Bitcoin at $81K: Is extreme ‘crypto greed’ a warning for BTC traders?

- With the crypto greed index at elevated levels, asset prices could become inflated, and market volatility may increase.

- However, current key metrics signal a potential BTC short-squeeze to $85K.

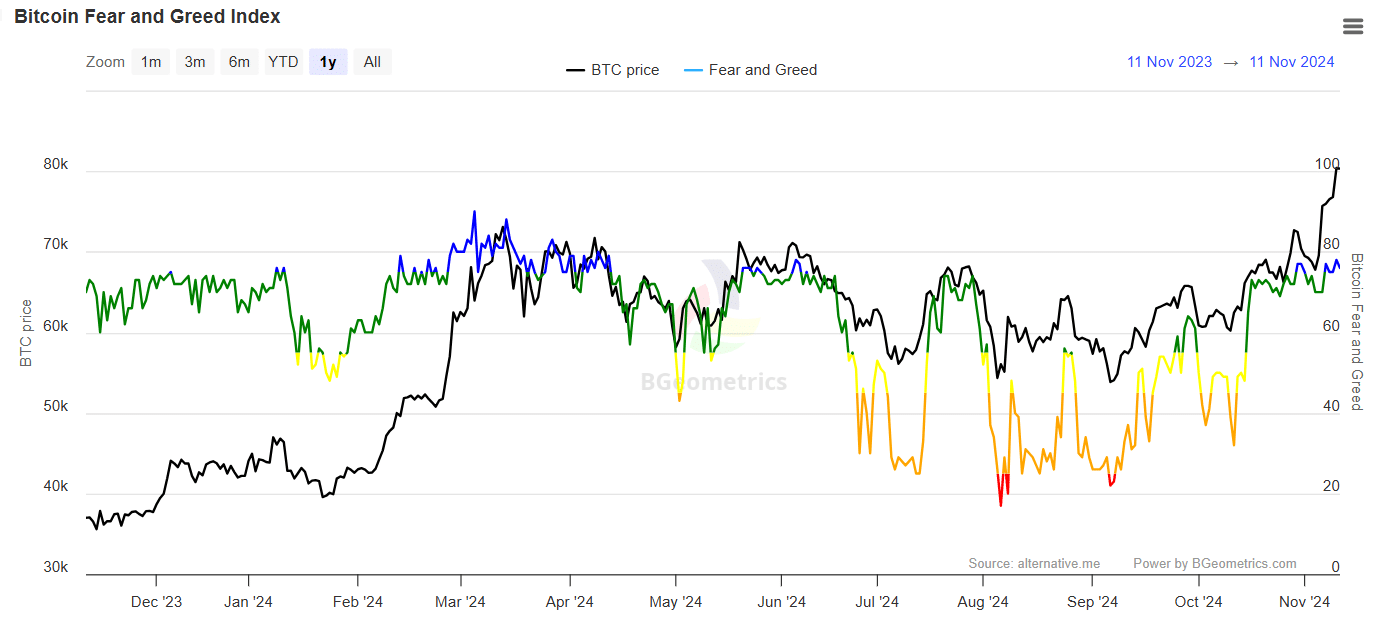

With nearly all Bitcoin [BTC] holders in profit, market sentiment teeters between greed and fear. As BTC breaks records with a new ATH of $81K, the crypto greed index has reached a 7-month high.

This situation is fragile, as heightened greed could push prices higher, but a sudden shift in sentiment might trigger a swift sell-off.

Crypto greed index shows signs of overvaluation

For context, the crypto greed index helps investors gauge market emotions, which can heavily influence buying and selling decisions. Data from CoinMarketCap shows the market gradually edging toward extreme greed.

Before Bitcoin hit $80K, the market was in a greed position. While high greed suggests investors are still aiming for more upside, extreme greed could signal overconfidence, increasing the risk of a market correction, as seen during the March rally.

In March, as BTC reached the $73K benchmark, the crypto greed index peaked at 90. As the index signaled extreme greed, many investors decided to exit the market after securing massive gains from the rally. Subsequently, the price retraced back to $67K in less than a week.

Now, with the crypto greed index reaching a 7-month high and reflecting a similar market sentiment, the question arises : Does this signal that BTC is due for a correction, especially with 100% of holders currently in profit?

Bulls are betting on further upside

With BTC jumping over 2% from the previous day’s close, despite entering a high-risk phase, it’s clear that investors are optimistic about Bitcoin’s long-term potential.

This optimism is reflected in the high crypto greed index, which currently indicates a stronger-than-usual risk-taking behavior in the market.

Put simply, investors may be overlooking potential risks to chase outsized returns, suggesting a willingness to stay invested despite signs of overvaluation.

This confidence, however, needs to hold steady in the coming days to prevent BTC from slipping below the crucial $80K level.

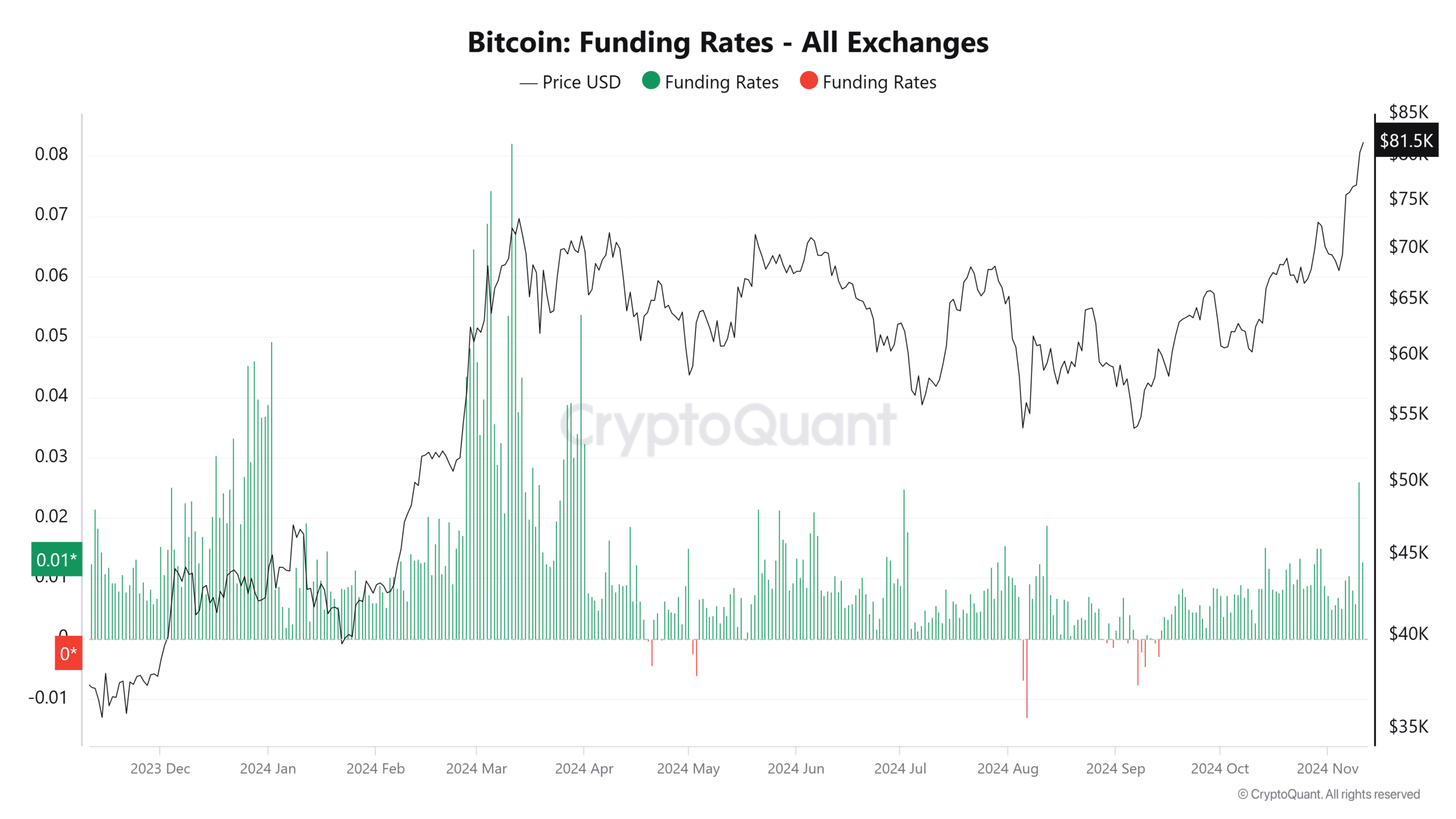

In the derivatives market, bulls are currently dominating short-sellers, reinforcing the crypto greed index. While bullish activity remains strong, it still falls short of the intensity seen during the rally in March.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, the combination of robust whale accumulation, new bulls entering the market, a derivatives landscape dominated by longs, and a high greed index suggests that a top may still be distant.

This creates a favorable setup for a potential short squeeze, where BTC could surge to $85K before month’s end as investor optimism and risk-taking behavior reach unusually high levels.