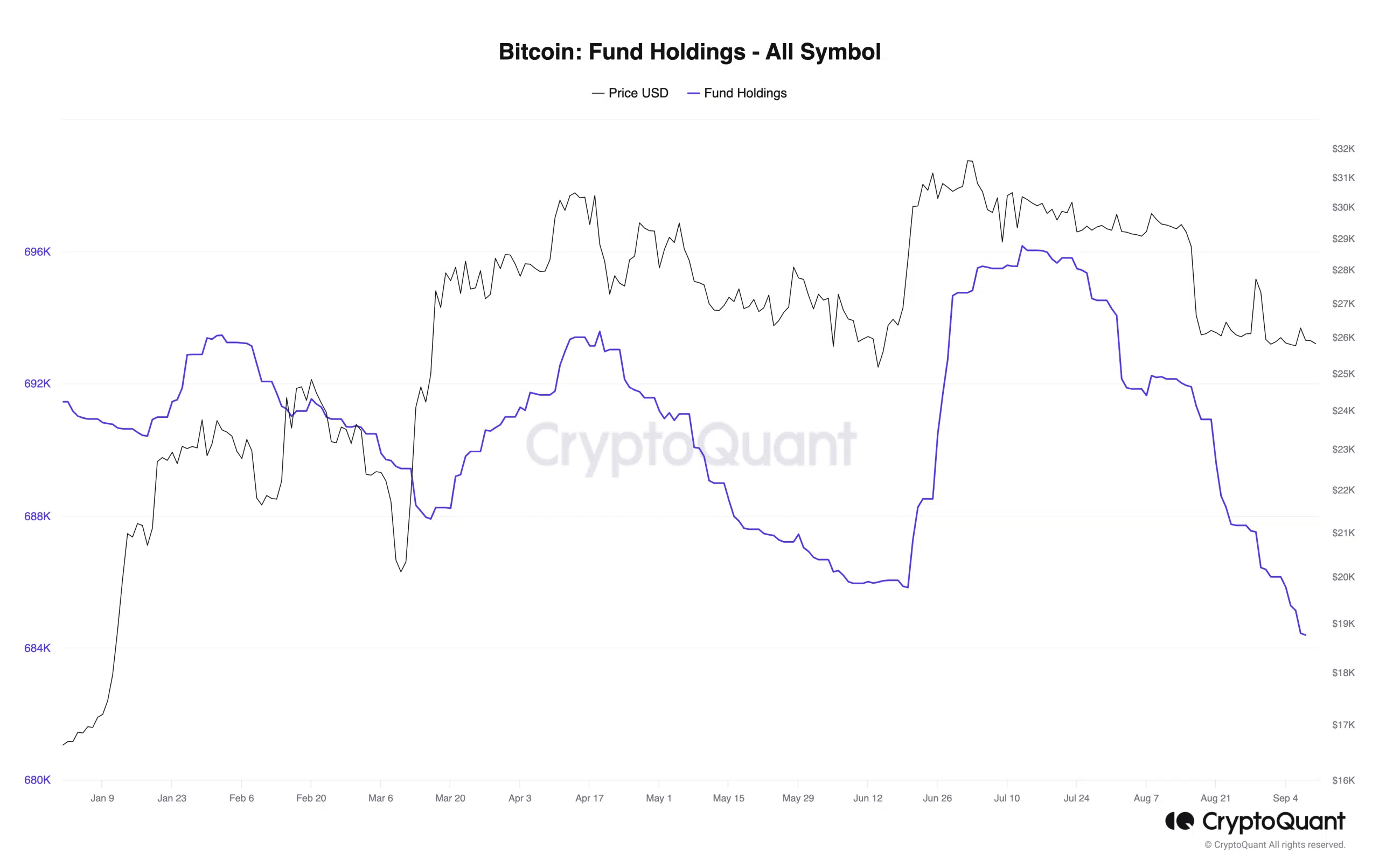

Bitcoin bears gain ground as fund holdings sink to 2020 lows

- Bitcoin Fund Holdings have dropped to their lowest in over two years.

- The coin’s liquid supply has also declined as short-traders exit the spot market.

The number of Bitcoins [BTC] held in BTC Fund Holdings has fallen to its lowest level in thirty months, pseudonymous CryptoQuant analyst Onchained noted in a new report.

Read Bitcoin’s [BTC] price prediction 2023-24

BTC Fund Holdings metric tracks the total amount of the leading coins held in the form of investment vehicles such as trusts, exchange-traded funds (ETFs), and funds. The cumulative quantity of coins held in these holdings may grow alongside rising interest in indirect investment.

According to data tracked by CryptoQuant, as of 8 September, this metric was 684,435 BTC. On a year-to-date (YTD) basis, the metric has seen a 1% decline in value.

While noting that the extended decline in fund holdings could be due to a number of reasons, Onchained added that it “may signify a more profound change in investor sentiment or strategy.”

The analyst added that the steep decline in fund holdings in the last year generally reflects cautious sentiment among investors and institutions, possibly due to regulations and market volatility concerns.

Also, it may result from profit-taking or portfolio adjustments, highlighting the dynamic nature of the cryptocurrency market.

A change in the investment behavior of this group of investors can have a major impact on BTC’s price because they control a large portion of the coin’s supply.

“This development highlights the pivotal role of institutional investors, trusts, ETFs, and funds in influencing Bitcoin’s market dynamics. Their actions can have a considerable impact on Bitcoin’s price and market stability, reinforcing the earlier understanding of their significance,” the analyst opined.

Short-term holders run for their lives as liquid supply plummets

As BTC continues to face strong resistance at the $26,000 price mark, the coin’s liquid supply has dropped to a low of 4,120,775 BTCs, Onchained found further.

How much are 1,10,100 BTCs worth today

According to the CryptoQuant analyst, this metric tracks the portion of BTC’s circulating supply that is readily available to be traded on the market. It is mostly held by short-term investors who are willing to sell their coins quickly if the price goes down.

When the liquid supply of BTC reduces in this manner, price volatility often ensues. This is because fewer sellers are available to sell their coins if the price rallies and fewer buyers are available to ape in should the price fall. This can lead to sharp price movements, both up and down.