Binance stares at a bleak future in the U.S.

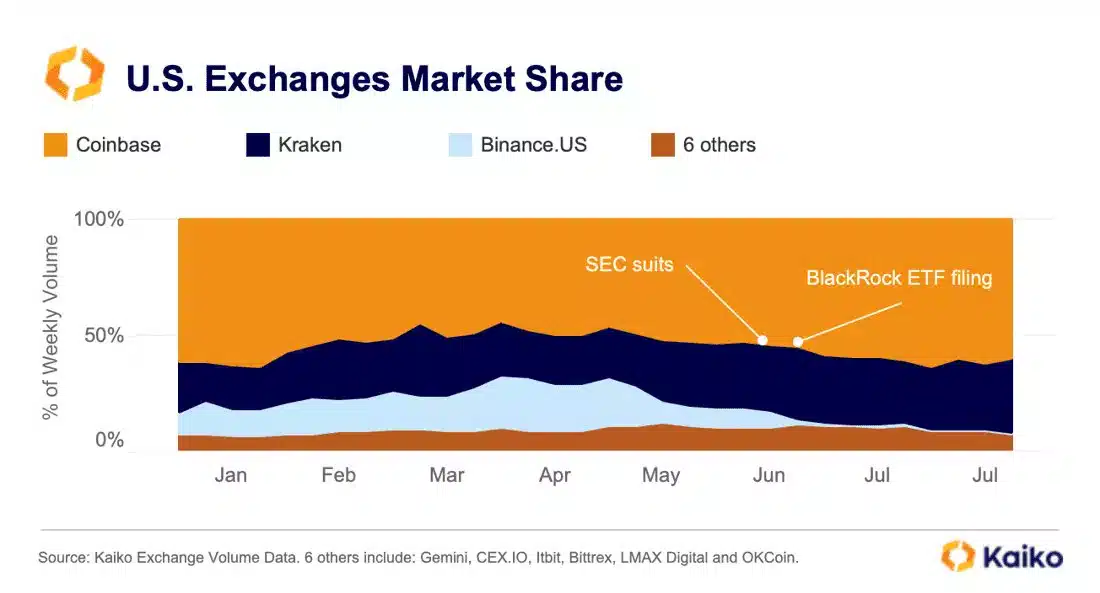

- Binance.US’ market share plunged from 20% in mid-April to less than 1% as of August.

- On the other hand, Coinbase increased its market dominance in the last few months.

The crypto exchange market in the U.S. has undergone a radical shake up ever since the early-June lawsuits on some of the biggest names in the industry. More specifically so, the action against Binance [BNB] by the U.S. Securities and Exchange Commission (SEC), has proven to be a death knell for the exchange’s operations in the country.

According to digital assets’ data provider Kaiko, Coinbase [COIN] and Kraken, the two biggest trading platforms in the U.S., scooped up the entirety of the market share lost by Binance’s American arm in the last three months.

Binance falters, Coinbase rises

Binance.US has been one of the biggest victims of the entire episode, as a large-scale exodus by jittery market makers and traders sucked liquidity out of the trading platform.

As evident above, the market share plunged from 20% in mid-April to less than 1% as of August, severely stunting its growth in the world’s largest financial market.

In contrast, notice how Coinbase, which also was hit by an SEC lawsuit, expanded its footprints in the U.S. market by increasing market dominance to 60%.

Although the largest exchange in the United States experienced some hiccups as a result of the litigation, a major bullish trigger tipped the scales in its favor. TradFi giants like Coinbase, Fidelity, and many more who applied for their spot Bitcoin [BTC] ETFs recently, named Coinbase as their surveillance sharing partner.

This resulted in Coinbase becoming the go-to platform for crypto spot trading in the country.

No end in sight to Binance’s woes

Things might just get worse for the world’s largest exchange as far as U.S. oversight was concerned. The crypto behemoth’s activities in Russia have come under the radar of the U.S. Justice Department, with experts believing that a criminal indictment was imminent.

Earlier in May, the U.S. government launched an investigation into Binance over allegations of allowing Russian users to bypass economic sanctions over the Kremlin’s military campaign in Ukraine. The charge has been repeatedly denied by Binance.

Despite the FUD, Binance remained the undisputed leader in crypto trading. The exchange handled transactions worth more than $6.2 billion in the last 24 hours, nearly six times more than the second-ranked Coinbase, according to data from CoinGecko.