Bitcoin [BTC] and S&P 500 part ways, where now for the king coin?

![Bitcoin [BTC] and S&P 500 part ways, where now for the king coin?](https://ambcrypto.com/wp-content/uploads/2023/02/kanchanara-rhm7H8X5J98-unsplash-1-1-e1677065342520.jpg)

- Bitcoin decoupled from S&P 500 for the first time after the FTX debacle.

- Sentiment for Bitcoin improved, but traders took short positions.

Bitcoin [BTC] had been leading the charge of the bullish sentiment surrounding crypto over the past few days. Due to its positive rally over the past few weeks, its correlation with the S&P 500 declined. Moreover, there has always been talk about how Bitcoin could act as an inflation hedge. This argument gained more credence as BTC decoupled from S&P 500.

Bitcoin's daily correlation to the S&P flipping negative for the first time since the FTX collapse pic.twitter.com/W4z0ePkxLR

— Will Clemente (@WClementeIII) February 21, 2023

How much are 1,10,100 BTCs worth today?

As BTC’s prices surged, the king coin’s overall sentiment also improved.

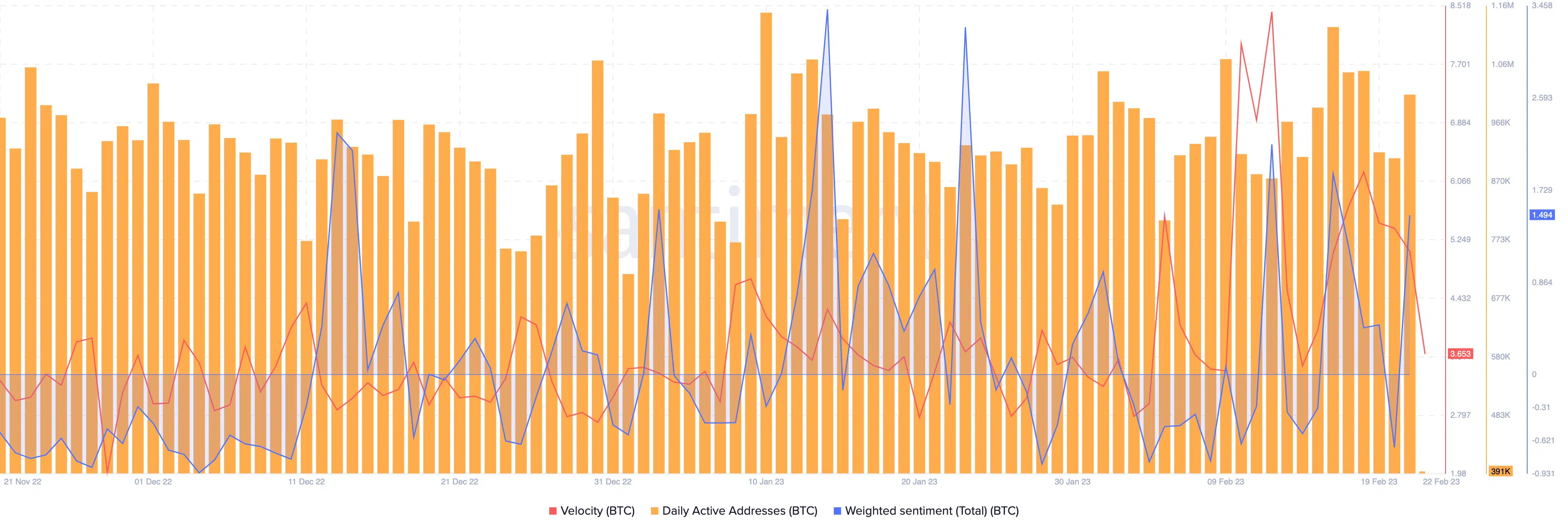

According to data provided by Santiment, it was observed that the weighted sentiment for Bitcoin increased. This implied that people from the crypto community had more positive than negative things to say about Bitcoin.

Due to the positive sentiment, Bitcoin’s overall network activity increased, as highlighted by the rise in the network’s daily active addresses. Along with that, BTC’s velocity rose as well, which indicated a surge in activity.

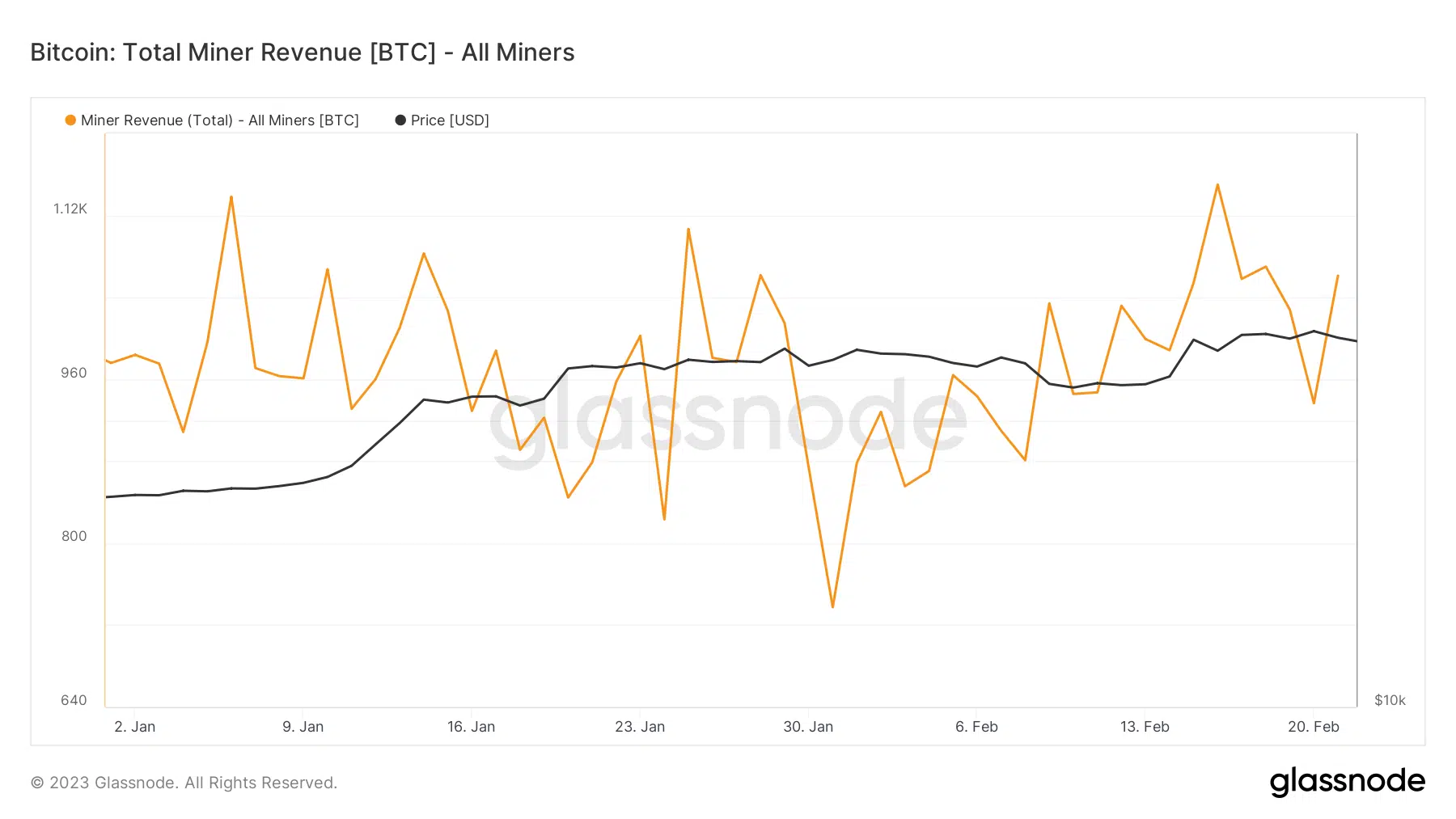

It wasn’t just the number of transactions that had increased. The mean size of each transaction also grew, as did the fee collected by miners. This rising miner revenue reduced selling pressure.

The tides may turn for Bitcoin

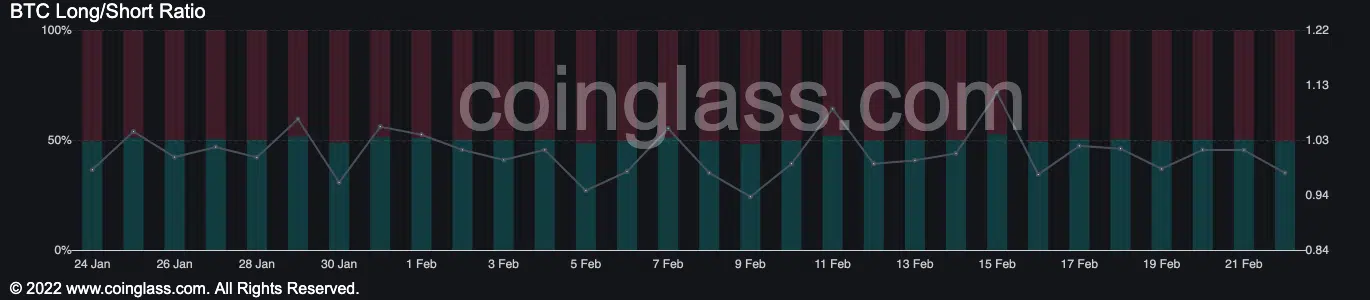

However, Bitcoin’s selling pressure could increase in the future. As addresses in loss continued to decline, the incentive for selling BTC grew. This could be one reason why trader sentiment fell. Additionally, according to data provided by Coinglass, the number of short positions taken against BTC increased.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Another cause of concern for BTC would be the rise in exchange reserves. According to CryptoQuant’s data, Exchange Reserves have grown by 0.67% in the last week. A high exchange reserve could lead to more selling pressure.

Overall, even though BTC decoupled from the S&P, there were some factors that could reverse its press time rally. Only time will tell if Bitcoin outperforms S&P 500.