Bitcoin: Assessing if BTC is in last phase of the bear market

Bitcoin [BTC] long-term holders may have started to lose their conviction for the cryptocurrency owing to the constant price decline. Additionally, these holders may have taken to selling BTC at a loss.

Glassnode, in its latest report, found that the 90-day Coin Days Destroyed (CDD-90) metric was at an all-time low. This meant that older BTC had been dormant as HODLers continued to hold in the face of declining market conditions.

HODL no more

According to CryptoQuant analyst Edris, a look at Exchange Inflow – Spent Output Age Bands metric revealed that coins that were previously held for 6-18 months had been “aggressively” distributed recently.

Most of these coins, according to Edris, were purchased during the 2021 bull market and above the $30,000 price mark. However, with increased uncertainty and doubts surrounding any significant growth in the price of BTC in the short term, some long-term holders have “exited the market at an approximate 50% loss.”

However, there was a silver lining to all of this. Edris believed that these types of sell-offs usually signify that a bear market cycle was nearing its end. According to Edris,

“During the late phases of bear markets, even the more loyal investors tend to capitulate out of fear and sell their coins at huge losses to prevent bigger ones. These types of capitulations tend to occur during the last months of a bear market, pointing to a potential bottom formation in the near future.”

What if…

While Edris opined that the current bear cycle might be nearing its end, BTC’s performance on the chain in the past two quarters revealed stagnancy.

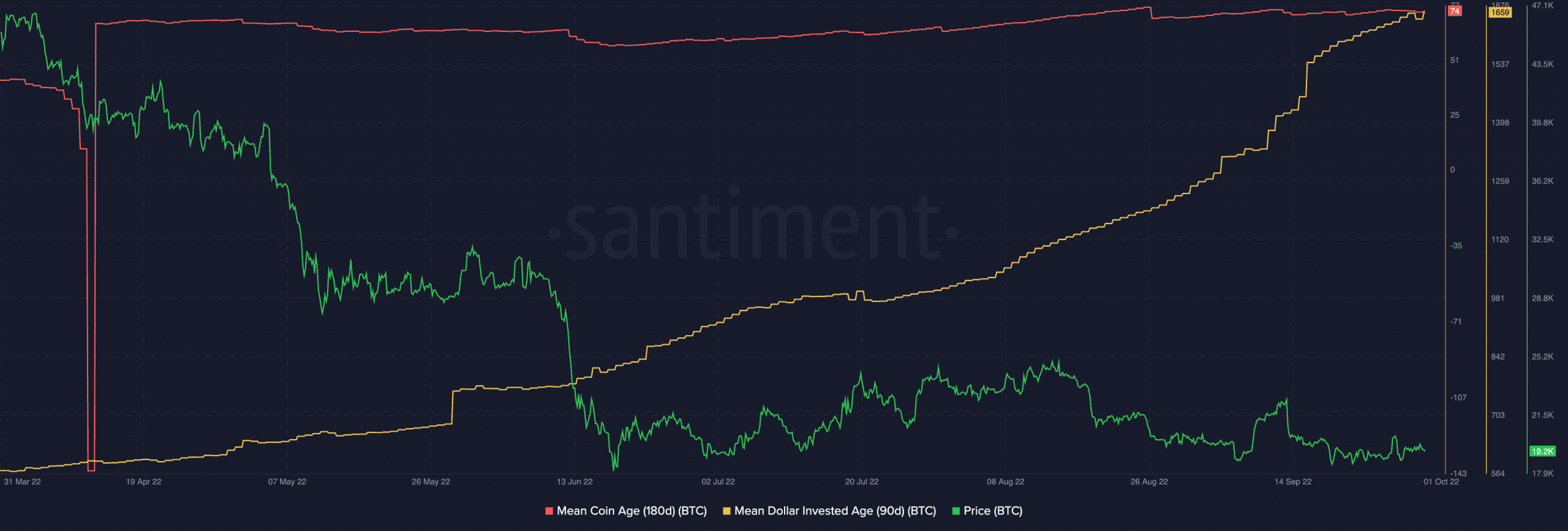

According to data from Santiment, its Mean Dollar Invested Age (MDIA) and Mean Coin Age has been on an uptrend in the last six months.

This meant that several BTC investments have been dormant for a while. Furthermore, such stagnancy on the network typically makes it hard for the price of an asset to rally. Therefore, for any significant price growth to be possible for BTC, these dormant coins have to see some activity.

That being said, at press time, BTC traded below the psychological $20,000 region.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)