Bitcoin: Are long-term trades back in full swing? This data suggests that…

- Bitcoin could be transitioning from a preference for short-term to long-term gains.

- Leverage traders back off after recent liquidations.

Bitcoin [BTC] traders have been waiting for signs that could indicate that the cryptocurrency was making the switch from short-term profit-taking to a long-term outlook. At press time, the market showed some signs that the switch might already be in effect.

How many are 1,10,100 BTCs worth today

Recent market data indicated that Bitcoin trades executed in the options (derivatives) segment have been shifting in favor of a long-term outlook. The assessment of recent options trades revealed that quite a substantial number of trades focus on long-term trades rather than short-term profits.

Even though the ETF news is over, there will not be any substantial benefits soon and the hype has come to an end. But BTC did attract market fund, with price up $1,000 compared to last week, while other coins were weaker.

And looking at the options data, bets on longer-term up… pic.twitter.com/kq9NNuojG5— Greeks.live (@GreeksLive) October 18, 2023

Bitcoin demand in the derivatives segment often aligns with the sentiment in the spot market. Hence, the surge in derivatives demand can be used as a yardstick to assess the current state of the market. So, let’s take a look at how Bitcoin’s derivatives metrics have been fairing.

Bitcoin sees some recovery

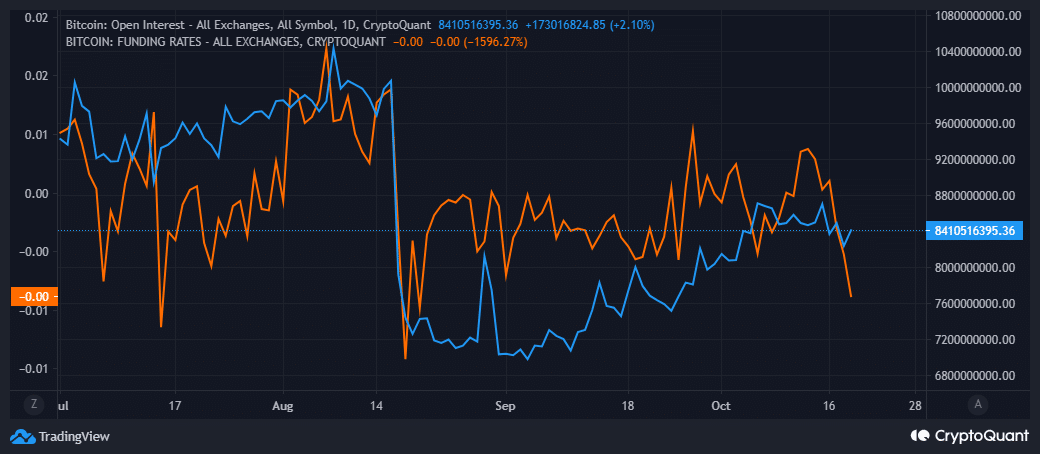

BTC’s open interest in the derivatives market dipped considerably in August. However, it has since recovered by a considerable margin. However, it did witness a slowdown since mid-October, and this could be due to a drop in the initial demand observed in the days prior.

Funding rates also recovered from August lows. However, the last three weeks saw a drop in BTC funding rates. This may not necessarily reflect the expectations of a long-term shift. However, there might be a good explanation for this.

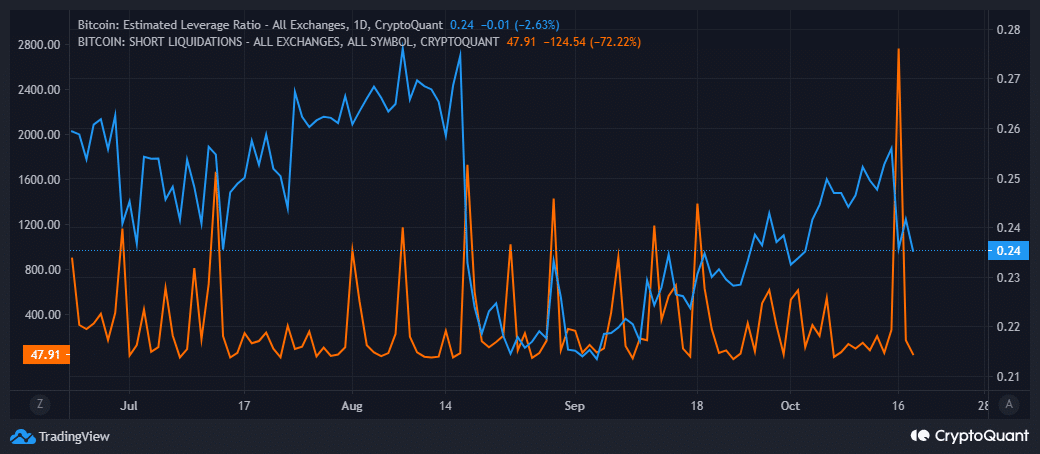

It turns out that Bitcoin’s latest price spike brought with it a dip in the estimated leverage ratio. This suggested that many traders had bearish expectations and thus, funding rates may have favored short positions prior to mid-October.

The sudden price shift in favor of the bulls may have thus led to investors pulling their funds from short positions. This is what triggered a spike in short liquidations which soared to a four-month high. This could have supported higher BTC prices.

Read Bitcoin’s [BTC] price prediction 2023-24

There are a few key observations that traders should note based on the above data. Open interest recovered slightly in line with the bullish sentiment. At the same time, Bitcoin also showed resilience above the $28,000 price level in the last four days despite evidence of some short-term profit-taking.

These findings confirmed that Bitcoin traders have been more willing to HODL perhaps in anticipation of recovery above the $30,000 range. The dip in the appetite for leverage suggests that BTC might be less sensitive to liquidations that may suppress its rally for now.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)