Bitcoin: Assessing the CPI impact on BTC in the face of FTX turmoil

Backing the resurgence of Bitcoin [BTC] above $17,000, was the release of the United States Consumer Price Index (CPI) report.

The king coin, which suffered a non-stop fall off the charts as a result of the FTX collapse, suddenly recovered as the Bureau of Labor Statistics released the report.

According to the news release, the CPI rose 0.4% in October. This implied that change in prices of goods and services eased a little. Thereby, leading to a bit of inflation stabilization.

Read AMBCrypto’s Price Prediction for Bitcoin 2023-2024

Lower rates, higher crypto prices

Other parts of the report highlighted that the medical index fell 0.5% from September. It was also a similar case for cars and trucks. Interestingly, this is not the first time that BTC correlated with the CPI inflation trend.

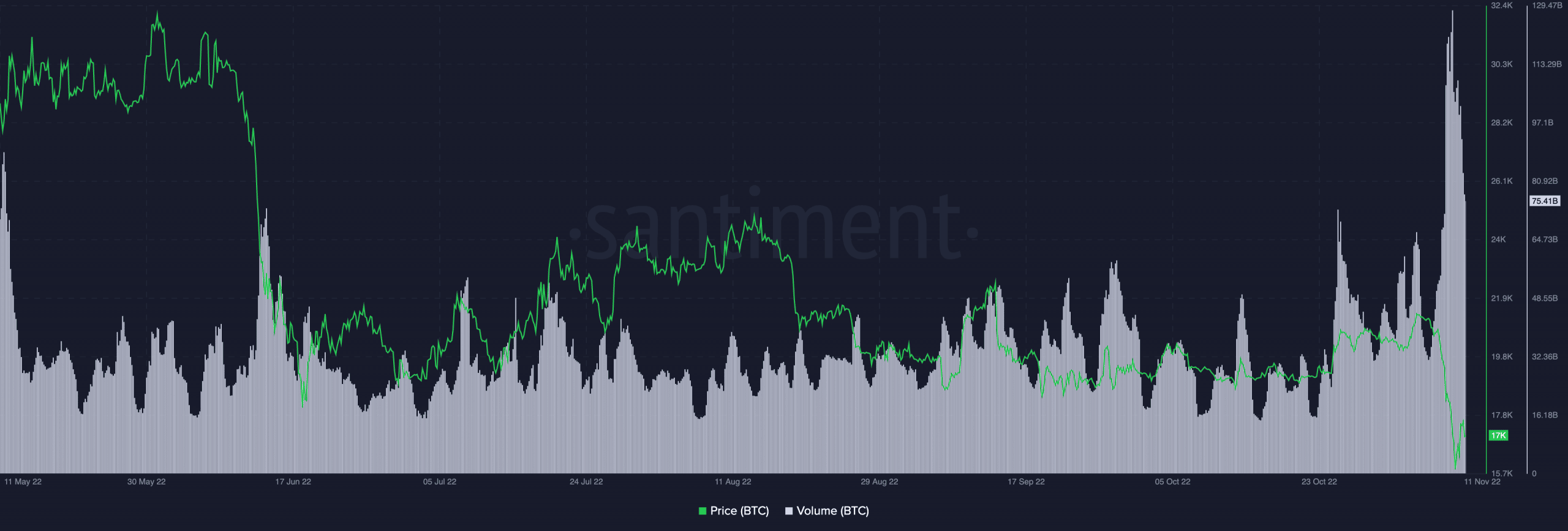

However, in the last 24 hours, Santiment showed that Bitcoin had increased 3.36%. At press time, the cryptocurrency was trading at exactly $17,200.

However, this increase was unable to reflect in its volume which shredded more than 30% to $75.41 billion within the same period. This indicated that the rising price was not an outcome from an increase in BTC transactions.

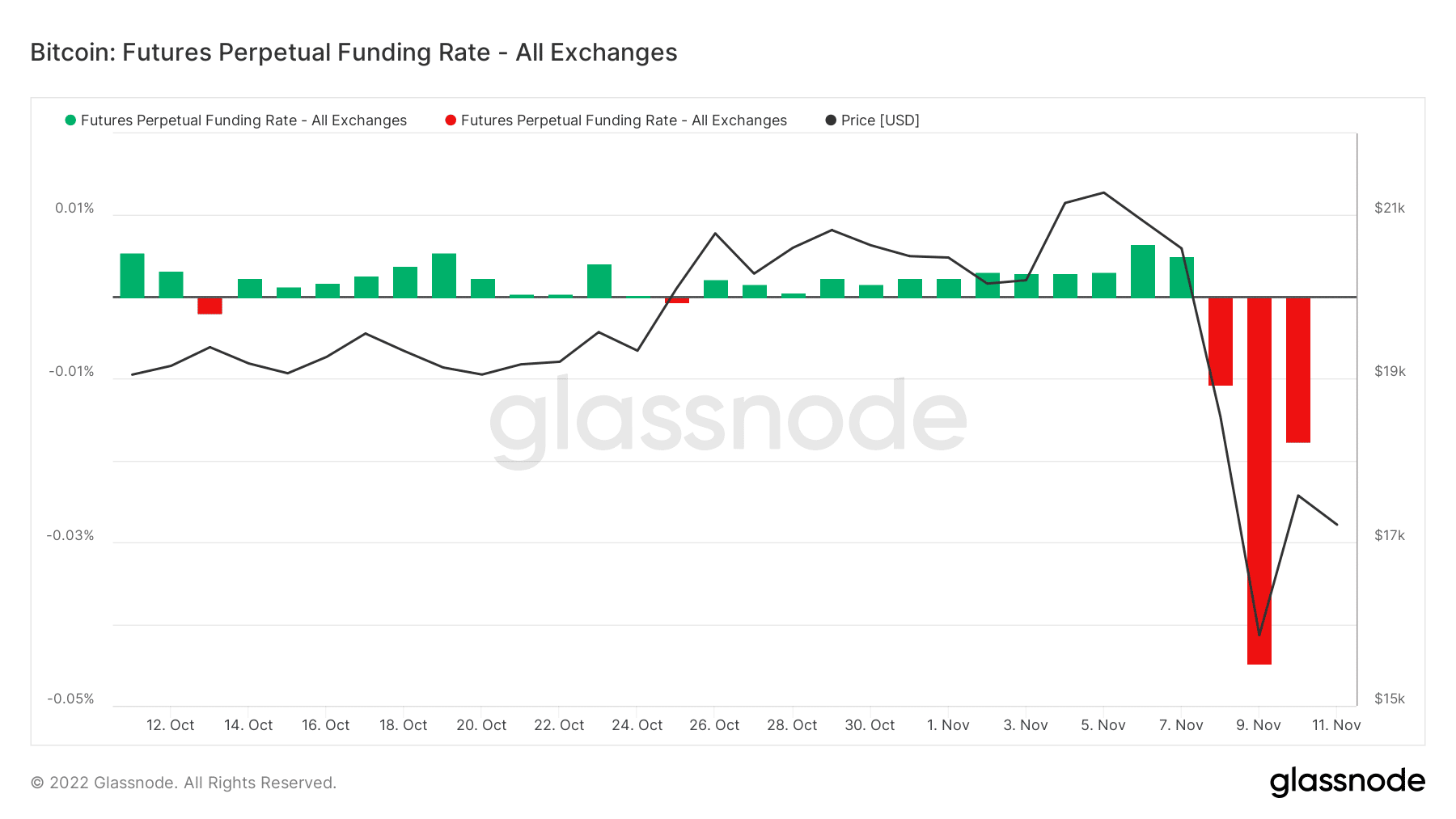

Despite the recovery, traders did not seem to find it enticing enough to jump into the derivatives market. According to Glassnode data, the futures perpetual funding rate was still in the negative. However, the rate had improved from the massive exit on 9 November.

At the time of writing, the BTC perpetual funding rate was 0.018%. With this percentage, it was obvious that the crypto community at large, was being careful of potential unbalance in volatility.

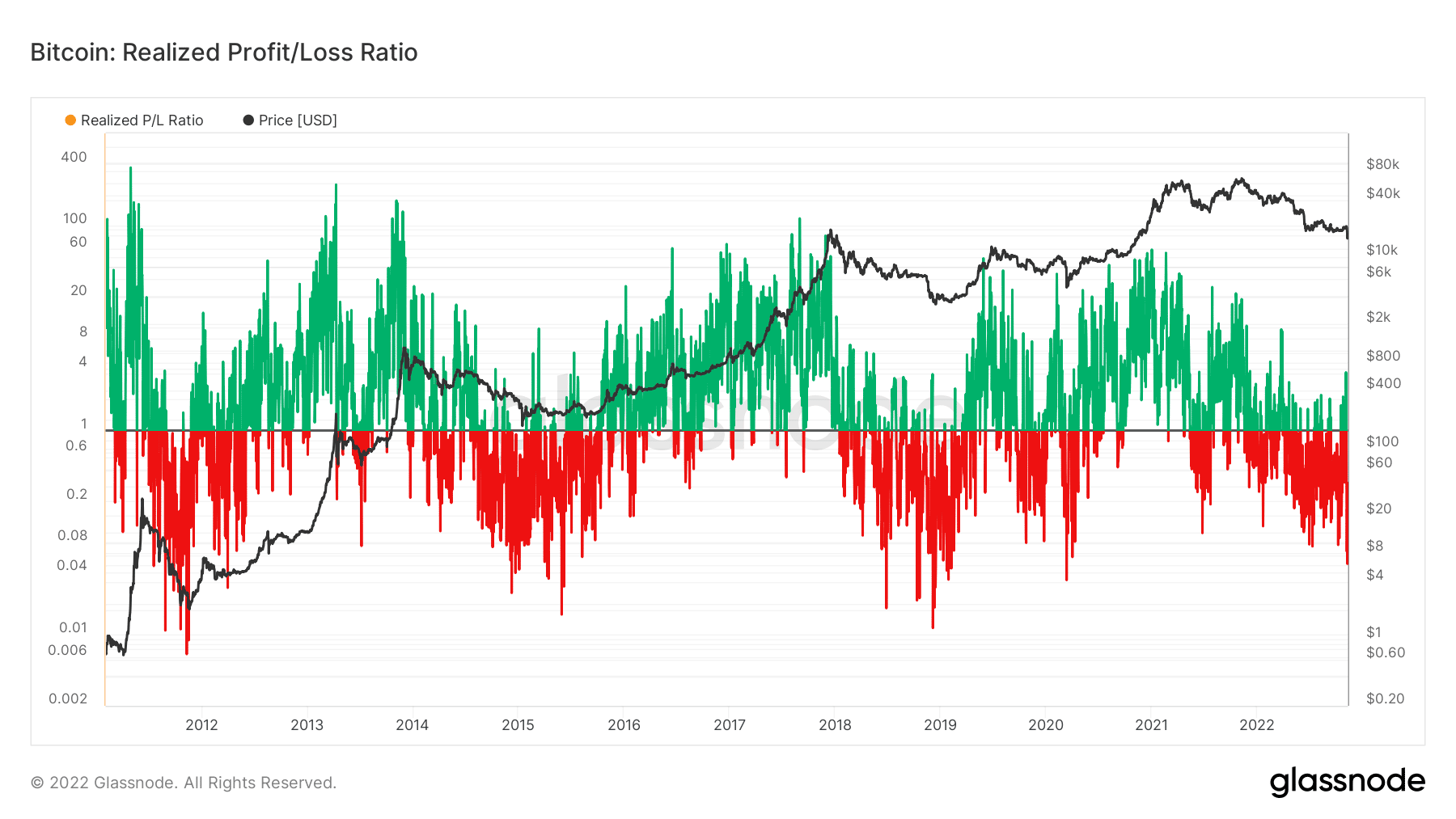

For the realized profit and loss ratio, Glassnode revealed that there hasn’t been extreme profits. However, losses incurred by investors lately have been somewhat on the high side.

This might come as less of a surprise due to the recent capitulation. However, the realized loss hitting local lows indicated that there could be some respite.

Of course, the recent BTC revival agreed with the sentiment. Still, there was no certainty that reversal would mark the end of a correction or be constant for the long term.

Bull or bear, which way fits?

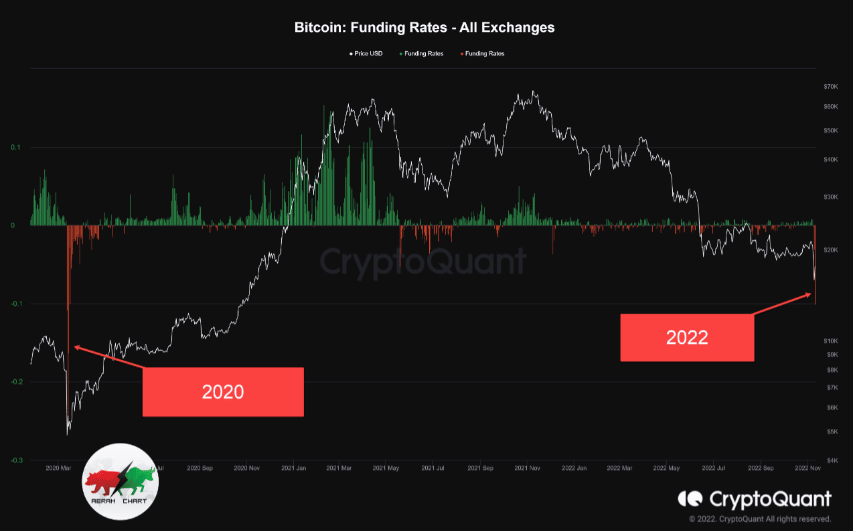

On other ends, there seemed to be some contradictory projections. This was because the funding rates were in between moving to the bull side and switching bearish.

According to Woominkyu, a CryptoQuant analyst, recent sentiments showed highly negative funding rates. With the rate reaching the lowest since March 2020, it was possible that a bullish reversal was close.

In contrast, another analyst on the platform, Abramchart, noted that the lows signaled a further bearish momentum. However, he agreed that BTC was within reach of hitting the bottom.

Nevertheless, there was still much uncertainty in the market. For both long and short term investors, the decision that might seem profitable could be to remain an onlooker. Notwithstanding, there was no denying that the market could also offer opportunities to gain.