Binance USD’s [BUSD] market cap hits two-year low: Who will take its place

![Binance USD’s [BUSD] market cap hits two-year low: Who will take its place](https://ambcrypto.com/wp-content/uploads/2023/04/BUSD-T.jpg)

– The number of circulating and reserved BUSD coins has tremendously decreased.

– Other stablecoins like TUSD and DAI now have the option to become the third-largest stablecoin as BUSD continues to fall.

Binance USD [BUSD], the stablecoin which was once known as a serious competitor to the top two U.S. dollar-pegged coins has seen a massive dip in market capitalization.

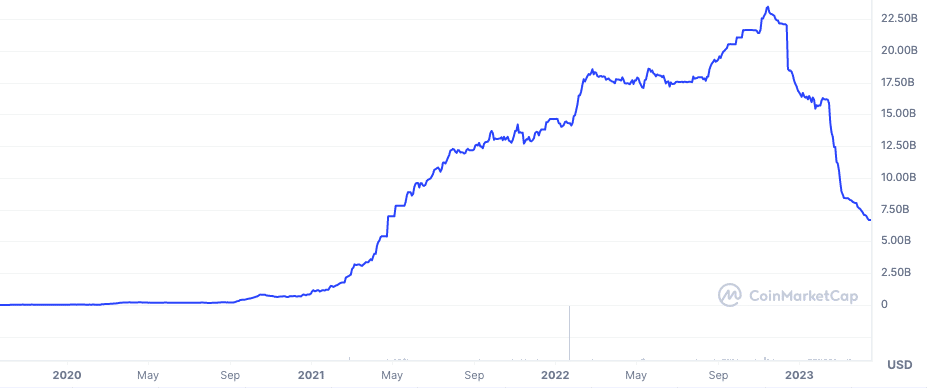

According to CoinMarketCap, the BUSD market cap was $6.68 billion— the lowest point it has reached since April 2021. This decline has led it to rank as the 15th most valuable asset such that Shiba Inu [SHIB] has also overtaken it.

How much are 1,10,100 BUSDs worth today?

A BUSD supply in a discouraging state

To arrive at an asset’s market cap, one needs to multiply the price by the circulating supply. But BUSD has been the fatality of regulatory decisions as the stablecoins landscape evolved.

In February, the New York Department of Financial Services [NYDFS] ordered a halt to minting new tokens. Therefore, affecting its supply.

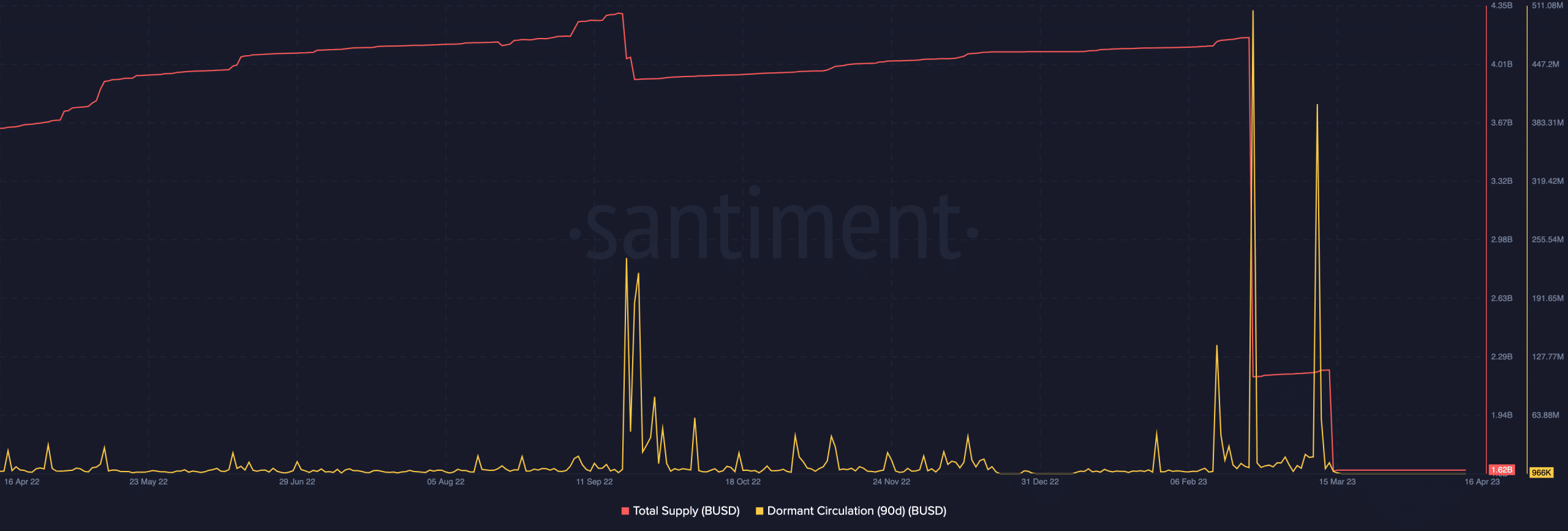

Although the price remained unchanged at $1, the total supply trend has been a shadow of its former self. According to Santiment, the BUSD total supply was down to 1.6 billion. A digital asset total supply refers to the amount of created tokens in circulation, burned or reserved.

Before its proscription in February, the same metric was as high as 4.71 billion. Hence, the decline is proof that Paxos, the issue of BUSD had heeded the instruction.

For long-term holders who once considered BUSD as their safe haven, taking drastic exit measures has been the order of the day.

At the time of writing, the 90-day dormant circulation had several significant spikes. High values of this metric usually mean that HODLers are selling to new entrants. In other scenarios, it could mean previously dormant coins are being exchanged for other assets or changed into liquid supply.

Realistic or not, here’s TUSD’s market cap in BUSD terms

A DAI or TUSD crown to take

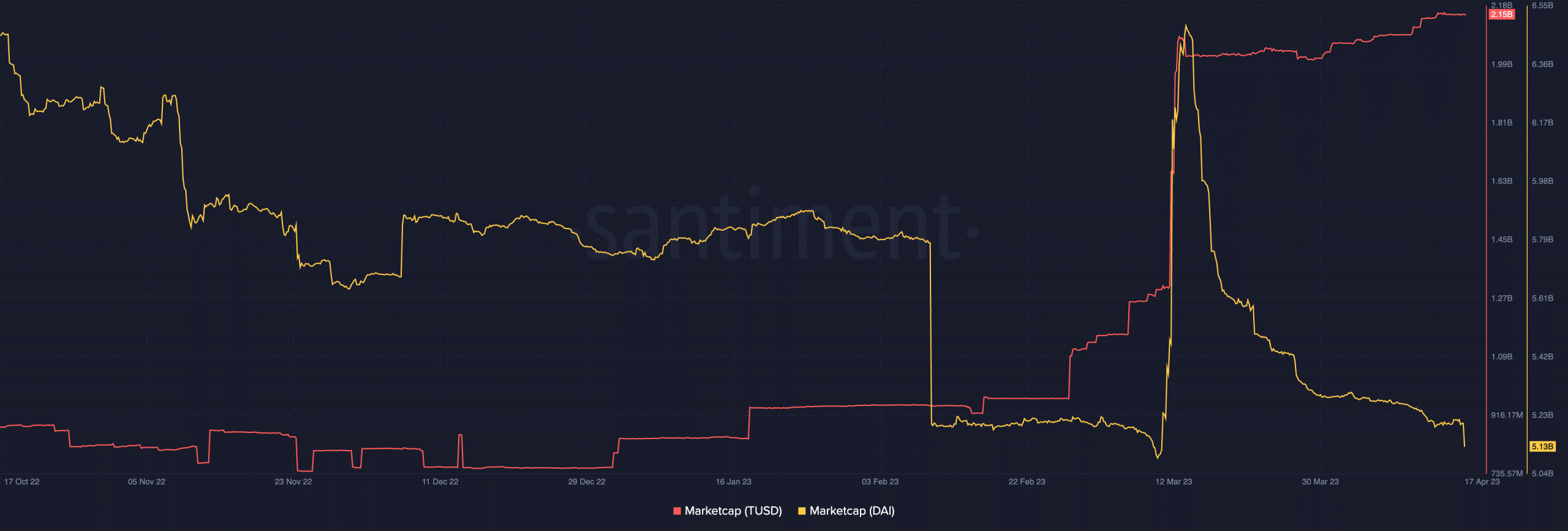

This decline has also raised questions about the potential contenders that could take its place in the stablecoin market. Two months ago, True USD [TUSD] was able to cross the $1 billion market cap, days after the BUSD hit. Although its growth has been impressive, the stablecoin with live on-chain attestation was not the only one vying for the vacant post.

DAI, backed by MakerDAO [MKR], and the largest decentralized stablecoin might also be a challenger. But the difference between both is that DAI’s trajectory has been downward lately. As of this writing, TUSD’s market cap was $2.15 billion. In DAI’s case, it dropped to $5.13 billion.

So, can TUSD surpass DAI? Well, there are many factors subject to the outcome. First, a switch away from centralized entities and their proneness to regulatory clampdown could be an advantage for DAI.

On the other end, TUSD also has the tendency of increased adoption since the billions of wallets that trade on centralized exchanges might be on the lookout for a third option.