Ethereum: What the latest ETF filing means for ETH prices

- The firm, which manages assets worth around $1.5 trillion, filed for a spot Ethereum ETF.

- If ETH staking, revenue, and TVL continue to increase, the price might hit $3,500 soon.

Franklin Templeton, one of the world’s largest asset management firms, has joined the race for an Ethereum [ETH] spot ETF. The move means Franklin Templeton has joined others including Grayscale, ARKInvest, Fidelity, VanEck, and a few others who have also filed the same application.

Franklin Templeton just joined the spot #Ethereum ETF race. pic.twitter.com/zJvk9seXe3

— James Seyffart (@JSeyff) February 12, 2024

The firm’s application for an Ethereum ETF might not come as a surprise to many. This was because Franklin Templeton was one of the 11 firms that got the U.S. SEC nod for a Bitcoin [BTC] spot ETF.

Despite that, the $1.5 trillion asset management firm has not gotten a high volume when compared to BlackRock and Fidelity.

All things are working together for ETH’s good

However, the latest development could be a good move for Ethereum’s price. This is because optimism about the launch of the ETF might drive demand for the altcoin. But beyond that, other metrics were supporting a significant price increase.

Previously, AMBCrypto reported how 25% of the total ETH supply had been staked. In the article, we also discussed how the development could spark a rally for the cryptocurrency. Between then and the time of writing, ETH’s price has increased from $2,428 to $2,645.

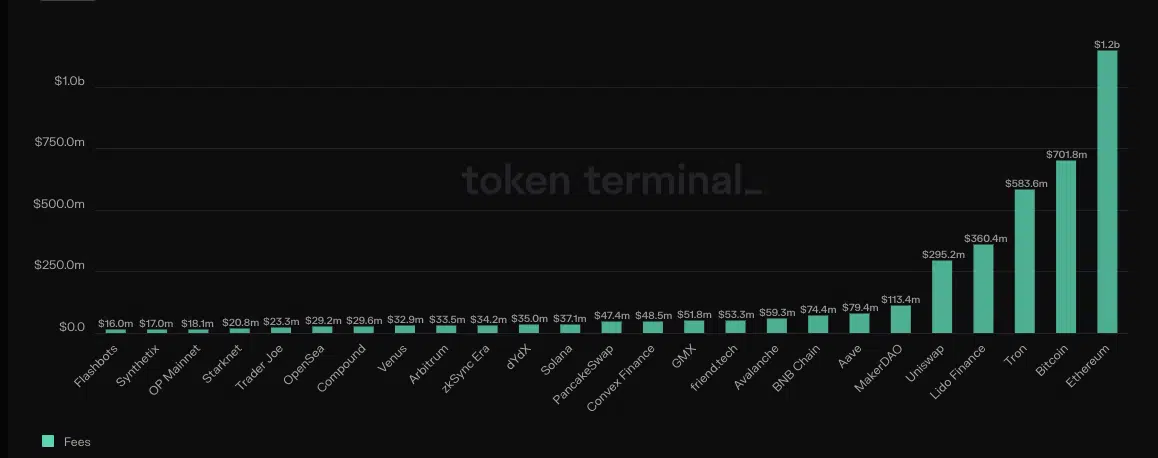

But demand and supply were not the only indicators suggesting a possible rally. One other metric predicting the move was Ethereum’s fees which is one of the project’s major sources of revenue.

According to data from Token Terminal, Ethereum’s fees had increased to $1.2 billion.

The increment also meant that Ethereum made more in fees than Bitcoin and Tron [TRX]. Furthermore, a high revenue for Ethereum was evidence that market participants are actively using the network.

Also, if demand for ETH increases due to the anticipation around a spot ETF approval, fees for the project would climb. ETH’s value might also jump. Therefore, predicting a move to $3,000 looked like a feasible price target in the coming weeks.

A new ATH could be in the works

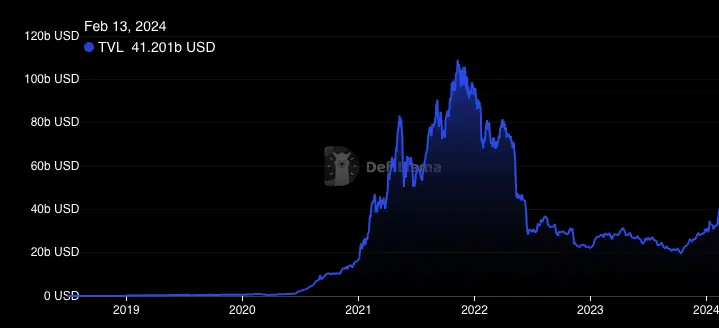

Another indicator supporting a price increase is the Total Value Locked (TVL). The TVL measures the overall health of a protocol.

When the TVL increases, it means more assets are staked or locked in a protocol. This also implies that market players trust the protocol to bring more yield.

But it is the other way around when the TVL decreases. On a Year-To-Date (YTD) basis, DeFiLlama showed that Ethereum’s TVL tapped a new high at 40.21 $billion.

Is your portfolio green? Check the ETH Profit Calculator

In a highly bullish condition, ETH might rise to $3,500 should the revenue, and TVL continue to increase.

In addition, if the SEC approves spot ETFs for Ethereum, ETH might head for a new All-Time High (ATH). But before the potential jump, the price might retrace below $2,500.