Can Bitcoin’s Q4 performance set it up for a favorable 2024

- Bitcoin showed a robust 57% QoQ gain in Q4, indicating resilience amid short-term corrections.

- Growth in inscriptions, Bitcoin’s NFT dominance, and Layer 2 solutions contributed to a positive market outlook.

Bitcoin [BTC] was navigating a period of correction few days into the new year, prompting reflections on its future trajectory.

Despite this short-term dip, the broader picture of BTC’s performance looks quite optimistic. For instance, according to Messari’s data, Q4 2023 showed promise with a robust 57% quarter-over-quarter gain.

However, as the deadline for the first spot ETF application approached, the market turned volatile.

https://twitter.com/redvelvetzip/status/1742956350349402383?ref_src=twsrc%5Etfw

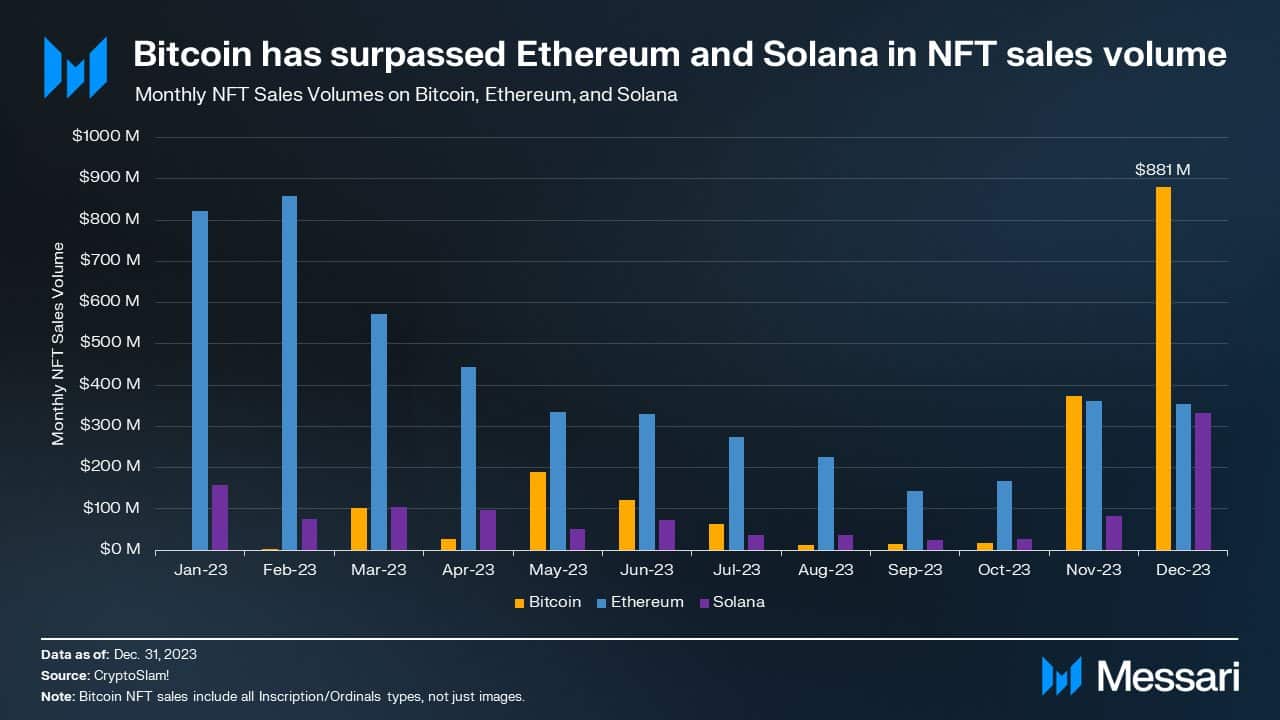

Dominating the NFT space

A major aspect contributing to BTC’s strength was the growth in inscriptions and ordinals. Inscriptions are increasingly constituting a larger share of total fees.

The surge in Inscriptions sales also helped miners see a surge in revenue. The rising revenue helped increase the profitability of miners.

Hence, they don’t have to sell their holdings to bear energy and equipment costs. These factors can help BTC’s rally sustain its momentum going forward.

In the realm of NFTs, Bitcoin outshone Ethereum, particularly in the BRC20 category. If we compare this sales volume to DEX volumes, Bitcoin’s Inscription and NFT sales rank 10th among all chains, underscoring its impact on the market dynamics.

More layers

The emergence of Bitcoin Layer 2 solutions is another positive trend. Currently, Stacks leads the Layer 2 landscape, with more BitcoinRollups in development.

These solutions are instrumental in enhancing scalability and reducing transaction costs, contributing significantly to the overall growth of the Bitcoin network.

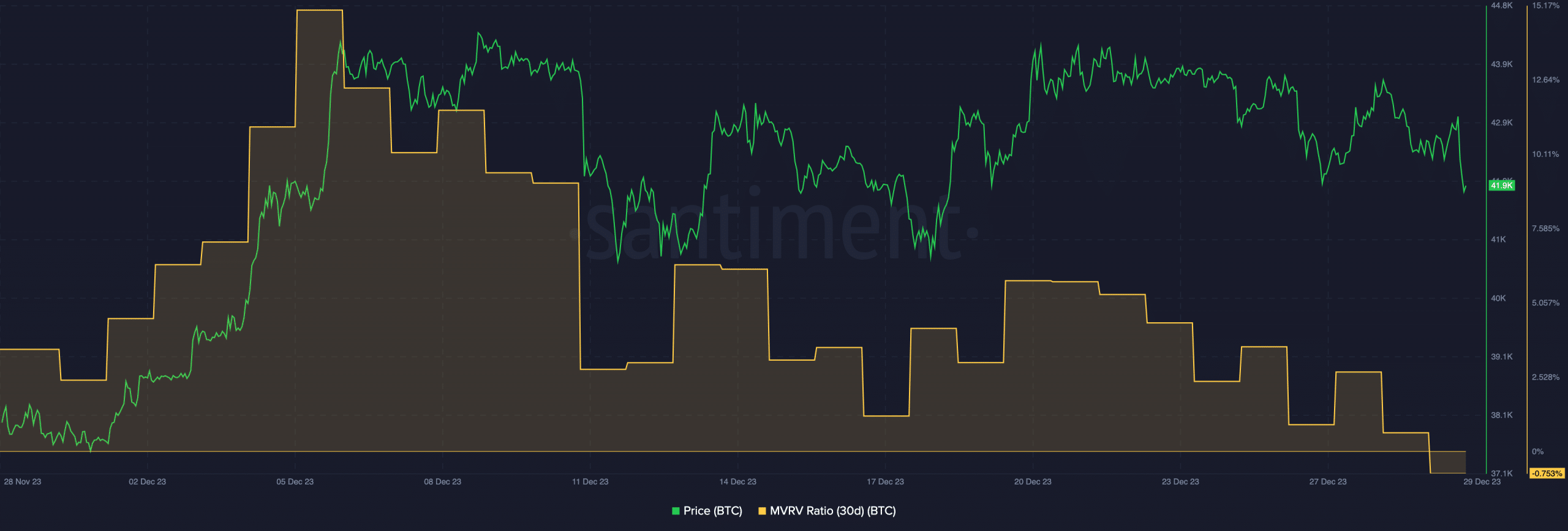

At the time of writing, BTC is trading at $42,544.09, reflecting a 1.13% decline in the last 24 hours. The recent correction has influenced the MVRV ratio to fall indicating that there were more addresses in loss than in profit.

The addresses that have lost money will not be incentivized to sell their holdings at press time. Due to this, the selling pressure on Bitcoin will be reduced.

Is your portfolio green? Check out the BTC Profit Calculator

These addresses in loss, however, may be waiting for the ETF approval announcement.

If prices end up surging after the event, these addresses will likely sell their holdings and grab their share of profits causing a price correction in the future.