Bitcoin breaks through the $50k barrier – What next for BTC?

- The rally followed sharp jump in stablecoin market caps in recent weeks.

- Strong inflows into the U.S. spot Bitcoin ETFs also helped market sentiment.

Bitcoin [BTC] smashed above the all-important $50,000 mark for the first time in more than two years, spurring a wave of bullish optimism in the digital asset market.

The king coin touched $50,000 at about 5:20 pm UTC on the 12th of February and retained the level until profit-taking by diamond hands pulled it to $49, 932 as of this writing, AMBCrypto noticed using CoinMarketCap.

Stablecoins supply surges

According to on-chain analytics firm Santiment, the rally followed sharp jump in stablecoin market caps in recent weeks, nearly 5% since the start of the year.

Such hikes in stablecoin market caps were signals of increasing capital inflows into the market. This is because most traders from traditional markets would use stablecoins to enter and exit trades on crypto exchanges.

Additionally, whale wallets with more than $5 million in holdings added 2.32% of the total stablecoin supply in the last four weeks, taking the overall share of the stablecoin market to 51.49% at press time. This suggested that whales were on an accumulation spree.

Inflows to spot ETFs rise significantly

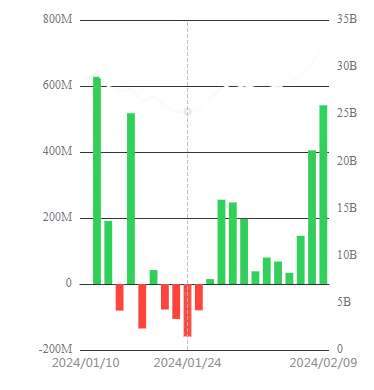

The rally comes amidst strong inflows into the U.S. spot Bitcoin ETFs. According to AMBCrypto’s analysis of SoSo Value data, net inflows have steadily risen in the past two weeks, reversing the tide of outflows from the Grayscale Bitcoin Trust (GBTC).

At press time, $32.42 billion worth of Bitcoins were held up in the spot ETF market, constituting 3.48% of Bitcoin’s total market cap.

If that lifted your mood, then hold! There’s more to come.

“$69,000 is not too far”

Popular on-chain analytics firm CryptoQuant predicted a “long-term upward-trending” momentum for Bitcoin, stretching through 2024 and 2025.

The conclusions were based on the twin effect of supply shortage (due to upcoming halving), and a sharp increase in demand (as seen by jump in active wallets), which makes Bitcoin an ideal store of wealth.

Read BTC’s Price Prediction 2024-25

The bullish predictions were coming from different corners. In a statement shared with AMBCrypto, Shivam Thakral, CEO of Indian crtptocurrency exchange BuyUcoin said,

“The macro factors such as the anticipated rate cut by the US Fed and the growing popularity of Bitcoin ETFs will drive the market in the mid to long term. We can expect Bitcoin to retest its all-time high of $69,000 post-halving.”