Binance offers a competitive fee structure for cost-effective trading

The cryptocurrency and blockchain technology space has seen remarkable growth in terms of innovation, users, and price over the last year. This tremendous growth has lured countless enthusiasts who want to be part of this evolving crypto ecosystem.

As the number of investors flocking into the space increases, crypto exchanges that offer a variety of services are sprouting in the space. But often, these exchanges add several different variables to the users’ purchasing process that can make investing in cryptocurrencies a tiresome ordeal for novice users.

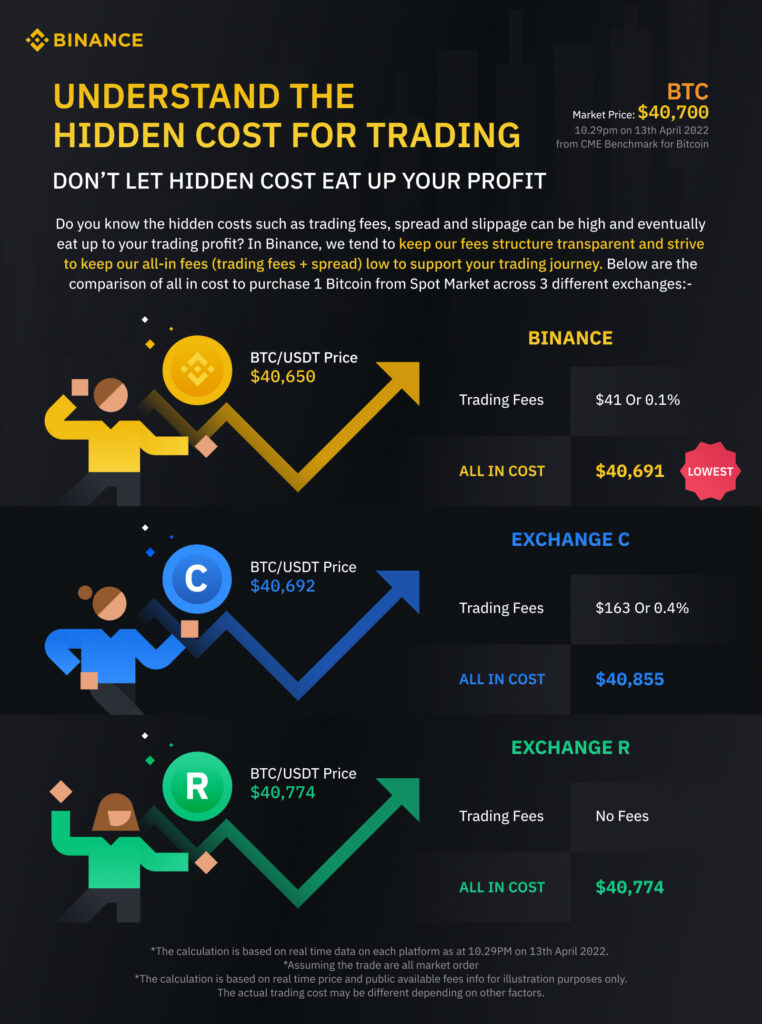

Variables like high exchange fees, network fees, conversions fees, and even when the broker platform the user chooses offers zero fees, the price rate can be as high as 5–10% premium over the actual market price. Thus users need to be aware of all the hidden charges or pricing strategies of these third parties.

Binance, one of the largest cryptocurrencies and blockchain technology providers strives to filter these variables by providing an inclusive platform, deeper liquidity, and a competitive fee structure to ensure users with the best value for their money for cost-efficient trading.

User-Focused Approach to Trading Fee

Crypto should be traded at its actual cost as higher trading fees are inconvenient, and detract users from an enjoyable crypto experience. As the crypto world is a popular avenue for regular investing and trading, traders shouldn’t have to worry about the trading fees eroding their hard-earned profits.

Binance prioritizes its users above everything. The platform offers some of the industry’s most affordable and competitive exchange rates. The exchange charges a flat 0.1% fee when users open or close a position on Binance spot trading. Users holding BNB also get an additional 25% discount.

Below given is an infographic highlighting the fees users might incur if they bought Bitcoin on April 13, 2022.

Minimal Market Spread

At times, users suffer an immediate loss just after buying Bitcoin at the market price. This loss can vary significantly across different exchanges. This happens as a result of insufficient liquidity and a high market spread on some exchanges, which occurs when the underlying asset has a low volume and is not actively traded.

In some cases, an exchange may advertise zero fees. However, in reality, this exchange has lower liquidity and a higher market spread than the competition. As a result, even if you don’t pay trading fees, the overall cost of the trade will be higher.

An ideal user experience minimizes both trading fees and market spread as much as possible. Binance offers features like Spot Liquidity Provider and Liquid Swap that not only boost liquidity on Binance by rewarding eligible market markers with trading fee reductions but also offer instant liquidity with low fees for DeFi users.

Thus with improved liquidity, based on historical live trading data, a lower slippage and minimal market spread are offered on Binance as compared to other exchanges.

An Accessible Ecosystem

Even though a variety of platforms offer services for crypto, users often stumble on hindrances like a complex user interface or unreasonable trading fee structures which makes them uncertain about diving into the crypto sphere.

Binance strives to be an inclusive platform where each product and service offering is designed by keeping users’ convenience in mind. The platform aims to eliminate slow transaction speed and high trading fees, which could act as a roadblock for novice users trying to explore the space thus making the platform accessible to all.

The platform advocates crypto adoption by all and is willing to provide an affordable fees structure and competitive crypto prices to lower the barriers in the crypto space and provide an opportunity for the masses to be a part of the crypto ecosystem.

The Way Forward

Trading fees play a crucial role in the crypto and blockchain ecosystem. With new exchanges popping up every day, the demand for better fees is higher than ever. Binance at the time of its inception charged 10x lower fees than other exchanges and is still the lowest fee exchange in the world, the platform plans to reduce its prices even further in the future.

The founder and CEO of Binance, Changpeng Zhao, popularly known as CZ said through a Binance blog post,

“Ultimately, crypto was designed for the user. The profit-over-user mindset of many exchanges goes entirely against this purpose. Sure, specific platforms may net high-profit margins in the short term. However, users will always be drawn to the platform that best adheres to their preferences. This is why Binance has and will continue to have the lowest fees in the market.”

With a comprehensive variety of crypto offerings, competitive trading fee structure, and deep liquidity enhanced by a variety of programs, Binance is determined to prioritize users’ preferences thus facilitating crypto adoption on a global scale to make the crypto ecosystem accessible to all.

For more information on Binance, please check out their official website.

Disclaimer: This is a paid post and should not be considered as news or advice.