Bitcoin and Ethereum: Is this strategy more profitable than shorting over the next 2 weeks?

The altcoins that suffered a drop in price offer several opportunities for buying the dip. Among top 25, Cardano, Dogecoin, XRP and Uniswap price has dropped in double digits over the past week.

Recovery for most other altcoins was overnight at the current volatility and momentum. Bitcoin’s dominance has increased ever so slightly, now at 41.5% and several altcoins have recovered from the drop, posting upwards of 15% in gains like Kusama (+20%) and Helium (+18%)

All retail traders are now watching for signs of Bitcoin and Ethereum’s price recovery this week. The time to buy the dip isn’t over yet, since both assets are trading below key support levels. Bitcoin’s price was below the $35000 level and Ethereum was below the $2600 level based on data from coinmarketcap.com.

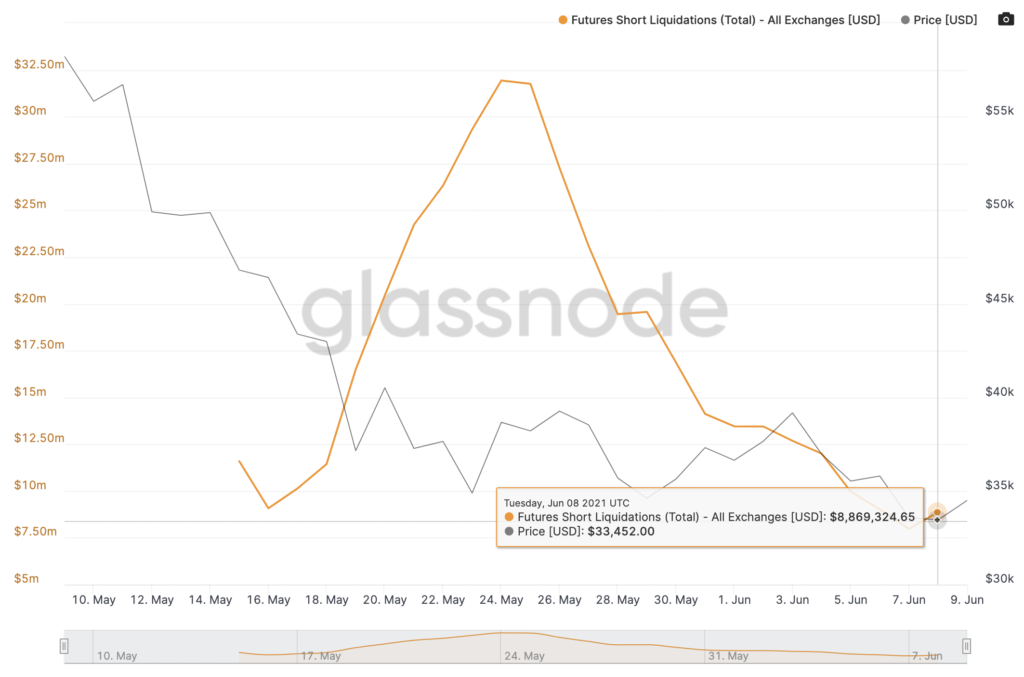

BTC Futures shorts liquidation | Source: Glassnode

Based on the above chart from Santiment, BTC futures short liquidation dropped consecutively in the past week. The trend showed that peak of futures liquidations corresponds with a recovery in price. The last time shorts’ liquidation hit a peak was in the last week of May 2021 and the price recovered, edging closer to the $40000 level. The current dip in the chart, therefore, signaled a bullish recovery in the following two weeks.

Based on on-chain metrics, and the current narrative for Dogecoin and Ethereum, a price rally is more likely. Further, Bitcoin’s on-chain activity suggested that Bitcoin’s address activity was near one-year lows, and Ethereum’s was the same. This was reflected in the price drop over the past week. Thus the narrative of buying the dip is now more relevant than ever, and at the current price level, 85% of addresses are in profit based on data from Glassnode.

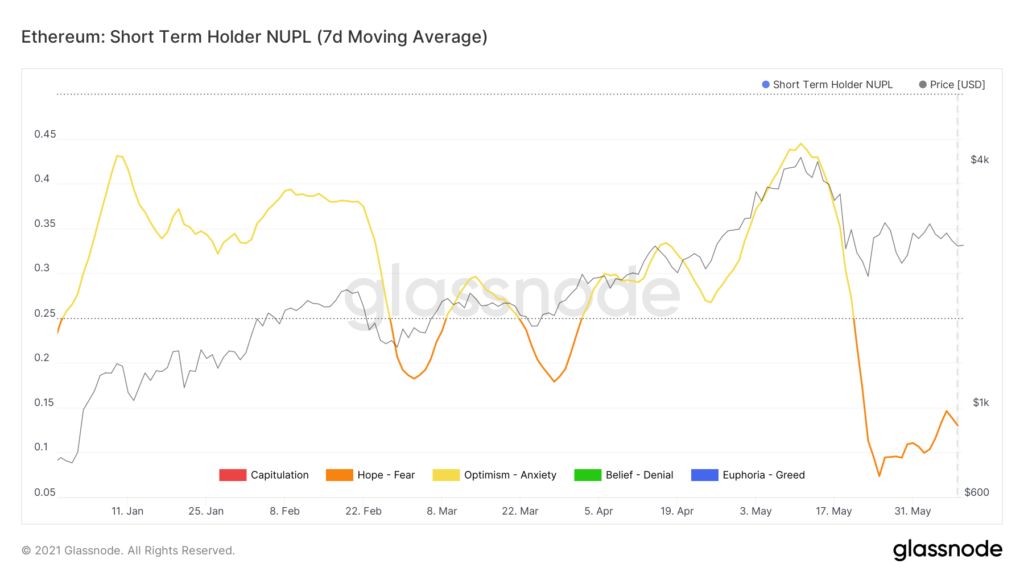

In the case of Ethereum, the short-term Net unrealized profit-loss chart showed that the current sentiment is that of fear, based on traders’ activity.

Source: Glassnode

Fear corresponds with recovery as noted in previous instances; the same was observed in the last week of March 2021. It is likely that after consistent hope-fear, the price will recover and rally to the $4000 level in the second week of June 2021. In either case, buying the dip is more likely to be profitable than shorting over the next two weeks.