Binance USD [BUSD] maintains its peg even as outflow increases

![Binance USD [BUSD] maintains its peg even as outflow increases](https://ambcrypto.com/wp-content/uploads/2023/02/kelly-sikkema-mdADGzyXCVE-unsplash-e1676724285447.jpg)

- BUSD has been able to maintain the $1 peg despite its FUD.

- Binance’s BUSD reserve has declined to around 12.4 billion.

The regulatory hammer hung above Binance for some time before landing on Binance USD (BUSD). Despite the FUD that has gripped the stablecoin, one metric has turned out to be positive for it thus far.

BUSD maintains its peg

Due to the Wells notice issued by the Security and Exchange Commission (SEC) to Paxos, the Binance USD (BUSD) has been put through a rigorous stress test.

Consequently, stablecoin investors have been forced to sell their holdings. It was estimated that as of 17 February, there had been close to $500 million worth of trades visible to the public.

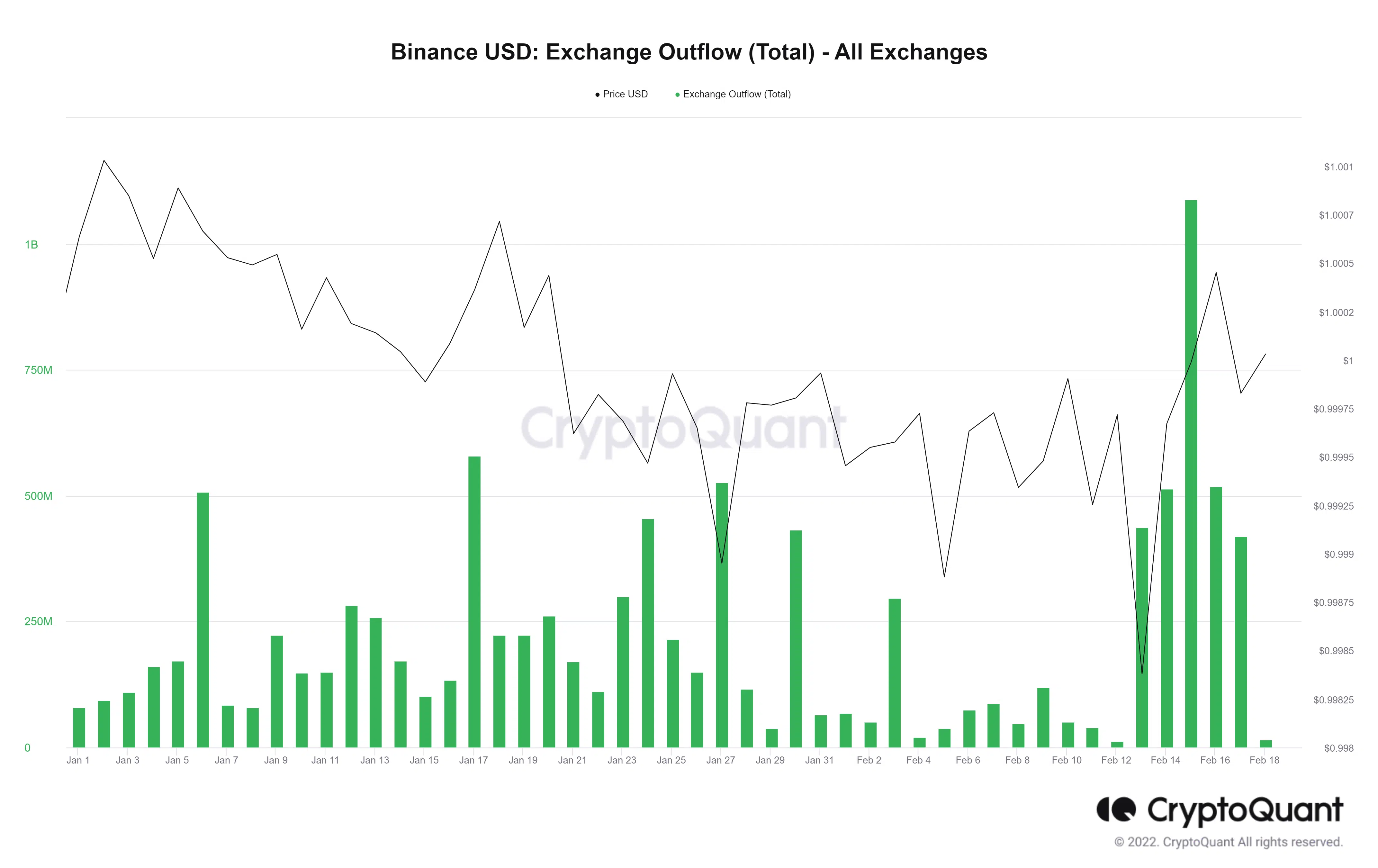

Despite the high volume of transactions, BUSD has kept its value fixed at one dollar, as per Crypto Quant. As of this writing, the volume had already exceeded 200 million while remaining stable at its current level. Despite the asset’s apparent fall, this is good news.

Outflow continues as reserve declines

All signs point to BUSD holders being in a hurry to sell their assets because they are unsure of what might happen next.

Analyzing the inflow and outflow statistics for all exchanges revealed that although the inflow had reduced, the outflow was still at a significant level.

The most recent figures indicated that the outflow was nearly 500 million. Holders may be switching to fiat or other stablecoins, as seen by the rising outflow.

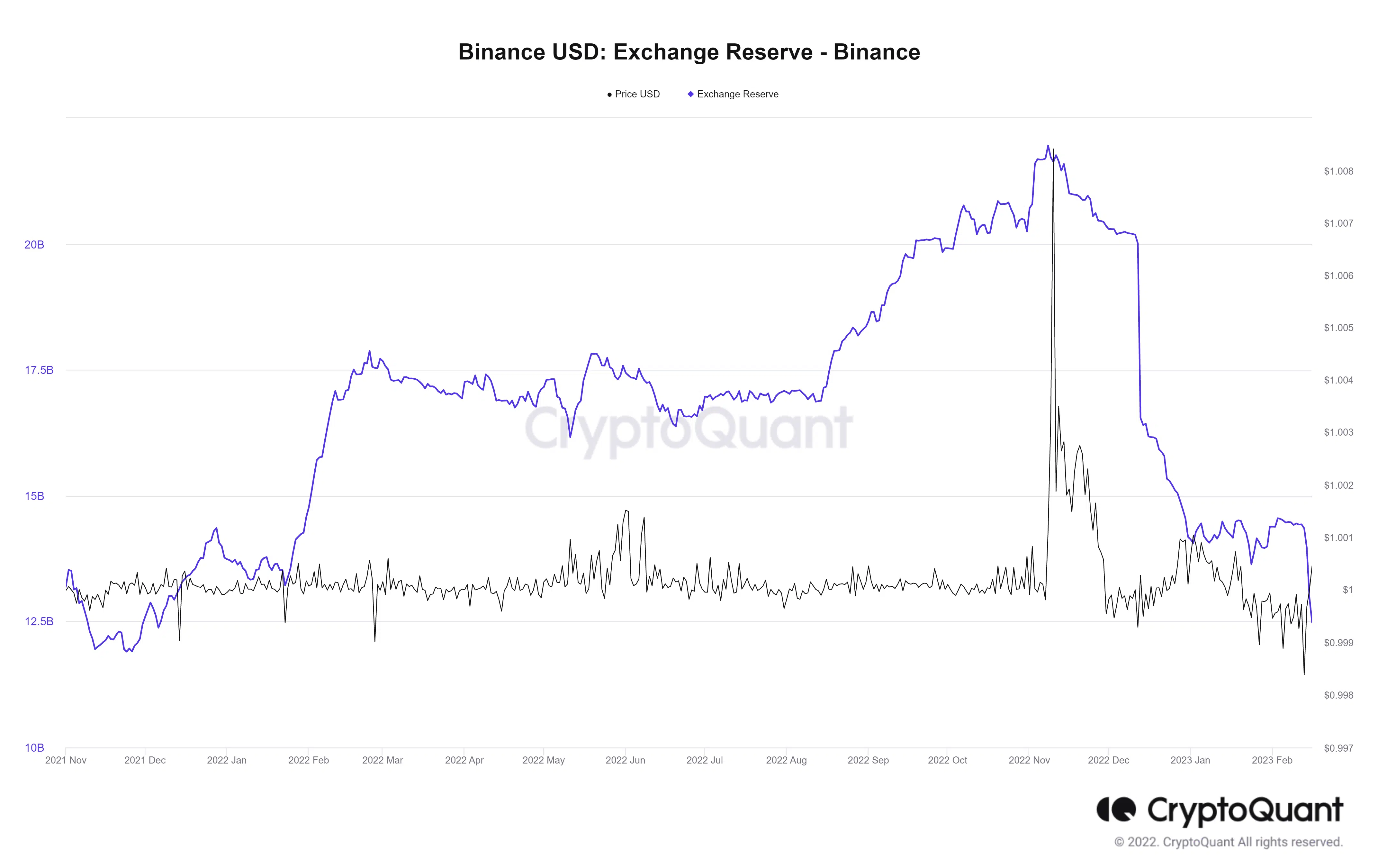

Furthermore, Binance’s BUSD reserve has been diminishing with the enormous volume of BUSD trading.

A check of Binance’s exchange reserve measure revealed that the reserve had dropped to roughly $12.48 billion as of this writing. It started the year with a reserve of nearly $14 billion and kept it until the decline began.

The Aave freeze

It’s important to note that a proposal to discontinue trading in BUSD on Aave was presented on 13 February and will be voted on until 19 February.

The proposal states that losing the ability to mint additional BUSD could harm peg arbitrage and asset peg. Furthermore, it was noted that freezing this reserve and encouraging users to migrate to another stablecoin was necessary. As of this writing, the proposal had gathered 99.96% votes.

How Paxo’s dispute with the SEC over Binance USD (BUSD) will be resolved is still mostly unknown. However, the true state of BUSD will be revealed in the following weeks or months as events play out and paint a complete picture.