Bitcoin: Are market bulls back after latest price crash?

- Buying sentiment was dominant in the market for Bitcoin.

- BTC was up by 3% last week, and a few indicators were bullish.

After a price correction on the 3rd of January 2024, Bitcoin [BTC] was quick to recover as its weekly chart turned green. While that happened, the king of cryptos witnessed a massive surge in a key metric, reflecting investors’ interest in trading the token.

Does this mean another bull rally is in the works?

Bitcoin transitions are skyrocketing

The year 2024 began on a good note, but just after a few days, BTC witnessed a price correction, pushing its price down to $42,200.

However, the coin was quick enough to make a rebound. As per CoinMarketCap, BTC was up by more than 3% in the last seven days.

When BTC was recovering, it witnessed its largest spike in transactions. Ali, a popular crypto analyst, recently posted a tweet highlighting this incident.

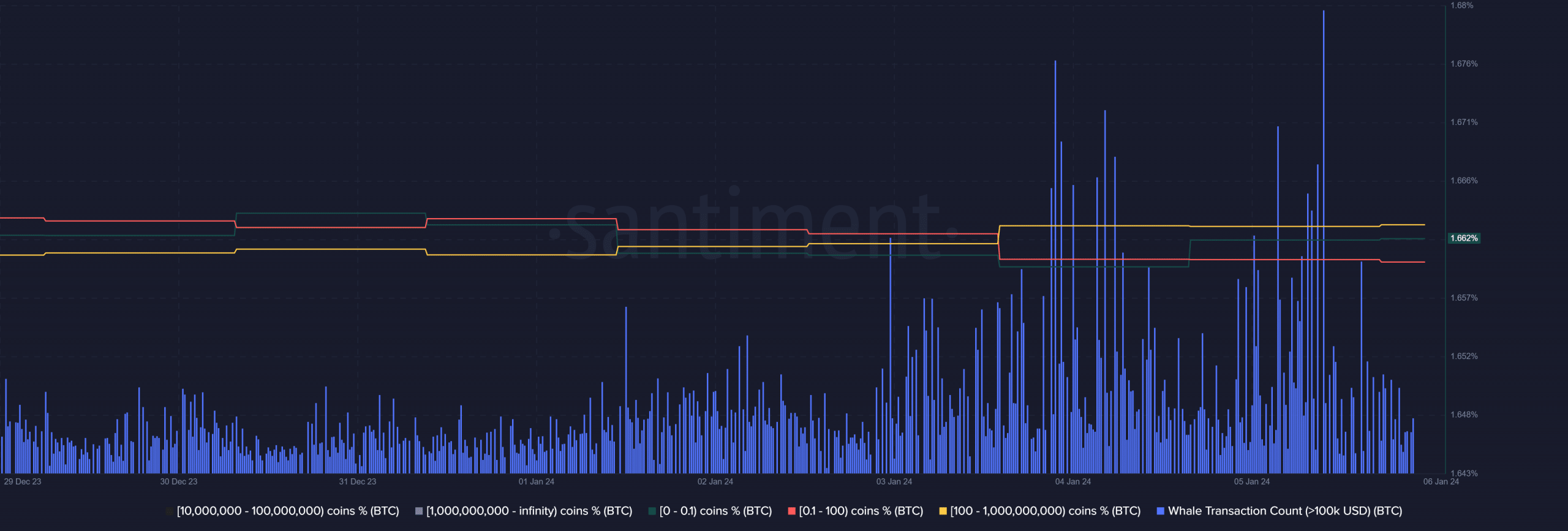

He mentioned that BTC experienced its largest spike in transactions over $100,000 in nearly two years.

In the past 24 hours, #Bitcoin experienced its largest spike in transactions over $100,000 in nearly two years.

The 16,900 large transactions serve as a proxy for $BTC whale activity, offering insights into how these major players might be positioned in the #crypto market. pic.twitter.com/CCnaoBOK0F

— Ali (@ali_charts) January 5, 2024

He mentioned,

“The 16,900 large transactions serve as a proxy for BTC whale activity, offering insights into how these major players might be positioned in the crypto market.”

To check how whales were reacting to this, AMBCrypto took a look at Bitcoin’s metrics. We found that whale activity around the coin actually increased in the last few days.

Additionally, a look at BTC’s supply distribution revealed that whales were buying BTC, as evident from the slight rise in the number of addresses holding more than 100 BTC (yellow line).

Is a fresh bull rally around the corner?

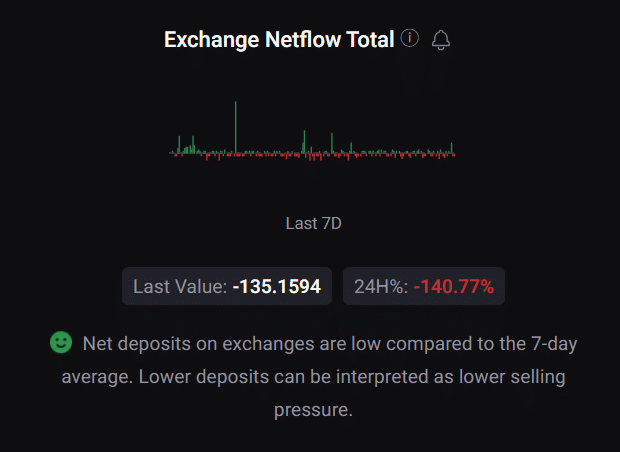

While the whales seemed to have accumulated BTC, AMBCrypto checked otter metrics to find out how retail investors were doing. As per our analysis of CryptoQuant’s data, BTC’s net deposit on exchanges was low compared to the last seven-day average.

This meant that the buying pressure on the coin was high. Moreover, its coinbase premium remained green, meaning that buying sentiment was dominant among US investors.

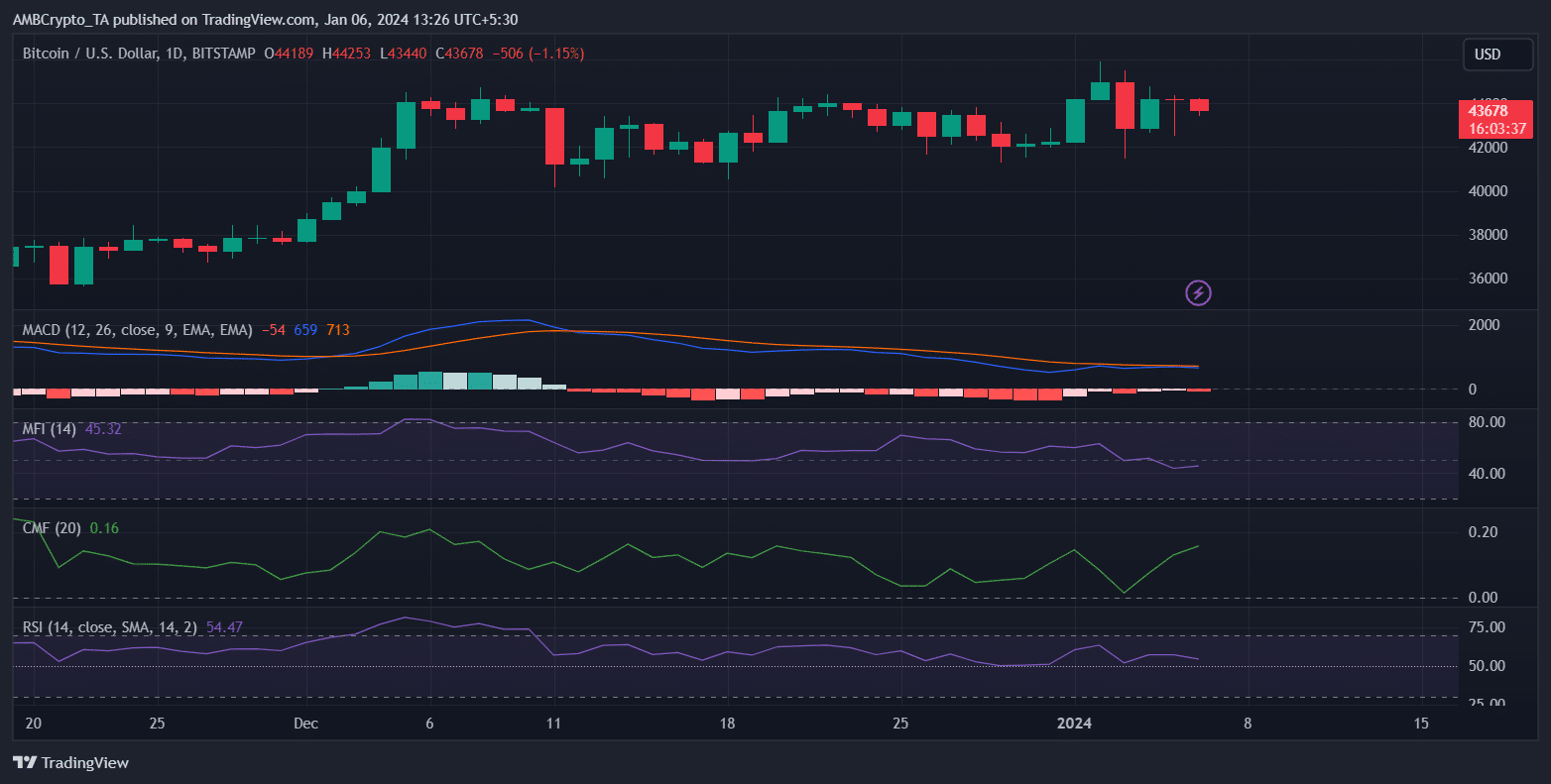

Since buying pressure was high, AMBCrypto took a look at BTC’s daily chart to better understand where a bull rally was around the corner. Our analysis of BTC’s MACD revealed that the bulls and the bears were in a battle to flip each other.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Interestingly, Bitcoin’s Chaikin Money Flow (CMF) registered a sharp uptick, which was indeed a bullish signal.

However, nothing can be said with certainty as both BTC’s Relative Strength Index (RSI) and Money Flow Index (MFI) were resting around the neutral mark, which spells trouble. At press time, BTC was trading at $43,601.01 with a market cap of over $854 billion.