Binance USD losing ground: Users shift away as key metrics decline

- BUSD’s usage and interaction have declined, as seen by Glassnode’s data and CryptoQuant’s metrics.

- Despite its decline, BUSD remains the third-largest stablecoin by market cap.

The decline of Binance USD (BUSD), a stablecoin that was once full of promise, is becoming increasingly evident as fewer addresses are receiving it.

In addition to reducing the number of addresses receiving the stablecoin, other metrics also indicate a gradual decline.

Users move away from BUSD

Since the SEC’s actions against Binance and Paxos, there has been a steady decrease in activities involving the Binance USD (BUSD) stablecoin. Recent data from Glassnode, as highlighted by Glassnode alerts, indicated that a crucial metric had recently hit a new low.

As of 21 April, the number of receiving addresses for BUSD was approximately 478. To put this into context, the number of receiving addresses in January was over 1,500; in February, it was almost 3,000.

The current level of 478 represented a 14-month low. Also, this metric is significant because it reveals the number of active receiving addresses for the stablecoin.

The decrease in this metric and its almost flat display on the chart suggested that users were shifting away from BUSD to other stablecoins.

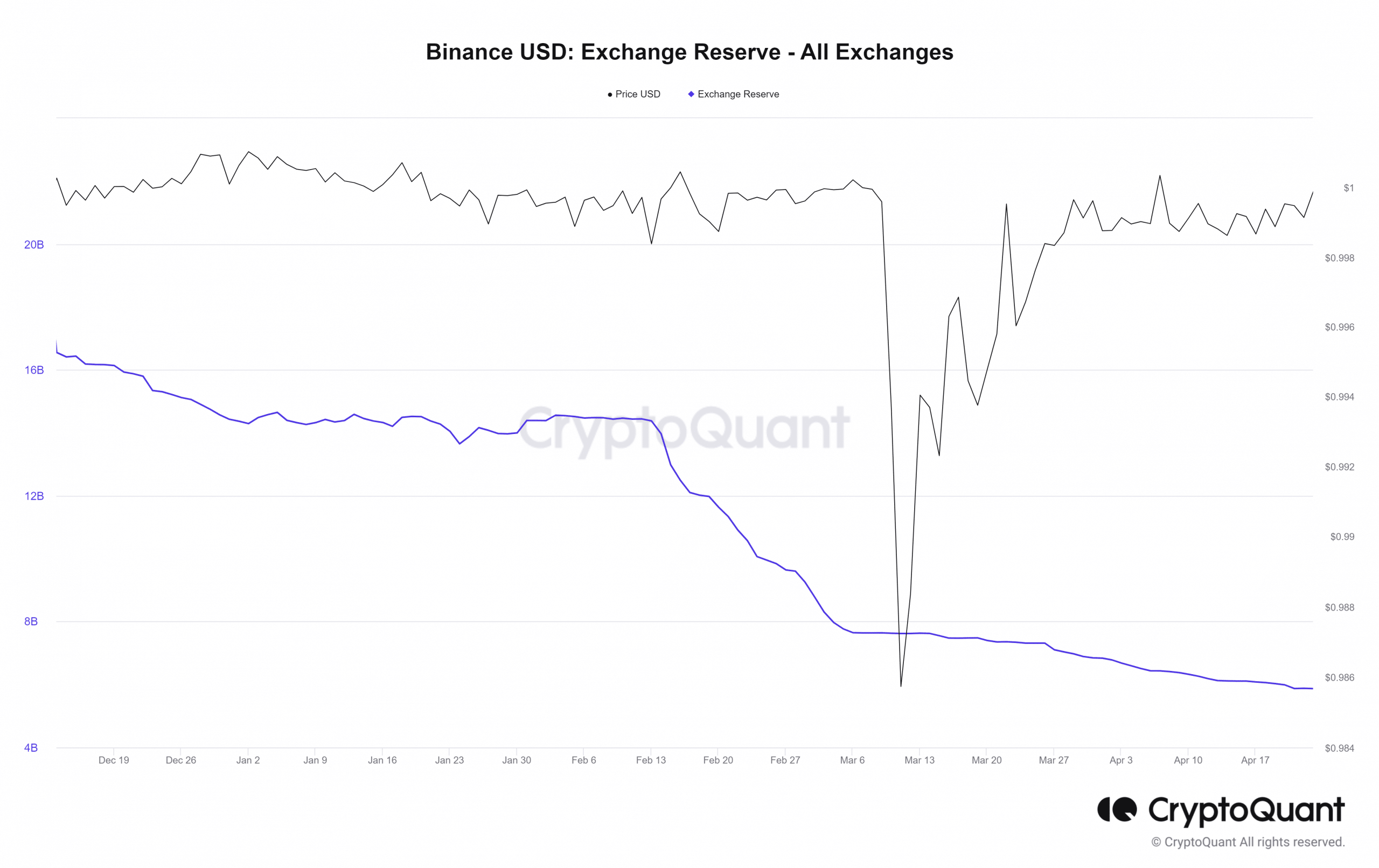

BUSD exchange reserve and Netflow post negatives

In addition, the decrease in usage and interaction with BUSD is further highlighted by the decline in the exchange reserve. According to data from CryptoQuant, the exchange reserve has experienced a significant drop in recent months.

In February, the exchange reserve was around 14 million, but as of this writing, it had fallen to approximately 5 million.

Additionally, the exchange NetFlow has been consistently dominated by outflows for BUSD. According to data from CryptoQuant, since February, there have been more outflows than inflows for the stablecoin.

While the flow has declined over the past few weeks, outflows have still exceeded inflows into exchanges. However, as of 22 April, the Netflow turned positive and was over 7 million.

The current state of the stablecoin market

Despite the decline that BUSD was experiencing, it managed to maintain its position as the third-largest stablecoin by market cap.

According to data from CoinMarketCap, BUSD’s market cap stood at over $6 billion as of this writing. Tether (USDT) continued to be the largest stablecoin with over $80 billion, while Circle (USDC) held the second position with over $30 billion in market cap.