Arkham Intelligence recently observed that Binance transferred 128,000 ETH to a staking address on the Beacon chain. Binance has transferred roughly 576,000 ETH to staking addresses so far this week, bringing the total value of staked ETH by Binance users to over $1 billion.

Earlier today, Binance moved another 128K ETH into a address used for staking on the Beacon Chain.

Just this week, they have transferred 576K ETH to staking addresses.

That's over $1.07B of ETH now locked in validators, from Binance users alone. pic.twitter.com/WLm1wEvRs4

— Arkham (@ArkhamIntel) May 10, 2023

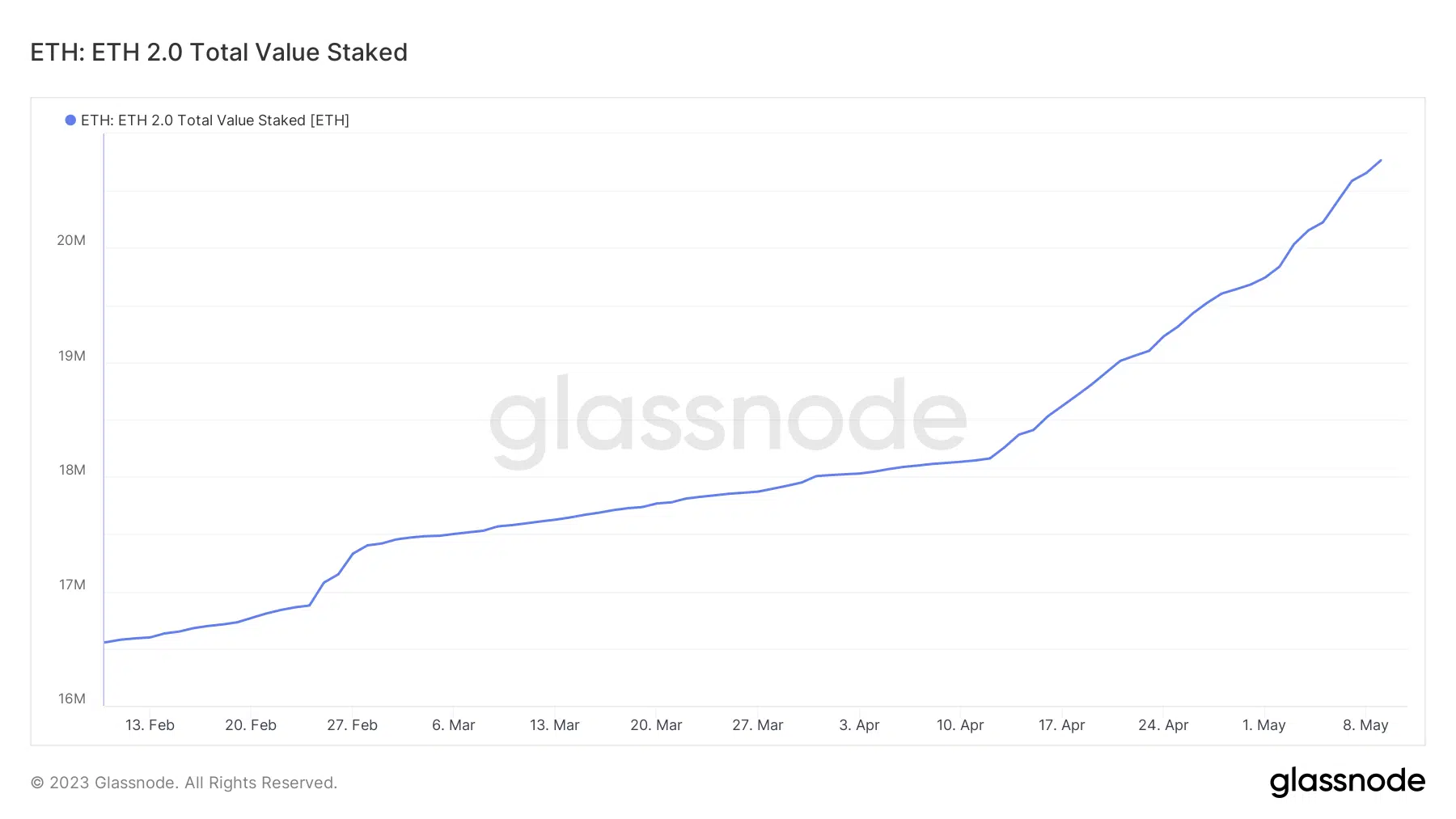

Total staked ETH hits new ATH

Binance’s additional ETH staked confirmed what we have been seeing across the market. The pace of ETH staking has been on the rise. This indicated that investors were now more confident than ever. As such, the total value of staked ETH has been on the rise and is currently at its highest historic levels. Roughly 20.7 million ETH has been staked so far.

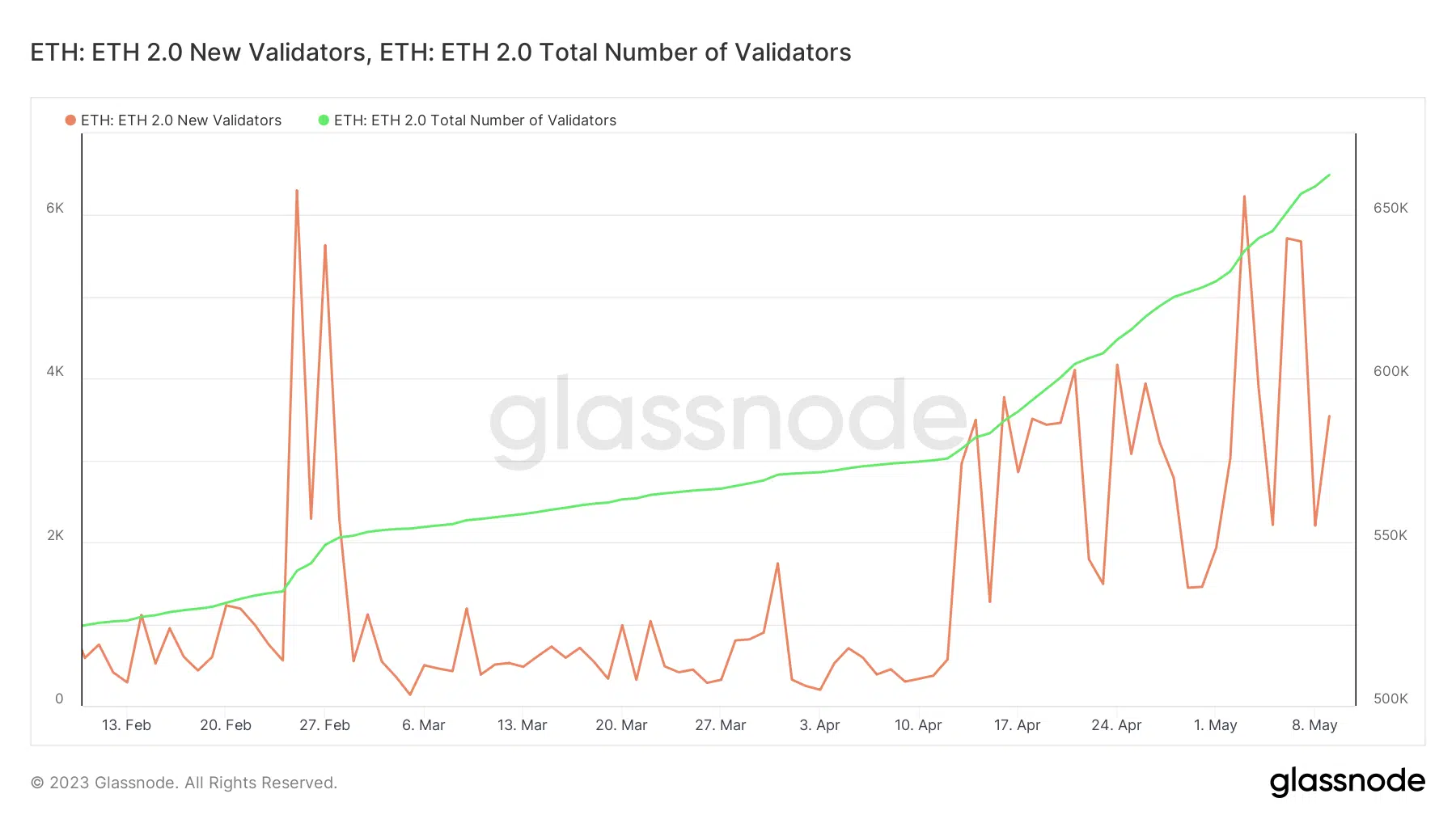

Higher confidence was once more reflected in the number of validators participating in ETH 2.0 staking. The latest findings revealed that at press time, ETH boasted of more validators than the total count prior to the activation of staking withdrawals.

There are now more active validators live on the Ethereum network than there were before staking withdrawals were enabled

It took less than a month for this to happen

ETH staking is up only

— sassal.eth ?? (@sassal0x) May 10, 2023

The number of new validators rose significantly in the last four weeks. This confirmed that the activation of staking withdrawals contributed to more confidence in market participants, especially validators. As such, the total number of validators went up exponentially and recently peaked slightly above 662,000.

A higher number of staking participants meant that there was more demand for ETH which could then be committed to staking. In other words, a sizable amount of existing demand for ETH was being funneled into staking. This was favorable for the cryptocurrency, especially in the long-term.

How many are 1,10,100 ETHs worth today

Is it enough to stimulate ETH demand in the market?

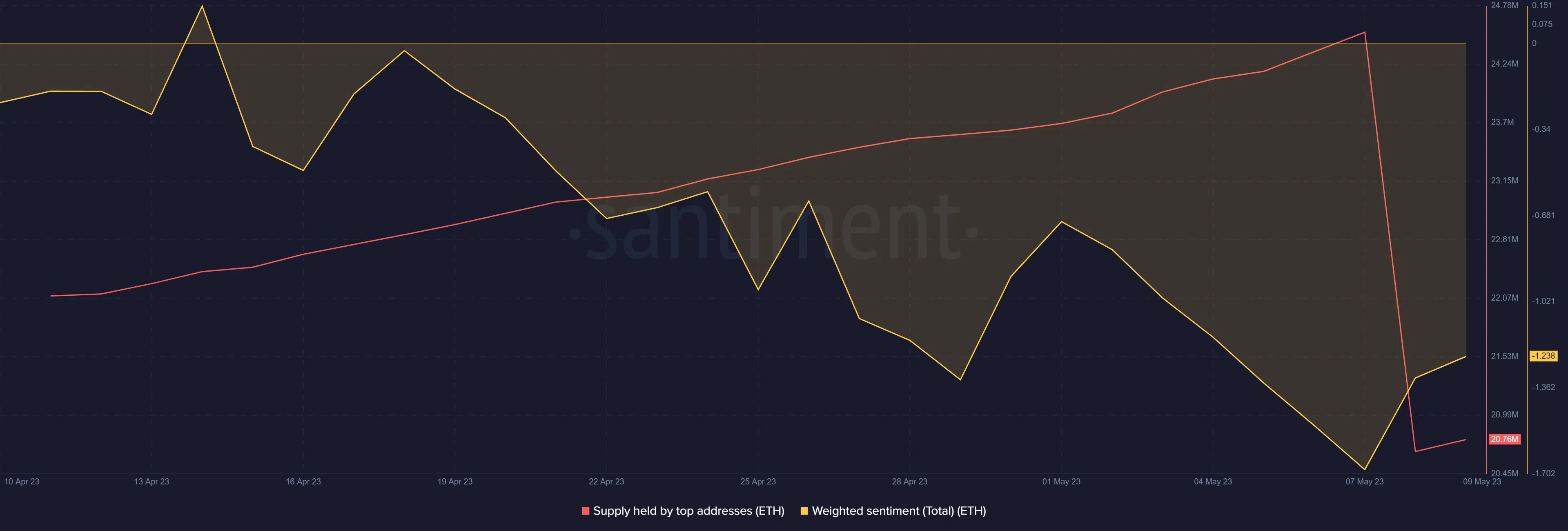

Despite the above findings, the current market sentiment has been low. Part of it is because ETH whales offloaded a large amount of ETH from their addresses between 7 and 8 May. However, the weighted sentiment metric shows a slight surge in weighted sentiment.

The supply held by top addresses had a slight uptick in the last 24 hours. Nevertheless, it still has some ground to cover before recovering back to its current monthly high.