Bitcoin (BTC) breaks $25k mark, a day after breaching $24k

- Bitcoin breached the $25,000 mark for the first time since June 2022

- The coin has maintained the upward momentum, which it gained yesterday after breaking past the $24,000 level

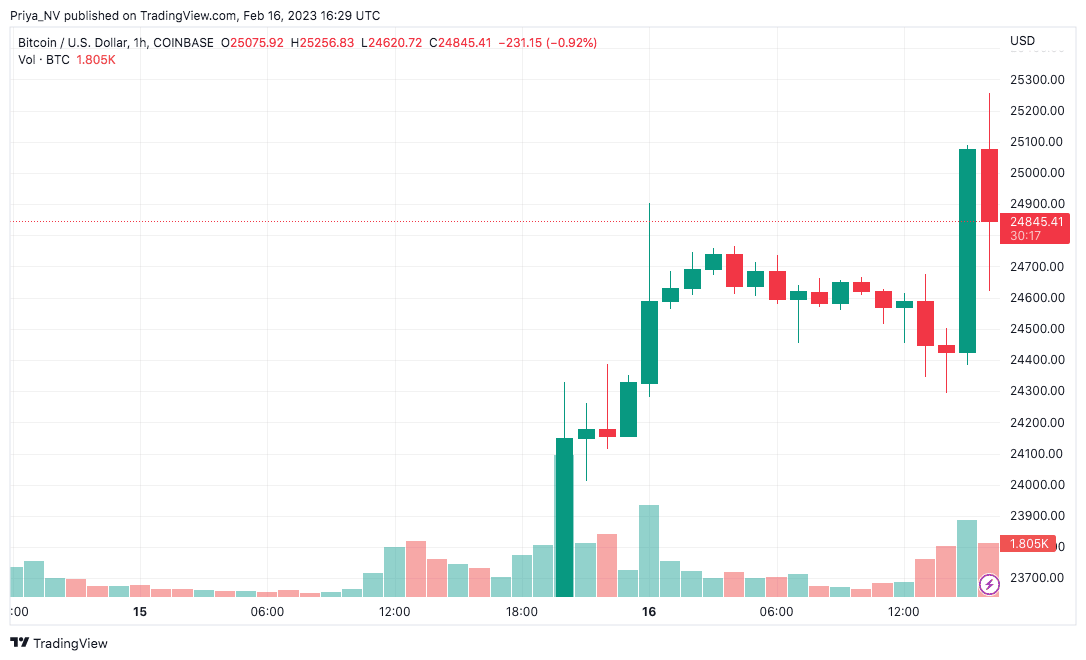

Bitcoin (BTC), the king coin, has broken another level within a span of 24 hours. The largest cryptocurrency by market cap breached the $25,000 mark, a day after the coin broke another key level. The coin reached a high of $25,256 on Coinbase, as per the data presented on Trading View. The coin’s price has retracted ever since it peaked at this level.

Read Bitcoin’s [BTC] Price Prediction 2023-24

According to CoinMarketCap, Bitcoin was trading at $24,790 at press time and saw an uptrend of over 8% in the past 24 hours. The cryptocurrency registered a market cap of over $482 billion and had a market dominance of 42.8%.

Bitcoin (BTC) price | TradingView

Notably, the current level of Bitcoin was last seen in June 2022. Additionally, the coin added the additional numbers just a day after it swung past $24,000, a level first seen since August last year.

Speaking about the new breach, Cameron Winklevoss, co-founder of Gemini, stated that Bitcoin’s price levels have surpassed the lows it registered post-FTX collapse in November 2022. At the time, the king coin saw a sharp decline, with BTC’s price collapsing from the $20k level to the $15k level within a few days. Winklevoss said,

“Bitcoin just broke 25k, price levels well above pre-FTX collapse. A clear signal that our industry is moving beyond this painful chapter — we will not be defined by it. We are back to building the future.”

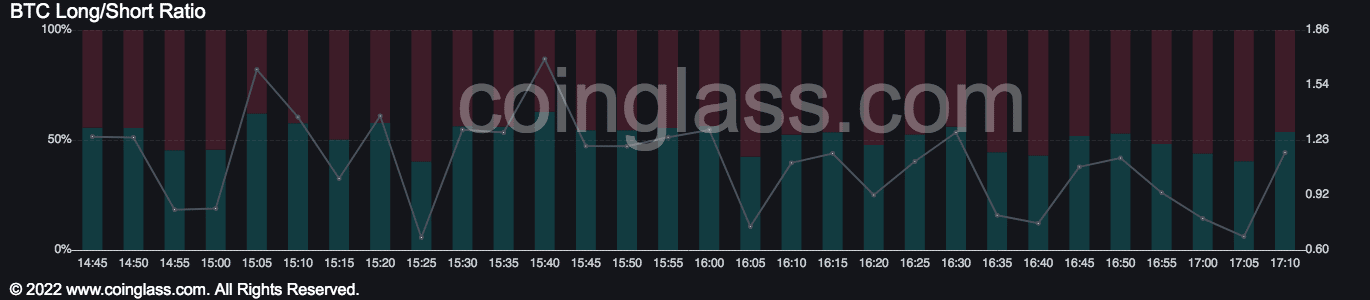

Bitcoin short holders take the losing end

The coin’s rise in the market has left Bitcoin’s short traders on the losing end of the stick. According to Coinglass, the ratio of long/short positions for BTC saw the long position holders topple the short position holders. The ratio was at 1:16, with over 53% of traders taking a long position, and over 46% of traders still holding a short position.

BTC Long/Short Ratio | Coinglass

Moreover, over $7 million was liquidated in the past hour. And, the total liquidation of short positions as of February 16 was $26.81 million.