Bitcoin bear running sprint or marathon? Answer might make you portfolio-sick

With the king coin testing new support levels every single day, it can be said that the bear has outright refused to come out of its ongoing slumber and wishes to stay in hibernation.

The last month has been extremely draining for Bitcoin (BTC) as the token fell from $46,598 on 4 April to $36,432 at press time. Furthermore, the Awesome Oscillator (AO) substantiates the bear run since the beginning of April.

Red is the color of April

On 5 May, BTC witnessed a steep fall of approximately -7.90%. The token opened at $39,669, went to a low of $36,129, and eventually closed off at $36,441 for the day. As per a tweet by Wu Blockchain, BTC witnessed liquidity of approximately $120 million within an hour of the price drop.

Furthermore, according to the data on Santiment, the number of active addresses spiked from 868K on 4 May to an approximate number of 1.17 million on 5 May.

The exchange netflow volume further went on to increase from -2,350 on 4 May to 1,492 on 5 May indicating that BTC owners may be on the lookout to cut short their losses in case the price of the coin steeps down to test new support levels. The Bitcoin Fear & Greed Index too depicted the sentiment of ‘Extreme fear’ standing at a score of 22 at press time.

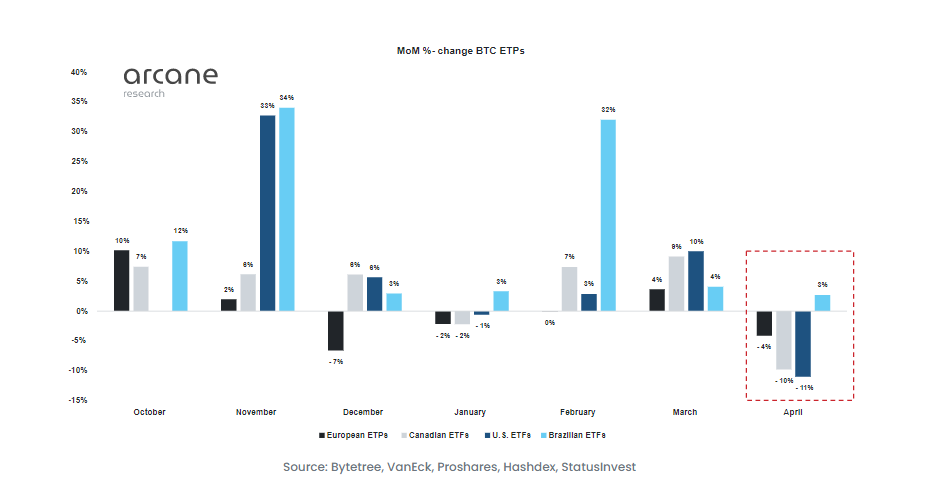

The bear run of the BTC token further affected the Outflow of BTC Exchange Traded Products (ETPs). As per the latest statistics published by Arcane Research, a total of 14,327 BTC outflow took place in the month of April, which can be considered the largest monthly outflow in the history of BTC ETPs.

Canada and the U.S. witnessed net outflows of approximately 7,100 BTC and 3,312 BTC respectively. On the other hand, Europe witnessed 3,974 BTC outflows as of April 2022.

Despite the ongoing bear run in place, BTC HODLers and investors still seemed to have a positive outlook with regard to the price movement. Lark Davis, a crypto analyst, put out a series of tweets indicating that he still feels bullish about the token. Furthermore, another analyst, Willy Woo, took to Twitter to defend the king coin stating that BTC has always outperformed every other token. The Microstrategy exec, Micheal Saylor, too stuck to his bullish stance on BTC.

Is the BTC bear running a marathon?

It can be stated that the bear is extremely comfortable staying below the $40,000 mark, especially given its price movements in the last couple of weeks. With the token in the red zone at press time, looks like the bear mistook a sprint for a marathon and doesn’t intend to stop running anytime soon.

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)