Bitcoin and traditional assets, can there be an ideal mix for one’s portfolio?

Over the past year, portfolio diversification has been an ardent topic of discussion. The rise of Bitcoin led to various debates about its inclusion in present-day investment holdings. While many traditional analysts are skeptical of a massive allocation for the crypto, some Bitcoin proponents would come across as over-ambitious putting 100% of their capital in BTC.

None of the above is correct when it comes to investing in Bitcoin, but there might be a way to incorporate a popular stock, a precious commodity, and Bitcoin together, and enjoy the best of all scenarios; be it profits or losses.

Bitcoin-S&P 500-Gold: The perfect concoction?

Comparisons have been off-the-charts for the above trio of assets since the start of 2020. After the black swan event in March 2020, correlations between them have been fervently discussed but from a long-term perspective, the inclusion of all three of them makes sense.

According to a recent Ecoinometrics report, rebalancing is key in order to maintain consistent profits from these assets. In order to understand the concept, let’s say you have $1000 dollars invested in Bitcoin and Gold during the start of the month, with an equal 50-50% allocation. At the end of the same month, the growth might lead to 75% allocation for BTC and 25% for Gold.

Then, a proper re-balancing is carried out by selling some BTC and buying some amount of gold, to allocate a portfolio of 50-50% again. The action is almost like a re-set and its importance will be discussed further.

Why is re-balancing important if an asset is surging better than the rest?

Over the past 8 years of historical data analyzed, this is how the scene looked like if 100% capital went into one asset.

- 100% BTC, 0% Gold, 0% S&P 500

Annualized returns 100%, largest drawdown: 89% - 100% Gold, 0% BTC, 0% S&P 500

Annualized returns -1%, largest drawdown 42% - 100% S&P 500, 0% Gold, 0% BTC

Annualized returns 9%, largest drawdown 37%

So while going all-in with Bitcoin looks extremely lucrative, it also springs the largest drawdown and in that situation, the ‘mental/emotional’ situation is more difficult to deal with than the losses.

Hence, an appropriate amalgamation of Bitcoin, stocks leads to a reduced size of drawdown, while keeping the risk-adjusted return on the same level.

A 34%-33%-33%; Better annualized Returns-Less Risk?

The idea of an equally distributed portfolio is with regard to taking advantage of all scenarios.

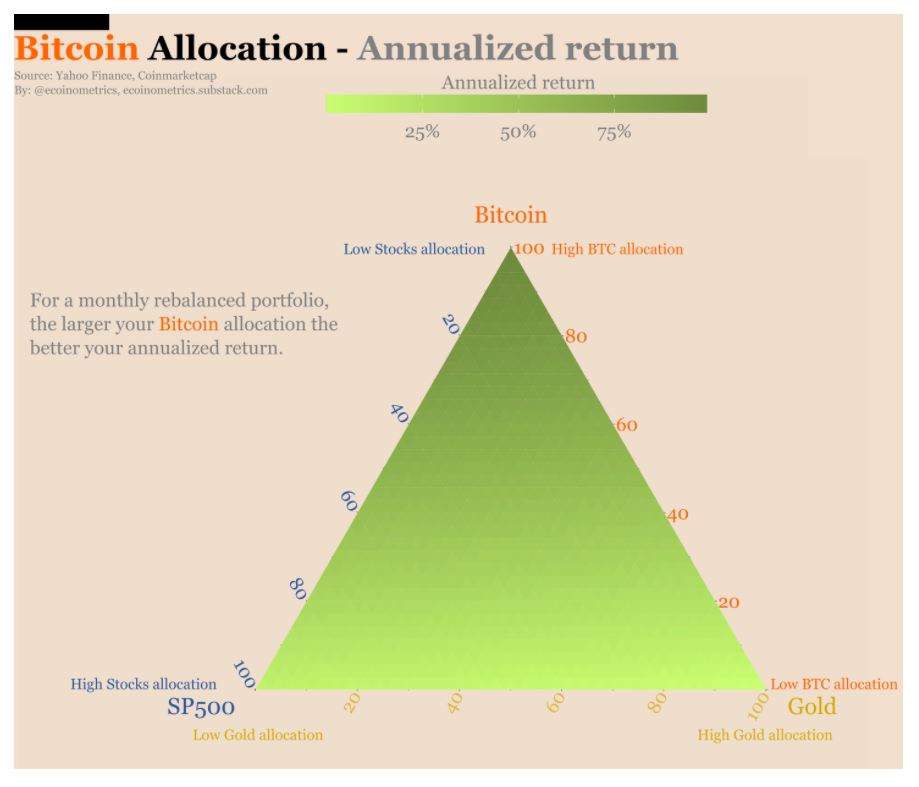

Therefore, when it comes to higher annualized returns, investing higher in Bitcoin would definitely be more profitable. But such returns remain high on the chart only for a lower period of time and dealing with such market volatility may lead to stressful re-balancing.

An equal allocation starts to make sense when Bitcoin faces massive drawdowns and S&P 500 and Gold balances out some of the losses in risk-adjusted returns.

It is important to understand that Bitcoin is still at an early adoption phase hence the correlation between S&P 500, Gold will not be similar over the long-term. However, managing the gains over the long-term is more important than scalping a short-term outlook. Rebalancing helps smoothen the returns by mitigating some of Bitcoin’s downside volatility.