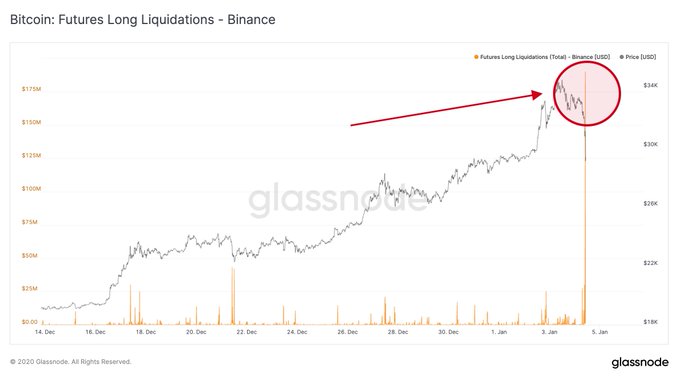

Binance sees record long liquidations as Bitcoin slips under $30k

The price of Bitcoin, the world’s largest cryptocurrency, registered a new all-time high of $34,800 on 3 January 2021. However, thanks to the exponential nature of BTC’s hike, corrections were inevitable. On 4 January, as the crypto was consolidating above $32k, it witnessed a sudden dump, with the value of the cryptocurrency plummeting from $33,374 to $27,734 in a matter of just four hours.

While by the time of writing Bitcoin had recovered its position above $30k, the scale of its aforementioned drop was interesting to note.

Source: BTC/USD on TradingView

In fact, according to some market observers, the aforementioned drop of $5,000 in 3 hours may have been one of the worst price drops in the history of Bitcoin.

Thanks to Bitcoin’s sudden foray below $30k, many long positions were liquidated. In fact, according to data provided by Bybt, nearly $1.19 billion worth of longs were liquidated on 4 January.

Source: Bybt

Leading exchanges like BitMEX, Bitfinex, and Binance were the ones to note most of these large scale liquidations. At the time of writing, nearly 183 long positions had been liquidated on Bitfinex, equivalent to $25.140 million [at the press time price], according to data provided by Datamish. Further, BitMEX saw 271 long positions get liquidated at the same time, or longs worth $110.76 million.

Binance saw the worst of it, however, with the exchange having gained prominence as one of the prime avenues for the Bitcoin derivatives market. The sudden price fall triggered record liquidations of $190,000,000 [in long positions] in 10 minutes, a figure which is the largest value recorded on the exchange ever.

Source: Glassnode

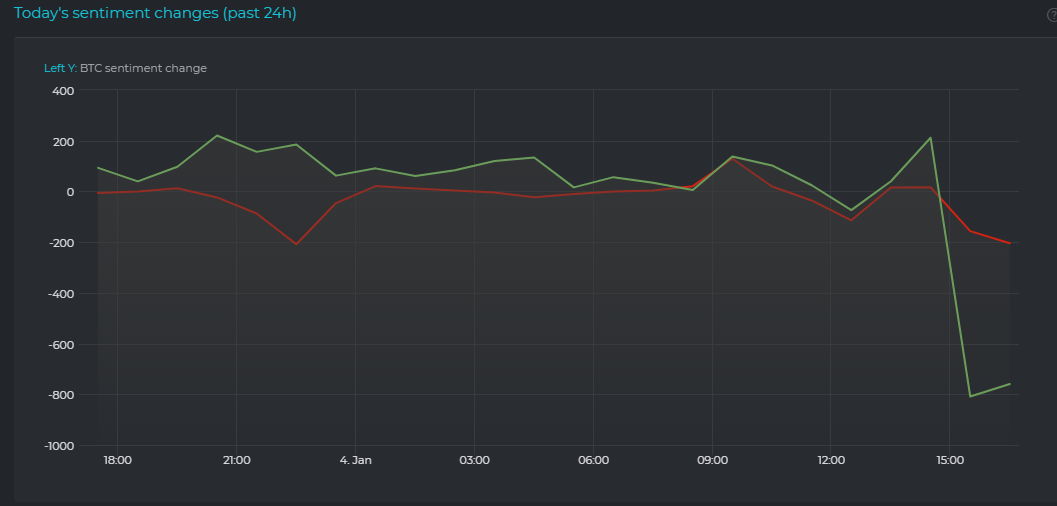

As the market took a hit, the long sentiment fell into the negative zone, while shorts dropped too. As the longs were liquidated more than the shorts, the press time change in sentiment sided with the market’s bears. While the longs dropped to -809 before recovering to a value of -732, the value of shorts remained at -221.

Source: Datamish

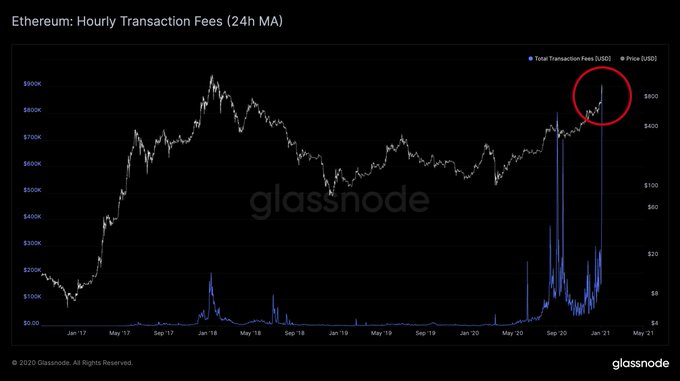

With Bitcoin’s market crumbling, the value of the market’s altcoins was not holding well either. Ethereum, the world’s second-largest cryptocurrency, having surged past $1000 for the first time since 2018, dropped to $854. Even though the coin recovered from this low and was trading at $976 at press time, its gas fees had climbed to an all-time high, making it expensive for traders to trade.

Source: Glassnode

In fact, Glassnode noted that Ethereum’s hourly transaction fees [24h MA] had hit $898,000.