Bitcoin: Assessing whether or not a local bottom has been reached

- CryptoQuant analyst Wedson has opined that a local top has been reached.

- On-chain metrics, however, paint a different picture.

CryptoQuant analyst Joao Wedson has suggested that Bitcoin’s [BTC] price, which saw a 6% decline in the last week, may have hit a local bottom at the $24,000 price mark.

Wedson concluded after assessing the 350-day moving average and the 100-day exponential moving average that makes up BTC’s Taker Buy Sell Ratio indicator.

According to Wedson, with the Taker Buy Sell Ratio indicator, analysts have found that the 350-day MA and 100-day EMA can identify BTC’s price trend changes.

Is your portfolio green? Check out the Bitcoin Profit Calculator

He noted further that the 100-day EMA crossing a value line of one could also signal local tops and bottoms, presenting buying or selling opportunities.

In the current BTC cycle, the rally in BTC’s price since the year began pushed the 100-day EMA above one.

This, according to Wedson, might have ushered in a bear cycle that might result in a downward trend in BTC’s price.

On-chain price bottom markers say otherwise

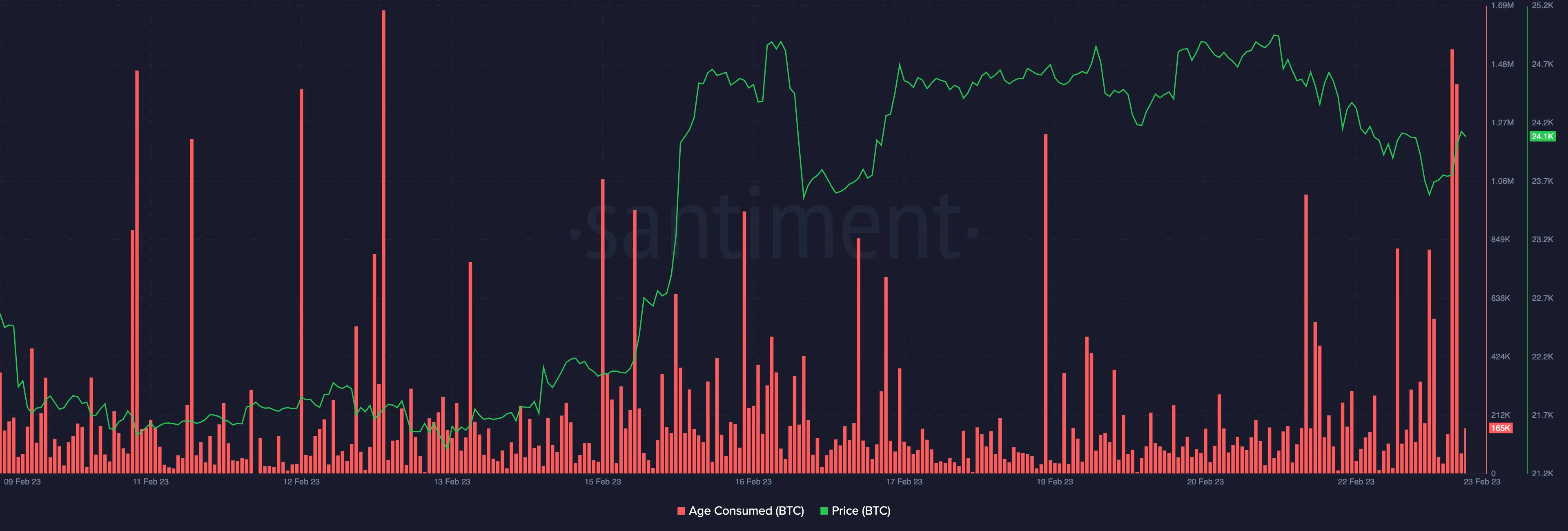

In terms of identifying local price bottoms for cryptocurrency assets, some on-chain metrics have been effective in that regard. One of the most effective indicators is Age Consumed, which monitors the behavior of previously inactive coins on the blockchain.

A surge in Age Consumed indicates a significant number of inactive tokens have been transferred to new addresses, indicating a sudden and pronounced change in the behavior of long-term holders.

Since long-term holders and experienced traders seldom make impulsive decisions, a renewed activity of dormant coins often corresponds with significant changes in market conditions.

Read Bitcoin’s [BTC] Price Prediction 2023-24

A look at BTC’s age consumed revealed a spike in its Age Consumed metric on 22 February, when the king coin traded at $23,700. BTC’s price spent the next three days rallying to trade at $24,100, at press time.

The growth in BTC’s price, which followed the surge in Age Consumed, could be taken to mean that the leading coin bottomed at the $23,700 price point, and further rallies should be anticipated.

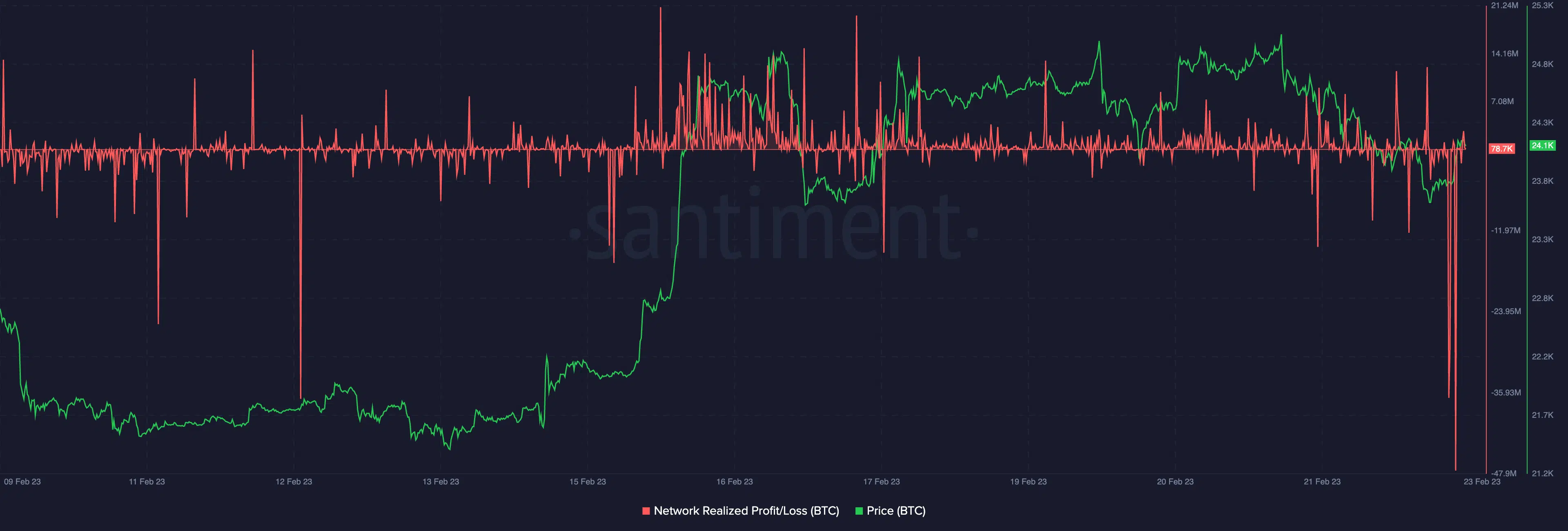

Another indicator that might be useful in this regard is BTC’s Network Profit/Loss ratio (NPL). This metric calculates the mean profit or loss of all coins that are transferred to new addresses on a daily basis.

This approach is used to identify instances of profit-taking or holder capitulation on the blockchain.

Dips in the NPL metric frequently indicate brief periods of capitulation by “weak hands” and the return of “smart money” to the market. This is why these dips often occur concurrently with local rebounds and phases of price recovery.

This has been the case with BTC in the past few days. Data from Santiment revealed a significant dip in the king coin’s NPL on 22 February, which has since been followed by a surge in its price.