Bitcoin: Assessing what’s in store for BTC short-term holders

- Bitcoin’s social activity continues to climb.

- However, this should not be taken as a bullish sign as the outlook remains predominantly bearish

Data from the cryptocurrency social analytics platform LunarCrush revealed a surge in Bitcoin’s [BTC] social activity following the collapse of cryptocurrency exchange FTX.

We are noticing increased #Bitcoin social activity following the collapse of FTX.

And unlike some #altcoins (i.e. $FTT & $SOL) the activity is rather positive.

? Insights: https://t.co/es2fM7SmAD pic.twitter.com/0oaHhH1yt4

— LunarCrush (@LunarCrush) November 16, 2022

According to LunarCrush, as of 16 November, the index for BTC’s average social dominance stood at 15.11%. While a spike in an asset’s social activity is usually a precursor to an imminent price rally, macro factors and general market conditions revealed that the king coin might not be well primed for the same just yet.

Read Bitcoin’s [BTC] price prediction 2022-2023

At the time of writing, BTC exchanged hands at $16,558.24, data from CoinMarketCap revealed.

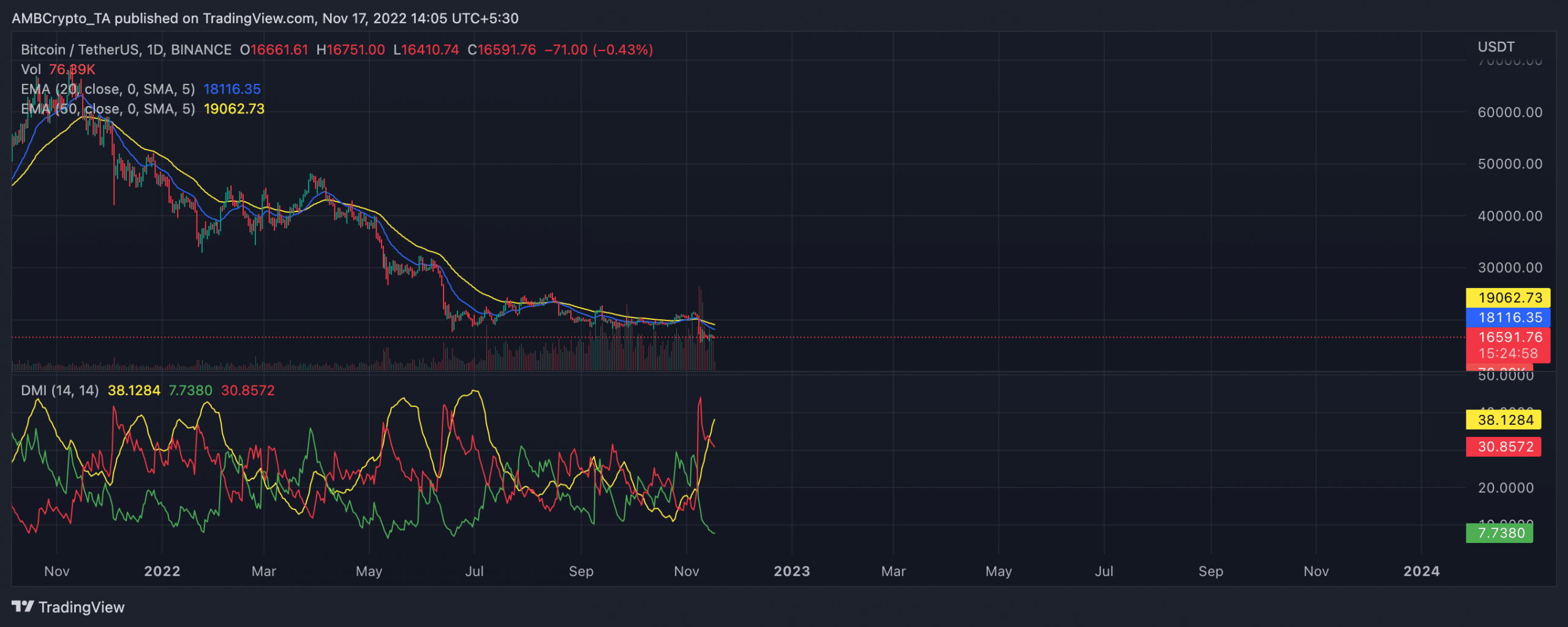

Trading at its October 2020 level, BTC sellers continued to overpower buyers on the daily chart. This was made clear by BTC’s Directional Movement Index (DMI) position.

At the time of writing, BTC sellers’ strength (red) at 30.85 rested above the buyers’ (green) at 7.73.

Additionally, the Average Directional Index (ADX) showed that buyers might need more help to revoke the sellers’ strength in the short term.

Also, with the 20 Exponential Moving Average (EMA) positioned below the 50 EMA (yellow) line at press time, the severity of ongoing bear action in the BTC market is better appreciated.

More Ls to come

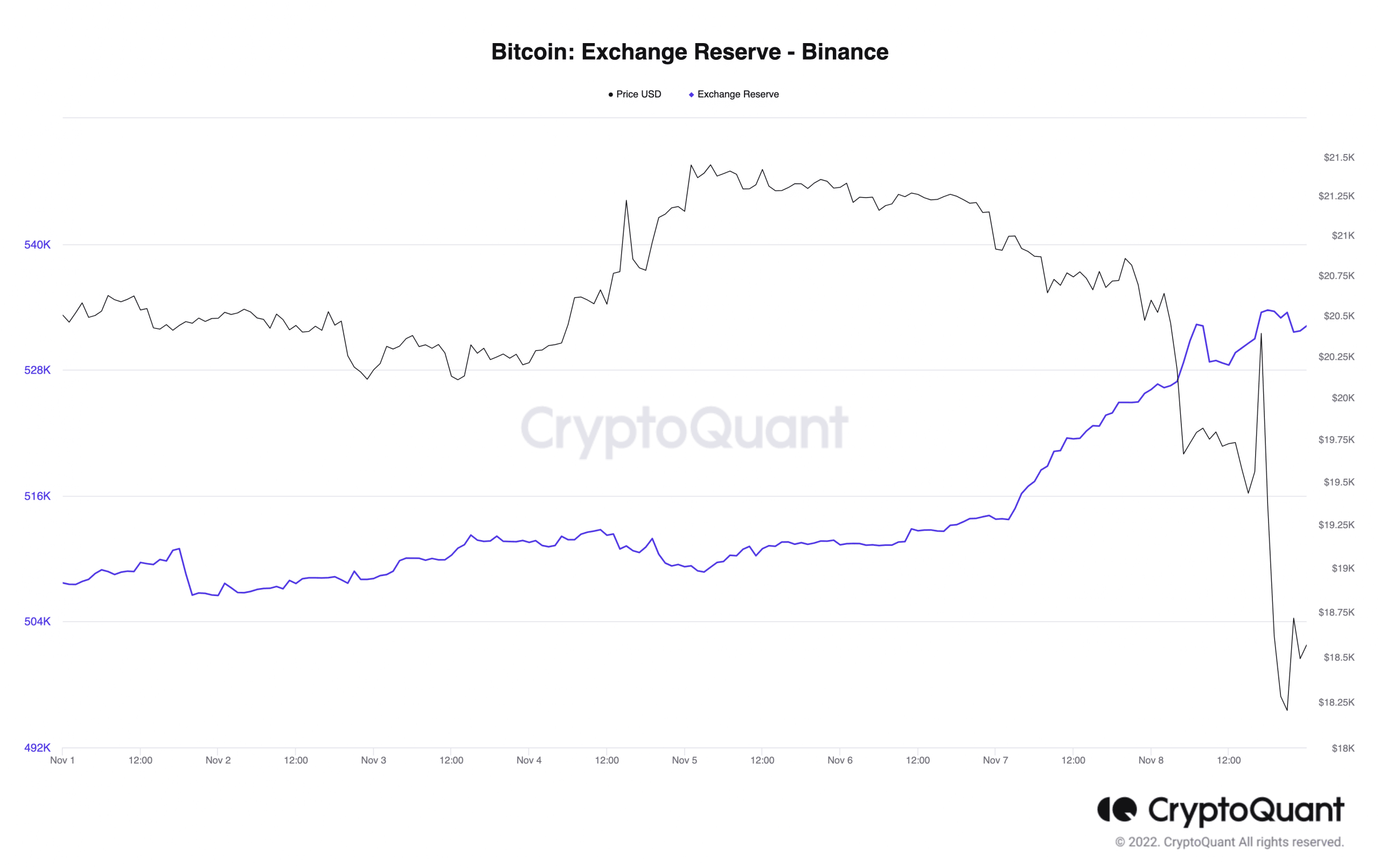

According to data from the on-chain analytics platform CryptoQuant, the BTC exchange reserve on Binance had rallied in the past few days. This showed that investors took to depositing a net amount of their BTC holdings to Binance for the purposes of withdrawal since FTX collapsed.

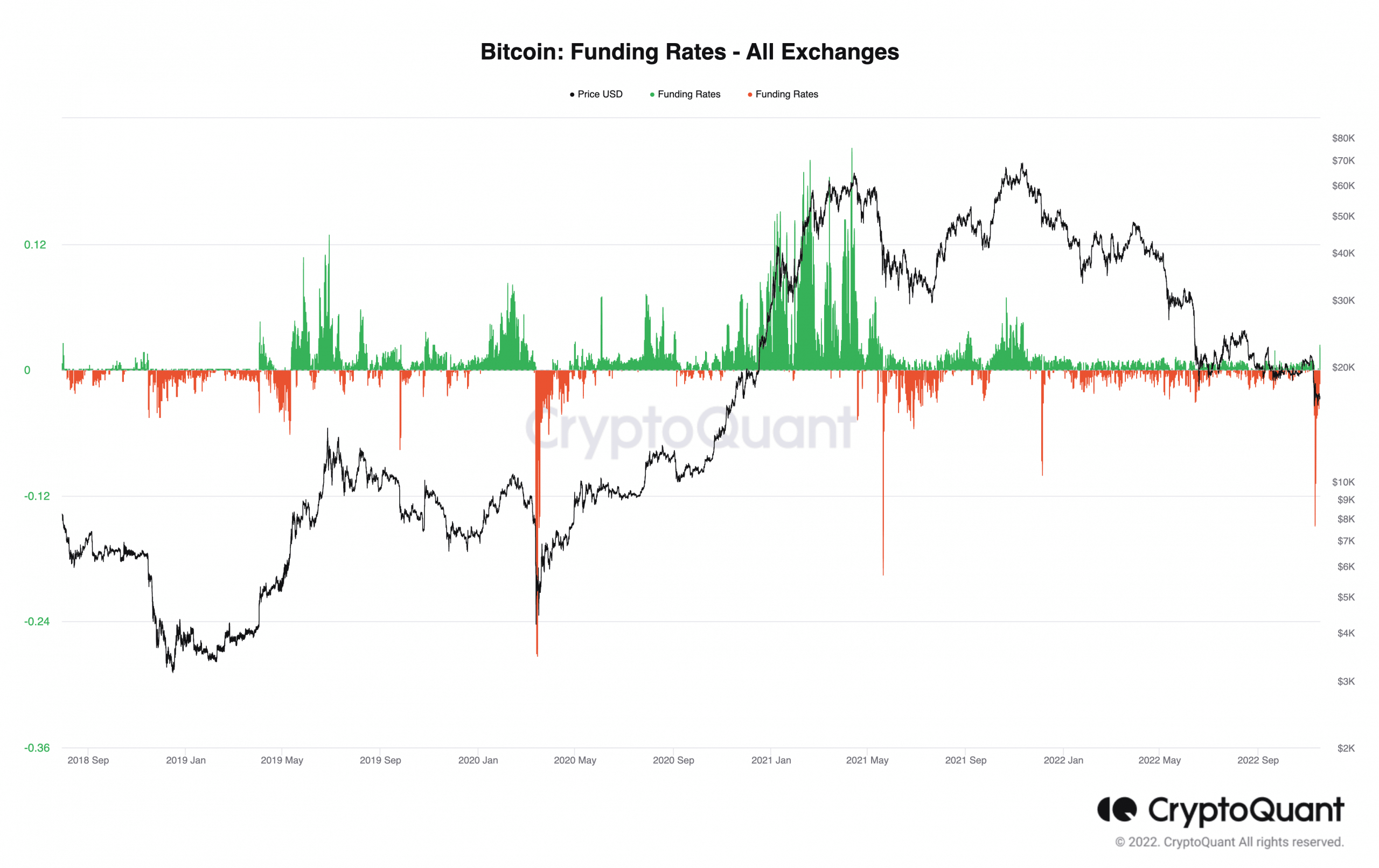

In addition, BTC’s funding rates remained extremely negative as of this writing, per CryptoQuant. This revealed that negative bias continued to trail the leading coin as more holders bet on a further price decline.

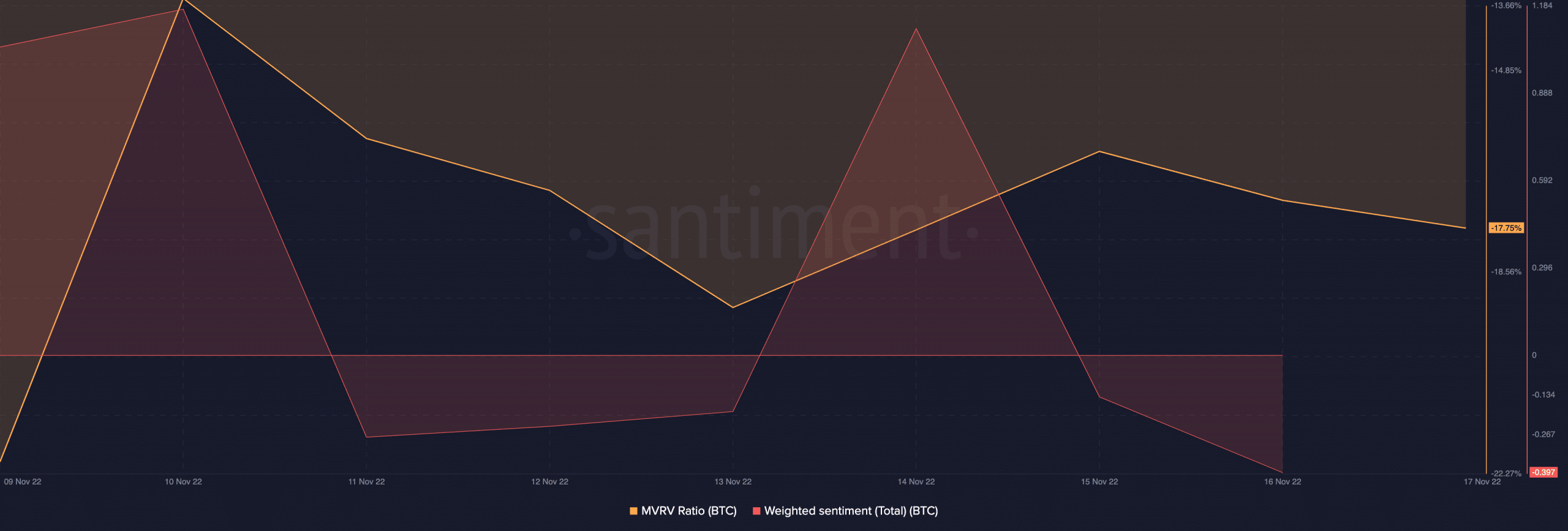

In the past two days, investors’ sentiment about BTC remained negative as the king coin traded in the $16,000 and $16,500 price range. Data from Santiment showed that the asset’s weighted sentiment posted a negative -0.397, at press time.

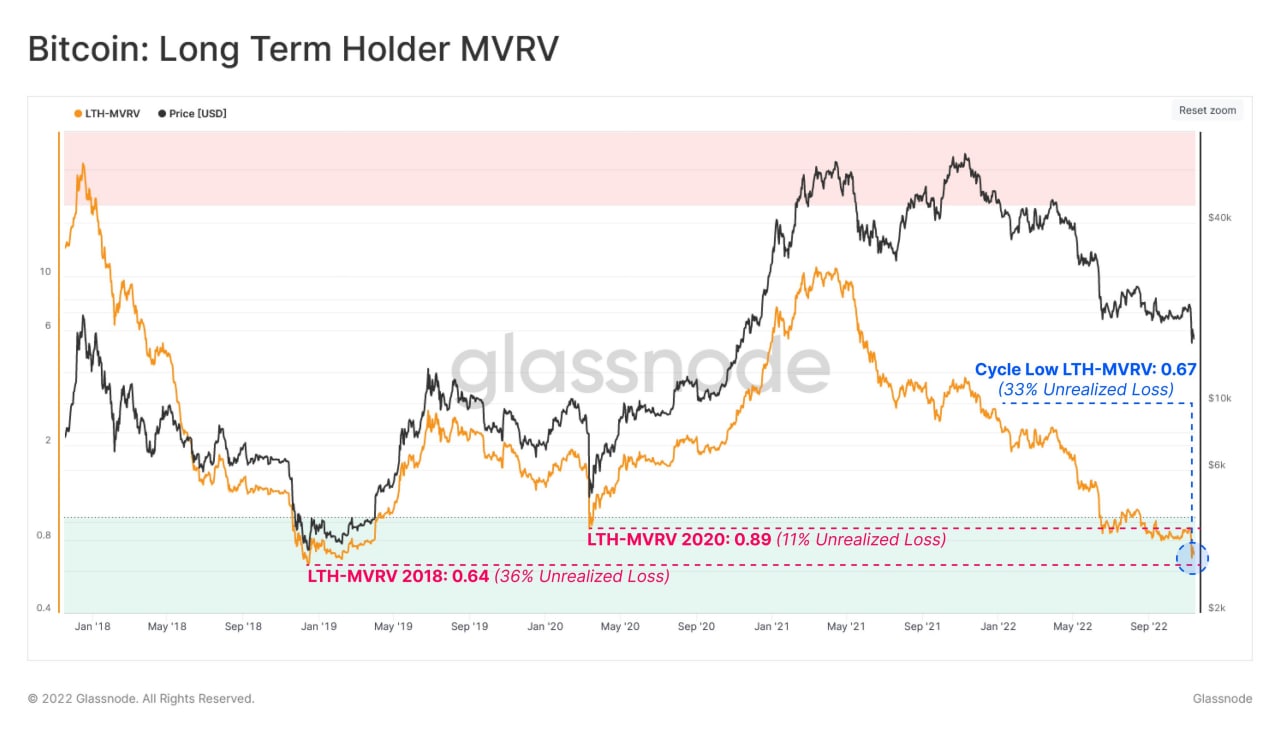

As regards profitability, BTC’s MVRV ratio has remained negative since the collapse of FTX. This showed that holders saw losses on their investments, and any attempts to sell at the current price would be met with no gains on investments.

Much to the surprise, even BTC long-term holders were not spared, as data from Glassnode showed that this cohort of investors experienced acute financial stress, holding an average of -33% in unrealized losses.