Bitcoin: Are investors bullish despite BTC’s correction?

- BTC’s exchange reserve was increasing, hinting at high sell pressure.

- Derivatives investors were still buying BTC as its price dropped.

Bitcoin’s [BTC] price touched an all-time high on 6th March as its value went above the $69k mark. However, the trend changed soon as the king of cryptos’ price fell substantially.

Meanwhile, the market acted differently as whales continued to accumulate at a time when BTC worth millions of dollars got liquidated.

What is up with Bitcoin?

After touching a new ATH, the king of cryptos’ price witnessed a correction as it dropped by more than 6% in the last 24 hours. According to CoinMarketCap, at the time of writing, BTC was trading at $64,488.27 with a market capitalization of over $1.27 trillion.

While the coin’s price went down, large holders continued to accumulate. As per a recent tweet from IntoTheBlock, large Bitcoin holders increased their holdings by 4177 BTC in the last seven days, worth more than 279 million at current prices.

Surprisingly, Ali, a popular crypto analyst, revealed that a substantial amount of BTC got liquidated while whales continued to stockpile. The tweet mentioned that nearly $164 million in Bitcoin long and short positions had liquidated across the board in the past 24 hours.

To see what is actually going on around BTC, AMBCrypto took a look at the coin’s on-chain metrics. As per our analysis of CryptoQuant’s data, BTC’s exchange reserve was increasing.

Additionally, BTC’s net deposit on exchanges was also high compared to the last seven-day average. These two metrics suggested that selling pressure was high on the coin.

However, when we checked Satiment’s data, a different story was revealed. We found that BTC’s supply on exchanges went down.

In the meantime, the coin’s supply outside of exchanges went up slightly, meaning that investors were still buying BTC even after its price fell under $64k.

A look at investor sentiment around BTC

Though the coin’s price dropped, derivatives investors found the right opportunity to buy more BTC. This was the case because its funding rate was high.

Additionally, its taker-buy-sell ratio remained green, meaning that buying sentiment was dominant in the futures market.

Read Bitcoin’s [BTC] Price Prediction 2024-25

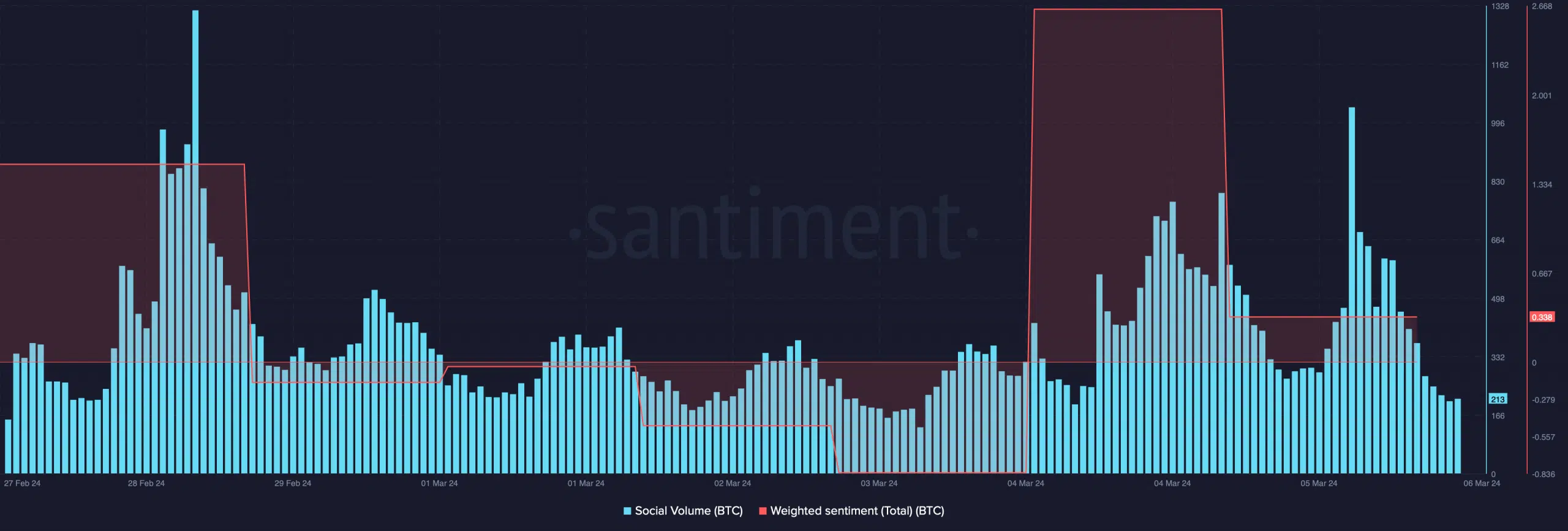

Mentioning market sentiment, BTC’s social volume remained high, which can be attributed to the recent volatility in price.

Since the coin’s price dropped, bearish sentiment around the token went up, as evident from the drop in its weighted sentiment.